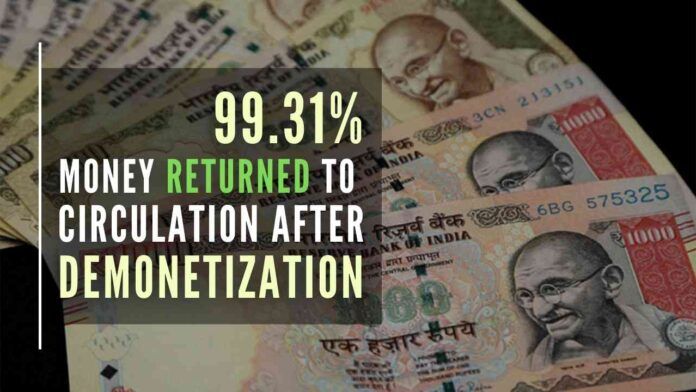

Going by the objective that 13% of the money in circulation would not come back, should the Demonetization be deemed a failure?

The Union Finance Ministry has informed Parliament that Rs.10,720 crore worth old Rs.1000 and Rs.500 notes were not returned to circulation after demonetization. According to the Finance Ministry, when demonetization was announced on November 8, 2016, Rs.15,41,793 crore worth withdrawn notes were in circulation. The Ministry said that after verification and reconciliation, as of June 30, 2018 Rs.15,31,073 crore worth was returned from circulation.

The Finance Ministry was replying to the questions raised by BJP MP Subramanian Swamy about the return of money in circulation after demonetization. This reply shows that 99.31% of the money has returned to circulation after banning old Rs.500 and 1000 notes and just 0.69% of the money (Rs.10,720 crore) has not returned to circulation.

“Total value of the currency in circulation of the old notes of Rs.500 and Rs.1000 denomination that were demonetized on November 8, 2016, post verification and reconciliation, was Rs.15,41,793 crore. Out of which, the total value of the Specified Bank Notes (SBNs) of Rs.500 denomination and Rs.1000 denomination was Rs.8,56,445 crore and Rs.6,85,348 crore respectively,” said MoS Finance Pankaj Chaudhary in a written reply to Subramanian Swamy.

“As of June 30, 2018, the total value of SBNs returned from circulation is Rs.15,31,073 crore. Out of which, the total value of SBNs of Rs.500 denomination and Rs.1000 denomination from circulation was Rs.8,53,100 crore and Rs.6,77,973 crore respectively,” said the Minister to the question on return of money after the demonetization.

The above figures show that hardly 0.69% (Rs.10,720 crore) of black money could not be converted to a new currency.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

99.31% fake notes are returned !!

Is there any country in the world where its citizens trust their govts ? The answer is 100% NONE.

India is no exception. Right hand does not what Left is doing. No transparency in Central or State govt activities. Each one is drum beating their own versions. Supreme Court is living in fools paradise.

A top political party during its tenure, printed a massive sum of parallel currency to be used in election which ultimately they lost. Now this currency was printed in the same press and with same details and nomenclature as the regular Indian currency. Even the numbers were kept similar to some previous currency blocks. It is no surprise that someday you may come across two similar numbered notes. This illegitimate currency worth many thousand crores has already entered our banks during demonetisation..

Have you read https://www.amazon.in/Who-painted-money-white-everything/dp/1732025622/ref=tmm_pap_swatch_0?_encoding=UTF8&qid=&sr=#customerReviews ?

The 10,720 crores which was not returned must belong to those who did not stand in the queue for changing old for new and these are the ones did not like the DeMo and continue to call it a blunder, and still feel the pain of the loss. Other than the fake currency part it also shows how deep was the rot and how much of the stolen money was safely moved out of the country.

If 10,720 crores of thieves did not stand in the queue, each was worth a crore.

The Minister, most probably could not disclose the illegal Indian Currency Printing activities that were functioning inside Bangladesh, China, Nepal and Pakistan, because we sold some our old Printing Machinery used in our Government Minting Industries to our neighbouring countries, when P Chidambaram was Finance Minister. It is possible that those machines were printing higher denomination Indian Currency with the same serial numbers that were available with us! This is the most likely reason for such a large sum of money returning to our banking system after the announcement of demonetisation.

I’m sure no one will believe that 99.31% of the genuine demonetized currency returned. Very clearly, this indicates that fake currency has returned which RBI could not detect as fake. Whether fake currency returned was 13% or even more or less is open to speculation.

I say whether fake currency returned could have been even more than 13% because, the Govt estimates were not reckoning fake currency. If Govt estimates were right, 13% genuine currency didn’t return instead of which fake currency passed of genuine ones returned. How about fake currency in circulation that didn’t return? It’s difficult to estimate that. All I can say for sure is, it is most likely that lots of genuine currency and fake currency didn’t return.

But for demonetization, it’s possible that fake currency in circulation would have spiralled out of control. At some stage, there may have been more fake currency than original ones.

I agree that demonetisation was not handled the best way possible. We realized that the Govt had not done enough home work. In an operation like this where the decision makers could not have consulted the best of minds unless they could trust them 100% (and I’m not sure if at least some of those consulted were worthy of consultation, but they may have been in such positions where they could not have been left out), such failures are bound to happen. Only, it’s sad that implementation wasn’t good enough to prove the case for it.

Surely, intentions were right. There were some intended and unintended gains and losses in that exercise.

The concern is, if we have stopped fake-ability of currency with the new notes.

But the Govt not coming up with a detailed open and frank explanation about the demonetisation exercise is puzzling. I don’t doubt anything amiss, though, as there are no reasonable grounds to doubt. Maybe the Govt has no guts to admit the failures in the exercise.