Home Search

GST Council - search results

If you're not happy with the results, please do another search

GST Council meet: Tax on millet flour scrapped; alcohol for consumption exempted; GST on...

GST council cuts taxes on millet flour

On Saturday, the GST Council exempted millet flour from GST. However, branded millet products will attract a GST...

GST council to take final call on 28% levy on online gaming, casinos &...

Key decision on 28% tax on online gaming expected in today’s GST council meeting

On Wednesday, the GST council will take a final call on...

GST Council decides to impose 28 pc tax on turnover of online gaming firms,...

Online gaming to be taxed at 28%, no GST on drugs for rare diseases

The all-powerful Goods and Services Tax (GST) Council of India on Tuesday...

GST Council likely to take a call on taxing heavy utility vehicles, horse racing,...

GST mechanism for online gaming, casinos & horse racing to dominate the proceedings

Headed by Union Finance Minister Nirmala Sitharaman, the GST Council in its...

GST Council may mull steps to prevent fake generation of Input Tax Credit: Official

GST Council meet on July 11, likely to discuss steps to prevent fake generation of Input Tax Credit

Chairman of Central Board of Indirect Taxes...

GST Council to hold virtual meet; the panel of state ministers to look into...

The 48th meet of the GST Council to be held on Saturday

After a gap of nearly six months, the meeting of the GST Council,...

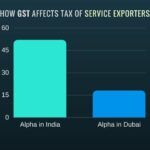

GST Council should exempt Service Exporters from Tax

The Goods and Services Tax (GST) can have an adverse affect on a group of companies that GST terms as Service Exporters. Imagine an...

GST authorities issue Rs.1 lakh crore show cause notice to online gaming companies

Online gaming firms face GST hurdle over tax evasion

The Goods and Services Tax (GST) authorities issued show cause notices demanding as much as Rs.1...

GST evasion cases surge 23.5% in 2 years; 166% rise in detection in value...

In 2022-23, Rs.33,226 cr were recovered in terms of GST evaded from 15,562 cases detected

As per Finance Ministry data, there has been a rise...

FM Sitharaman says GST compensation cess of Rs.16,982 cr to states will be cleared

GST Council key outcomes: Tax on liquid jaggery reduced; okays setting up tribunals, specific levy for pan masala firms

While addressing a press conference soon...