Introduction

It was one of history’s major ironies when Khrushchev at his meeting with President Eisenhower at Camp David in 1958 remarked that the Soviets “are using the incentive system to increase production far more than the U.S” and that the American tax system “stifles increased productivity. Soviet Russia had a top income rate of only 13%. In January 1963, Kennedy, realising the self-defeating consequences of excessive taxation, proposed a bold measure of tax reform and the bill was passed by the Congress after his death wherein maximum marginal tax income tax rate was scaled down and minimum rate was reduced to 16% in 1965. As expected, the tax cuts had a galvanising effect on the national economy and actually increased the revenues of U.S.A enormously. The enormous upsurge in government revenues as a result of the tax cuts gave point to the joke current in Washington about a pre-Keynesian asking his up-to-date companion how the president is to pay for his new social programmes. The answer comes back “How Old-fashioned! Out of tax cuts, of course!

The tax measures of the German Government in the early 1950s represented an average reduction of 30% in both the personal and corporate rates of taxation. The then Vice-Chancellor of the German Federal Republic, Prof. Ludwig Erhard in “prosperity through competition, has expressed his unshakeable conviction that the record increase in the real net income of Germany in the last decade” – an annual rate of growth of 7.5% exceeded only by that of Japan 8.8% would have impossible but for the “incentive taxation’’ policy pursued by him.

In Japan, 1957, the rate of income tax levied on the average lower middle class and the upper working class was literally cut in half. Japan found that with every cut, the economy boomed and the exchange garnered golden grain.

Apart from the US, Germany and Japan, and other developed countries like Belgium and Holland have employed the fiscal stimulus and with Lower tax rates reaped ever richer harvests.

The case in India

The most expensive hobby of Indians is work. The rates of income-tax on individuals stifles his expenditure and savings in a big way. No other nation taxes the fruits of labour more heavily than India. i.e., with no job security, individual taxpayers have the least support from the government and their earnings from day one of employment.

Let us see some data points, patterns which constitute the backdrop of the argument on why personal income tax needs to be abolished:

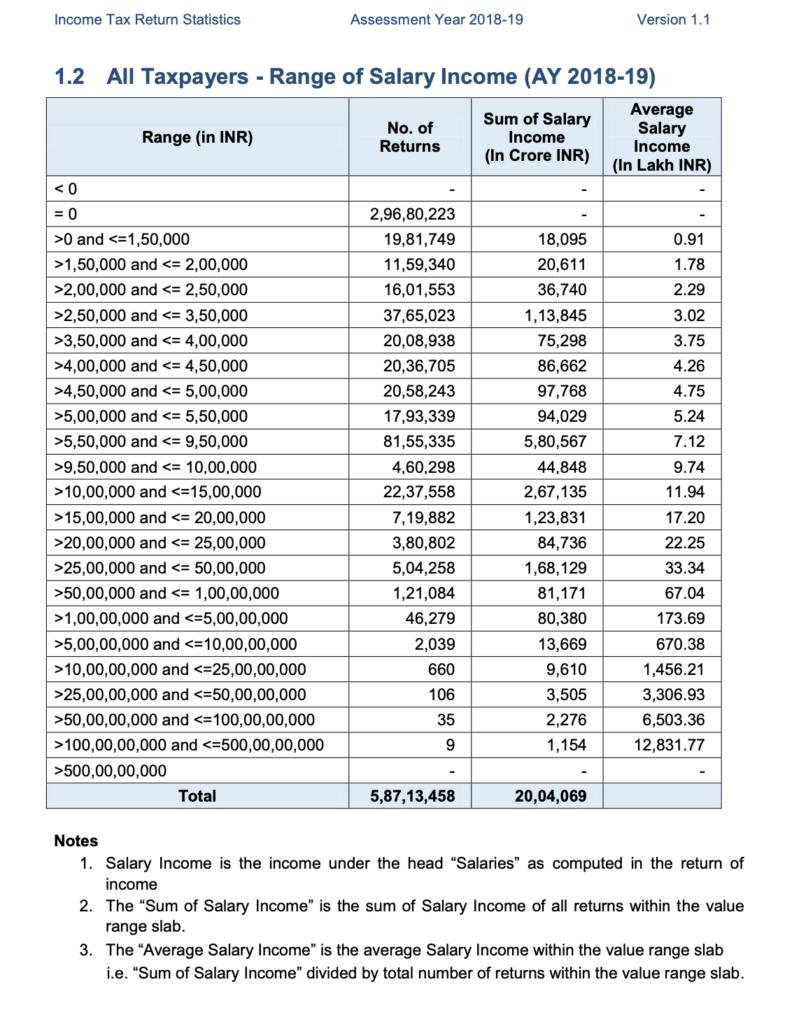

Salary returns filed for FY 2017-18: 5,87,13,458 out 1.3 billion. These include 2,96,80,223 nil return. Out the balance salary return payers, range of income ranges from Rs 150,000 to 500 crores. Ref, Table below:

| Contribution of personal income to GDP | |||||

| Details (Rs. crores) | FY 2018-19 | FY 2017-18 | FY 2016-17 | FY 2015-16 | FY 2014-15 |

| Personal Income tax | 4,73,121 | 4,19,884 | 3,49,503 | 2,87,637 | 2,65,772 |

| GDP on current market price | 1,90,10,164 | 1,70,95,005 | 1,53,62,386 | 1,35,67,192 | 1,25,41,208 |

| Personal income tax to GDP ratio | 2.49% | 2.46% | 2.28% | 2.12% | 2.12% |

Tax foregone by Government due to abolishing of personal income can be pegged at 4.5 lakh crores, average. This can be recouped by auctioning available natural resources as happened in the case of #2G but abolishing personal income tax opens new avenues for taxation as well:

- Tax shortfall of 4.5 lakh crores to the government and simultaneous increase in purchasing power of personal income taxpayers

- Increase in disposable income leading to self-generating income tax revenues i.e., Increase in purchasing power may lead to asset purchase like house property, cars, sin goods and increased domestic consumption

- An incentive to save and increase in the domestic savings rate

- Creates new enterprises

What stops from the abolishment of Personal Income tax?

- Control psyche: Psyche of taxing and keeping personal income taxpayers in control orchestrated by bureaucrats

- Lack of empathy: Never able to appreciate the hardship of others exactly in the same light in which they appreciate their own personal hardships

- Dehydrated Intermediaries: Accountants and advisers feeling their minimised status thereby bugging the mind of decision-makers to continue taxation sustaining their livelihood

- Propaganda Tool: Media plant by vested interest signalling people will no longer fear government policies when their disposable income is high and planting arguments against the viable idea

Conclusion

The old-fashioned fiscal theory that income tax rates must be increased to provide larger revenues for the state has long been exploded. India pathetically clings to it despite inevitable disillusionment year after year.

Dr Subramanian Swamy has been at the forefront mooting this idea from the early 1970s by saying that the full potential of the people must be unleashed to create national wealth. He advocates – nation’s progress depends mainly on the extent to which people’s time and energy are released for productive purposes.

After the impact of COVID-19, such measures will help to bring back the economy on a fast track and people will be relieved from much anxiety and fear in terms of monetary considerations.

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- Textbook revision – Submission from concerned citizen - August 14, 2023

- Abolishing Personal Income tax in India – A study along with History and Data - April 27, 2020

- A tete-a-tete between Guru Extraordinaire Paul Samuelson and his Genius Pupil, Dr. Swamy - September 4, 2019

India never needed personal income tax to fund its customary profligacy but to keep its garrotte on any non Government middle class that may bud and start working for freedom instead of merely craving it

[…] Abolishing Personal Income tax in India – A study along with History and Data – Apr 27, 2020, […]

Excellent !! The author could also have determined the cost of recovering ,and collection , of this 4.5 lakh crore of personal income tax ,to the exchequer.

Is it worth the annual effort year after year ??

Exactly, the cost of collection + bribes + CA fees and the lengths people go to scam the system doesn’t make any sense in continuing this atrocity.

It’s only the middle class salaried employees who will be the scapegoats!

The habit or rules of filing tax return is to be totally done away with. This stupid system keeps the bureacracy, who does no worthy work. Instead raise the GST rates on everything including gold. Stupid Indians should stopped buying gold & hoarding gold.

Encourage simple marriage functions, those who conduct lavish parties to be taxed heavilty. India should land of simplity & NOT maharaja living style. Those days gone after 1947.

To start with at least the government must remove senior citizens from the income tax as it must be a negligible amount.

Sir, the whole idea is to keep a huge workforce busy, worried always searching for ways and means to save tax.

After any Budget people are talking about the IT only. The middle class if kept busy like this will hinder any country’s progress.

Keep your population less strained.

The country will progress.

The income the govt will increase if the IT is abolishe. People don’t mind spendin. Increase the indirect tax. That’s all is needed.

The figures are known to the think tank of the gov.

The control psyche needs to go. The top leaders need a fresh though. It’s our countr. Nobody needs control others.

The day people start thinking we than I, this idiotic idea will go.

Simple thinking : example : 1.one lakh in an individual’s pocket is more productively spent than the same lakh of rupees by govt. and hence contributes more to the national economy by way of quick returns or employment.

2. If the govt wants private partnership in big infra projects, how can they participate if they pay huge taxes.

3. The govt should tax minimum, say 10% for expenses like defence where no else will spend.

but if the consumption increases ( may be now it is ok) otherwise it will increase the demand for the goods and if the supply is not matching then the inflation will shoot up. Again govt needs to interfere for the control of price of some commodity. Also there could be increase in the savings may lead to reduction interest by bank and post office . Senior citizen will be much affected. They should be taken care as India is having system for the pension for non govt employees.

Let the union govt try to accept my hero Dr. Swamy’ view as far as economics of public finance and at the same time govt. should come out with some policy on temple fund which actually belongs to public money.

For Analysis of Table 1.2, income range is grouped under A,B&C.

A.Number of Nil returns (29680233 No’s) constitute 50% of returns filed.

B.Returns filed with income range Rs.1,50,000 to Rs.10,00,000 is 2,50,20,523 Nos which constitute 41% of returns filed.

Income reported in this range is 11,68,463 Crores. I.T@20% on this income works out to 2,33,692 Crores which constitutes 48% of I.T collected.

Central/State/PSU employees and pensioners and employees of listed Pvt companies constitute this Group -B. I.Tax is deducted as TDS I.r.o this Group.

C. Returns filed with income range Rs.1,00,000 to Rs.,500 Crores is 40,12,712 Nos which constitute 9% of returns filed.

Income reported in this range is 8,35,596 Crores. I.T@30% on this income works out to 2,50,678 Crores which constitutes 52% of I.T collected.

HNI represent this group.

Conclusion.

Income tax can be abolished in a staggered manner and at first IT on the income group B could be abolished. A 20% reduction in salaries of this group if implemented, it would be revenue neutral. The exercise of TDS and Return filing and Scrutiny of 91% returns could be avoided.

Thanks sir,

Very interesting article. If the revenue from Personal income tax goes, Government is likely to get substantial revenues under GST, Customs etc due to GDP growth. Can it be quantified?

Due to increase in GDP growth, unemployment as well as poverty will come down. Associated subsidies will also come down. Can it be quantified?

Income tax department could be pruned down with shifting of officers to other departments or stopping further recruitments. How much money will be saved on this account?

I request the learned author of this article to quantify all the above. I earnestly feel that net effect may be positive for the Government and at the same time benefitting the society.

Thanks and regards,

Venkataramani

[…] खबर को अंग्रेजी में यहाँ […]

I should thank this author for informative analysis of how many who pay taxes fall into which category..He should not stop with this,,should also tell us comparative taxation rates in many progressive countries,say for example Japan,Korea,indonesia,malaysia,Brazil..What they tax and what benefits tax payers get

Congress with a cow in front government that is running now has the best excuse to remove income tax,,blame it on COVID.Will they? What these netas/babus have not factored is that European nations do tax heavily but then the tax payer gets ample benefits – unemployment benefits,old age ,life time free health services,children education..Infact by paying heavy taxes,they are rid of issues arising out of taking care of old parents,young children education/health,hospitalisation for entire family..What do tax payers especially lower,middle income in India get?Their life is full of uncertainties and these netas have least concerns for them because their votes don’t count.I will be surprised if this government will come out with any meaningful reforms for lower/middle income earners

We can keep writing articles or mails to PM or PMO. Nothing appears to be shaking the status-quo. A tragedy.

As per report by Nomura, Global companies moving out of China have preferred Vietnam, Taiwan and Thailand over India.

By the time the exclusive cell created by PM Modi to welcome Global companies, could draft its welcome note, the above 3 countries had granted all approvals for the companies to start operations in those countries. A real tragedy.

There is so much fear in the mind of the bureaucrats that they will lose control of their livelihood, income and control – the mind of the Indian bureaucrat has not changed in the past 70 years. This initiative must come from the top and driven across the entire bureaucracy as a priority. My experience with both Cong and BJP governments is that unless an emergency is upon them, they will not act. The 1991 foreign exchange crisis, for example, left the government of Narasimha Rao with no choice but to do something drastic. Perhaps in the coming months, another crisis will emerge that will force the BJP government to take some drastic actions: lower Repo rates to zero forcing banks to lower interest rates to SME’s drastically into the 0-5% range, introducing a flat income tax rate across all sectors like in Singapore, drastically streamlining GST to a single value-added tax across all types of products and services uniformly applied across the country. THis can be accomplished by creating a pan-India Economic Zone (learning from the failures of the EuroZone), which sets economic rules for States in the Union to be able to freely trade with each other, keeping Politics out of it. Enacting even a few of the above measures will catapult India several steps up the GDP ladder into the top 3 in the world.

At least for half year it can be introduced