In Part 1, I defined a few terms associated with High Frequency Trading (HFT) explained its beginnings and how it was gamed in the United States of America. Part 2 describes the amount of money looted by a small set of players, close to Rs.50,000 – Rs.70,000 crores ($7.7B – $11.5 B) over a five year period. In Part 3, how a few benefited at the expense of many was described. Part 4 discusses who benefited from this scam. This is the final and concluding part.

NSE banned OPG Securities from trading for six months but before the ban could go into effect, OPG moved the Delhi High court and obtained a stay order

Let us summarize the events as they happened since Jan 2015.

| Date | Event |

| Jan 2015 | NSE receives the first anonymous complaint from a whistleblower who calls himself Ken Fong. |

| Apr 2015 | My article on High Frequency Trading and how it affects you appeared in MoneyLife magazine |

| Jun 2015 | Sucheta Dalal’s article titled Blowing the Whistle on Manipulation in NSE appeared in which the whistleblower Ken Fong described how the broker OPG was gaming the system |

| Nov 2015 | Whistleblower letter referred to SEBI’s technical advisory committee (TAC) |

| Mar 2016 | SEBI concludes that NSE systems were prone to manipulation, cites data showing how OPG was consistently logging in first, second or third. |

| Sep 2016 | SEBI directs NSE to conduct a forensic audit of its systems and also forces them to deposit co-location revenue into an escrow account |

| May 2017 | SEBI issues a show cause notice to 14 key officials in NSE, including Ravi Narain and Chitra Ramakrishna |

| Jun 2017 | SEBI Chairman Ajay Tyagi says in a press conference that SEBI will conduct its own investigation into the possibility of connivance by NSE officials/ employees |

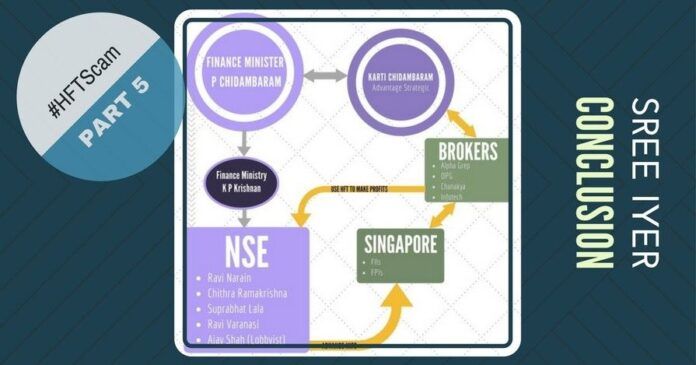

Some of the key officials in NSE and their roles are described in Figure 1.

The rot in NSE ran deep. According to the Whistleblower (and confirmed by the SEBI TAC report), OPG Securities got an edge by doing a simple trick – they knew that different servers in NSE were turned on at different times and they ensured that they knew exactly when the fastest servers came on (by bribing some in the NSE) and therefore managed to log in at or near the top of the queue. Doing so gave them a tremendous advantage – the way the NSE system worked, he who logged in first also got to look at all the orders first!

NSE banned OPG Securities from trading for six months but before the ban could go into effect, OPG moved the Delhi High court and obtained a stay order.

As for the 14 officials who have been issued a show cause notice by the SEBI, many including Ravi Narain and Chitra Ramakrishna have opted for a consent order. Consent orders are similar to an out-of-court settlement in securities law parlance. It is a negotiated settlement between the capital markets regulator (SEBI) and an entity by paying a penalty or by undergoing a voluntary ban from the stock markets.

Would this be like a slap on the wrist on these erring officials? What about possible illegal gains stashed abroad? Should it not be clawed back? Knowing the limitations of their architecture, should they have allowed co-location? Interestingly, Ajay Tyagi, the Chairman of SEBI has told reporters that SEBI wants to do its own investigation into the co-location scam. The reason? Deloitte’s forensic audit did not go into the connivance issue of possible collusion between NSE officials/ employees in aiding and abetting the crime. It will be interesting to see how this plays out.

What about the elephant in the room?

The whistleblower contends that the trading of about 15 entities if probed, would reveal a lot more facts. Here are some excerpts from the document (Pages 61-62), formatted with some edits:

Ajay Shah is the blue-eyed boy of P Chidambaram and was extremely close to K P Krishnan. The Finance Ministry was giving a project of a minimum value of Rs one crore per year to NIPFP for Ajay Shah’s group since K P Krishnan had become the Joint Secretary for Capital Markets. KP Krishnan is P Chidambaram’s most trusted bureaucrat and extremely close to him in the last 10 years. He is Chidambaram’s Man Friday.

OPG Securities alone had traded worth over Rs 6,000 crore on NSE using co-location facility. While details of other 15 entities are being analyzed, a huge amount of such trading would be surfacing. But what about the order book that was exported to FIIs and FPIs? Custodial interrogation should be initiated against OPG Securities and Ajay Shah to unearth the number of entities, including FIIs & FPIs to whom the order book has been exported to.

…

…

Who blessed the scandal in SEBI?

Mastermind Troika: Chidambaram, KPK & Bhave

A thorough probe by a special investigation team would not only unravel the specific role of some top officials of NSE played in allowing algorithm (algo) or high frequency trading (HFT) quietly and without regulatory clearances from SEBI right from 2010, but would also unearth the more sinister play of some people in the Finance Ministry at that time and those close to the then finance minister Mr P Chidambaram.While P Chidambaram was the Finance Minister for almost seven years out of the 10 years that UPA government was in power, his close aide K P Krishnan had been the longest-serving Joint Secretary and Additional Secretary for the Capital Market. During this period, SEBI did everything that NSE wanted and it was difficult to make out who was the regulator and who was the regulatee. Ravi Narain and Chitra Ramakrishna’s proximity to KP Krishnan and P Chidambaram is said to be the reason for such privileges. This high-level network had resulted in some top SEBI officials, including the then Chairman of SEBI Mr. C B Bhave choosing to remain silent and allowing NSE to continue such operations for many years, enabling brokers to help their clients – especially the FIIs – to make piles of illegal cash. SEBI even ignored complaints from Bombay Stock Exchange (BSE) and FT Group’s MCX-SX and didn’t ask the NSE to discontinue the system for years.

Conclusion

What the whistleblower is alleging must be investigated thoroughly. SEBI should not allow the NSE officials to escape by just paying fines. SEBI’s first and foremost loyalty is to the shareholders, and therefore it behooves SEBI to get to the bottom of this scam and ensure that justice is done. Until and unless this happens, the faith of the common man in the Stock Market will not be restored. For those interested in reading the complete document, it is available under Source below.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] C-Company- Part 9 – A Long History of Harassment – Nov 28, 2017, […]

[…] Anatomy of a crime – Conclusion – Oct 9, 2017, […]

100% agreed with you.

Stock exchanges r gambling dens of parasitic brokers created on flimsy theory spread by looters of public money. Modi should remove capital gain exemption on shares . 80% financial crimes disappear and real work becomes wealth.

Congress leaders are capable of getting oil even by squeezing hard rock.