It will not be surprising if many of the readers are completely overwhelmed by the description of the structure below.

In Part 1 of the series, we discussed how tax evasion and money laundering go hand in hand. We also discussed some mechanics of how the ‘black money’ leaves the shores of India – either via the Hawala route or direct to a super secret Tax Havens via mechanisms such as Under and Over-Invoicing. In this Part 2 of the series, we will start looking at the second leg of the international travel of black money. This second leg of the journey can have an interesting itinerary spanning multiple nations – most of them being idyllic islands with minuscule population, but the amount of money parked in these tiny islands can put many large nations to shame. Such offshore jurisdictions provide extremely high levels of secrecy, very lax corporate laws, zero or negligible taxation and carefully structured Double Taxation Avoidance Agreements (DTAA also called Tax Treaties) with other nations. It is in such tax havens that a complex web of shell companies and trusts is created to achieve objectives of money laundering and tax evasions (many times with an aim to achieve both together).

Mauritius has been the largest source of FDI into India for many years in the running ever since our economy was liberalized in the 1990s

While there are about 70 Tax Havens all over the world, two of them have been extremely popular when it comes to tax evasion and money laundering as far as India is concerned – the Cayman Islands and Mauritius. It is not uncommon for both of these being used in tandem in many of these complex schemes. There is something about sea and shells – didn’t we all try our luck with “she sells sea shells on the seashore?”

Cayman Islands – Secrecy

The primary reason that many seem to prefer the Cayman Islands as the tax haven of choice is that it has weak Know Your Customer (KYC) norms and very little scrutiny on the source of funds. They have been cagey even when the Queen Bee (read United Kingdom) comes calling[1].

The National Crime Agency (NCA) the organization that leads the UK to fight against money laundering and criminal money, has not been able to make headway getting information from the Cayman Islands, a British Overseas Territory.

Assume that the money has taken multiple hops through Tax Havens and landed in the Cayman Islands. The money has to be used for spending during elections, paying off bribes (is this what the corrupt politicians from UPA are doing?) and for investing in sure-shot projects. In other words, it should have the flexibility to be used for any scenario.

Mauritius – DTAA with India

Mauritius has been the largest source of FDI into India for many years in the running ever since our economy was liberalized in the 1990s. The primary reason it has left even the most developed nations behind is not that it has a vast surplus to invest; rather it is the most preferred conduit for bringing money into India due to an extremely ‘beneficial’ double tax avoidance treaty with India – this treaty along with the tax laws of Mauritius has provided such benefits that a few conscientious luminaries have rightly observed that the objective of double taxation avoidance needs to be replaced by the objective of double non-taxation, as many smart monied folks have escaped by paying zero tax in India and virtually zero tax in Mauritius. While the Indian government have finally shown some guts in the last couple of years to renegotiate this treaty to introduce the limitation of benefits clause, it is not absolutely clear that it has plugged too many loopholes.

A Fund entity is created in the Cayman and all the LPs (including GPs) pool in their investment into it.The KYC norms in Cayman are very weak and there is very little scrutiny on the source of funds

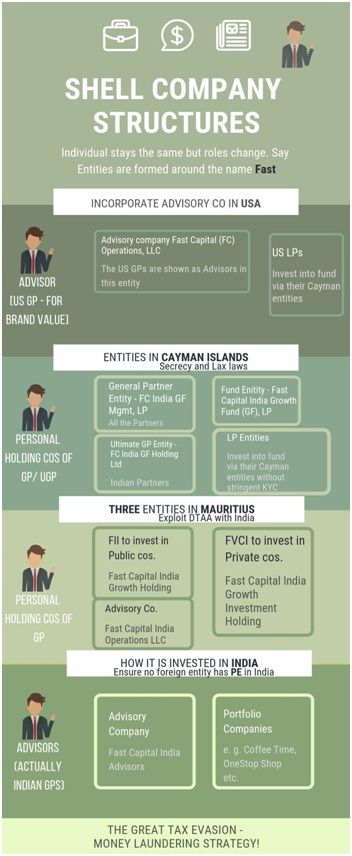

These two jurisdictions have been extremely popular with financial services (funds) industry. In the next section, we look at one such structure deployed by a leading venture capital fund to invest in public and private markets in India. While the structure is real (source is executed agreements) the names of the various entities have been changed.

Figure 1. The Great Tax Evasion and Money Laundering Strategy

Figure 1. The Great Tax Evasion and Money Laundering Strategy

- Create a GP(General Partner) partnership entity in Cayman which comprises of all the general partners (i.e. the fund managers) of the fund. This GP entity enters into partnership agreements with all the LPs (actual investors of the funds called Limited Partners) and the GPs. Since in the present case, there are two sets of GPs – US-based GPs who are mostly to provide brand name and the ‘India-based’ Gps, India based GPs also create an Ultimate GP entity in Cayman. This Ultimate GP entity signs a partnership agreement with the GP entity under which the shares in the GP entity get divided between the Ultimate GPs and US GPs in the ratio of 2:1. All these partnership agreements are structured in a way that the control and management of the fund are really with the Ultimate GP entity.

- A Fund entity is created in the Cayman and all the LPs (including GPs) pool in their investment into it. As mentioned above, the KYC norms in Cayman are very weak and there is very little scrutiny on the source of funds. It is not uncommon for such funds to have many LPs whose antecedents are difficult to trace as there are several layers through which the LP contribution eventually makes it to the fund. For example, some of the LPs are ‘funds of funds’ (FoF) which are supposed to be funds that invest in other funds, but it is difficult to ascertain who are the real contributors to these FoFs.

- All the GPs have personal holding companies (PHC) or trusts in Cayman and other geographies and it is typically these PHCs (instead of the individuals) that enter in the various agreements mentioned above. This helps in hiding the beneficial owner, evade taxes and have the flexibility to move money by leveraging the secrecy provided by tax havens such as Cayman.

- The GPs get paid management fees and are entitled to carry based on profit. They are also supposed to make the contribution to the fund – occasionally by forgoing part of the management fee, but sometimes by contributing to the fund from their (or their PHC’s) bank accounts which are usually in offshore jurisdictions. Such contribution and distribution (of carrying) generally happen via the PHCs of the GPs in Cayman (and other geographies, but never India).

- All the real activities of the fund are managed by Advisory companies in US, India and Mauritius. The GPs own and run these advisory companies (and the advisory companies practically run the fund) but these companies enter into an advisory agreement with the GP entity in Cayman wherein an arms-length relationship is established to show these advisers as an independent service provider to the fund, and not part of it. This ensures that the fund doesn’t appear to have a Place of Effective Management or a Permanent Establishment (described later) in India, and is not ‘liable’ to be taxed in India, and thus the fund is able to dodge taxes in India and US. All the key GPs are part of these advisory companies, the entire management fee could be getting transferred from the GP entity to the advisory company, all investments decisions are practically taken by the advisory companies, yet these companies are shown to be independent of the fund entities and in the business of providing ‘non-binding’ advice to the fund. Extreme care is taken to ensure that none of the Cayman/Mauritius entities establishes Permanent Establishment in India in order to ensure that nothing gets taxed in India.

- Two entities are created in Mauritius – FII subsidiary for investment into publicly listed companies in India and FVCI subsidiary for investment in private companies in India. The fund uses these as a conduit to invest in India and leverage the DTAA between India and Mauritius so that capital gains are not taxed in India. The investment is done on the advice of the advisory company in India (which gets paid through the advisory company in Mauritius) but all the decisions are shown to be taken in jurisdictions outside India.

It will not be surprising if many of the readers are completely overwhelmed by the description of the structure above. It is complex for the tax and enforcement (such as the Enforcement Directorate) too and it is hard to detect tax evasion and money laundering happening through such a structure – as it is the Indian authorities may not even be aware of all the entities and their owners.

To be continued…..

References:

[1] UK frustrated by Cayman Islands silence on money laundering – Sep 14, 2018, BBC

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Tried hard but am unable to clearly understand the structure? Could anyone please explain it further?

[…] Part 2 of the series, we went through a complex structure set up by a fund to invest into India. The structure had a […]

[…] deals with How Tax Havens are used by HNIs. Part 2 explains why High Net worth individuals open shell companies in tax havens. This is Part […]

The invention of “P-Notes” used widely by indian black money spinners to multiply their ill-gotten money should be banned once for all.

India urgently needs ‘draconian laws’ to deal with ‘Fiscal criminals’ like Chidu, Pappu etc. – the same way we have TADA, MCOCA etc to deal with ‘Physical terrorists’

–

With the existing ‘snail paced justice delivery system’ where almost all the HC & SC Judges are corrupt criminals it is foolish & height of naivety to expect rounding up criminals like Chidu.

–

Even if Modi returns in 2019 with 2/3 majority he will be unable to clean up our institutions where the Trojan Horses of the UPA Mafia are staying put.

Sir ,Small correction, most of the advisory Cos are in the financial district of Dubai, where no Indian investigating agency has any access. As low as with 1000 dollars , a tax haven account can be opened and the consultecy firm details are available in GULF NEWS classified column. These firms handle all paper work. Also Dubai is hub for hawala transactions to multiple countries ( legal in Dubai as it is a tax haven ) . Almost every diamond trader of India operates legally from Dubai Diamond Park a FZE or through DMCC a FZE for comoddity trading.

Once in a seminar in the Financial district few years ago, a German economist commented ‘ You rich Indians are feeding the poor Europeans ‘

Kudos for your untiring efforts to expose the corrupt politicians. Keep up your mission in the service of the nation.