PART I – Current Scene & Interim Solutions

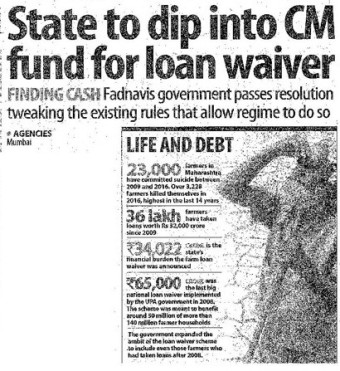

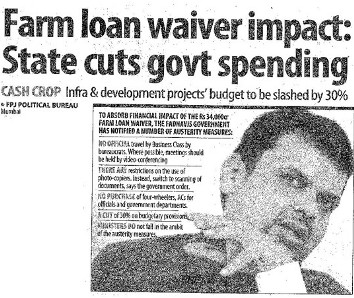

Felled by oppressive political pressure, Devendra Fadnavis is now suffering from an acute agricultural migraine. As the two pics of the front-page lead stories from the “Free Press Journal” (established since 1928) show below, the chief minister of Maharashtra seems struck by a panicky agony.

…a sum of around Rs.93,682 crores loan waivers have been announced by five major States since April 2017. (UP’s score is Rs.36,000 crores, Maharashtra’s is Rs.34,000 crores, Punjab’s is Rs.10,000 crores, Karnataka’s is Rs.8,200 crores, and Tamil Nadu’s is Rs.5,482 crores).

The bullet points in the below two pics give the facts and figures of the ambience causing this eco-political distressed mental state of a bright and youthful leader. And this distress exists although the man heads the State which has the highest projected Gross Domestic Product (GDP) in India with Rs.25.35 lakh crores in Financial Year 2017-18. Yes, even the richest State has been adversely afflicted with the viral called “Farm loan waiver.”

In fact, a sum of around Rs.93,682 crores loan waivers has been announced by five major States since April 2017. (UP’s score is Rs.36,000 crores; Maharashtra’s is Rs.34,000 crores, Punjab’s is Rs.10,000 crores, Karnataka’s is Rs.8,200 crores, and Tamil Nadu’s is Rs.5482 crores). What with Gujarat seemingly waiting in the queue with volumes of milk being thrown on the roads the other day, and with certain anti-BJP Maharashtra politicians demanding that, apart from short-term crop loans, medium-term loans (one-to-five year duration) of farmers also be waived, the country may well be headed for foregoing over a lakh of crores due from farmers. The nation could well be headed for an unprecedented financial crisis.

The problem is simple. The States just do not have the finances in their treasury to replenish the banks with the loan amounts which the latter gave the farmers and now are being waived by the State concerned. As a result, the States would have to raise additional resources to pay the lending banks in order to clean up the loan slate of the farmers.

Simply stated, SDLs are dated securities issued by States for meeting their market borrowings requirements.

That is why the Maharashtra CM has amended the CM Relief Fund Act to use it for meeting at least a part of its loan waiver commitment. He has also thought of selling, by auction, some of the package of lands which is presently leased out to occupants of those lands on a monthly/ annual basis. That is why, also, why he has decided to cut his State’s infrastructure development projects by about 30 per cent and also launch an austerity drive on spending by bureaucrats.

The Other States which have waived off loans will have done similar exercises if they do not wish to seek the last resort of high-cost State Development Loans (SDLs), a device monitored by the Reserve Bank of India under its own norms and rules. Simply stated, SDLs are dated securities issued by States for meeting their market borrowings requirements. In effect, the SDL is similar to the dated securities issued by the central government but entail a higher interest rate. The purpose of issuing SDLs is to meet the budgetary needs of State governments. Each State can borrow up to a set limit depending on the State’s present fiscal deficit etc. and their ability to bear the interest on these funds.

The Yogi Adityanath government of UP has, however, pulled out a rabbit out of the hat so to say. In its maiden annual budget presented to the State Assembly on 11th July, it has made full provision for the election manifesto promise of crop loan waiver! It performed this magic by discontinuing funds for some of the previous Samajwadi Government’s welfare and freebies schemes which he dubbed as shashan ki fizul ki kharchi — trust the mocking Yogi and his command over Hindustani! By the way, this UP allocation for farm loan waiver constitutes nearly 9.4 per cent of the total annual budget of Rs.3,84,650 crores.

The question arises: what would the Yogi do if those now deprived of their earlier freebies engaged in a wide and sustained agitation for restoration of those goodies? Will there be another “waiver” of another kind? Will another pain-killer be used to get rid of the migraine?

The unfortunate fact remains that Indian agriculture will remain fickle, susceptible to several vicissitudes and virals. It will remain so unless this recurring economic and political migraine is cured.

In the immediate short term, it will be most prudent for the country if our Parliament looks at the whole “loan-waiver” scheme in its entirety and lays down strict norms for sanctioning that populist vote-seeking policy which has the nasty potential of permanently fracturing our economic architecture through the fields of agriculture.

For instance, such a suggested law should ensure that a farmer’s loan repaying capacity is not judged by his crying out to the media and coming from Chennai to Jantar Mantar at some vested interest’s cost for a month and a half, publicly displaying his obese stomach or by going on disruptive strikes which include littering the highways with grains, vegetables, and milk. The real test of a farmer’s repaying capacity should be benchmarked by his average household income. His eligibility for a loan should not be determined by his document of his land ownership but, once again, by his household income.

This “household income” concept arises because there are cases where a farmer lives with his children get educated in an Industrial Training Institute, secure a good job 9, albeit temporary, in a reputed corporate house, but are given a “loan waiver” even as his other son, ITI qualified, runs a self-owned Ola car.

Again, a farmer never has to account for the details of how he spent the loan he receives from a bank, the assumption being that he spent it earlier for the purpose he showed in his application to the bank. There have been several cases where parts of the loan received have been spent on booze, jewelry for the wife/ daughter, marriage ceremonies, pujas etc. Demanding a loan waiver in such cases is outright thuggery of the bank and the bank at large. It must stop, now, straight away— by a law of Parliament.

There are some similar frauds which need to be legally stopped in this “crop loan” business. For instance, a farmer just does not pay for the Government’s Crop Insurance Scheme although the premium rates are low — paddy @Rs.270 per acre and pulses @ Rs.183 per acre. (A Table of rates fixed for various crops in 2016 is at The Hindu ).The question is: Why should a farmer get a loan waiver if he hasn’t paid even his prescribed insurance premium for his crop? The suggested law must stop this.

Whether the suggested law by Parliament can be made applicable to the States of the Union of India is a separate, Constitutional, issue. But Parliament must make it applicable wherever there is involvement of the funds/rules/norms of the Reserve Bank of India or of a Union Government organization such as National Bank for Agriculture & Rural Development (NABARD). The least the Parliament should do is to make it a model law for the States to follow.

Tomorrow: PART II: Long-term Solutions

- To Editors’ Guild; May we also have our say… please? - July 17, 2019

- Farooq Sahab is either down with dementia or he is a congenital liar? - July 8, 2019

- Shah Bano, Muslims in gutter &Zakaria’s secularism - June 30, 2019

Farm loan waivers are bad. They will first become a habit, then tradition, and finally formalised into the budget. The thin end of the wedge if you like.

I would submit that the reason for the problems is lack of imagination, weak administration, and lack of political will rather than anything else.

Lets look at the different items

Loans are commercial aagreements and waivers make a mockery of the loan process…we may as well give the money away in the first place.

Use of family income to judge farmer’s capacity – this is against sound commercial principles. Adult progeny may not be made part of the loan eligibility or repayment unless they are parties to the loan as a co-borrower or as guarantors. My estranged millionaire adult son cannot be held responsible for my loan. Banks can always have productive adult children as co-borrowers or guarantors. Blindly applying “family income” by ignoring the law and contractual boundaries will only create chaos and injustice.

Misuse of funds – banks have a long established policy of remitting money directly to the seller where the loan is for a purchase. So purchases of seeds and fertilisers can be tracked, and it can be ensured that the money is used for the right purpose. [I will not go into possible corruption among the parties]. This will reduce the opportunity for misuse of funds. If Banks are not doing this, the question to ask is why banks deviate from good practices

Likewise, when I take a mortgage loan, the bank makes me insure myself and the property. (The bank pays the insurance company directly). Why cannot, therefore, crop insurance be part of the lending schemes? (I am asssuming that they are not – as the artricle points in that direction).

Given the insurance, and given the standard norms are available for the productivity of a piece of land in a particular location, it should be possible to determine the cost of inputs and the expected revenues. That would be the sound approach.

It should also be possible with satellite data, aerial surveys, reports from field officers and the data collected from Banks and seed and fertiliser companies to collect comprehensive statistical information and specific farm information. With the technology available today, it should be possible to determine the state of farmland in an area in general or a farm in particular. The only caveat is that this must be done by an independent body, so that discrepancies across data sources can be used for fraud detection. You cant prevent collusion, but you can make it harder and put detective mechanisms in place.