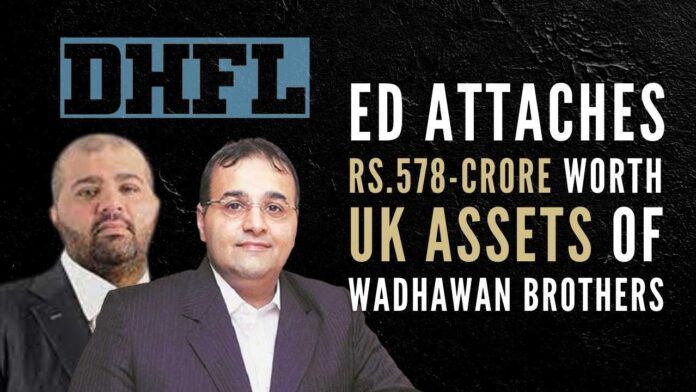

ED attaches Rs.578-crore worth UK assets of Wadhawan brothers

The Enforcement Directorate (ED) on Tuesday attached assets worth Rs.578 crore of a UK-based company owned by scam-hit DHFL promoters Kapil Wadhawan and his brother Dheeraj in connection with a money-laundering probe against them and others. The attached properties “are in the form of investment made by the Wadhawans through WGC-UK in United Kingdom-based companies” and a provisional order has been issued under the Prevention of Money Laundering Act (PMLA), said ED in a statement.

The value of the assets is GBP 57 million or Rs.578 crore. The Wadhawan siblings are at present in jail in connection with the Yes Bank alleged loan fraud money laundering case. The latest ED case against the Wadhawans is based on an FIR filed by Lucknow Police against some officials of Uttar Pradesh Power Corporation Ltd (UPPCL) for “illegal investment” of general provident fund (GPF) and central provident fund (CPF) of the employees of the power company into Dewan Housing Finance Limited (DHFL) “in violation” of the government notification and directives.

The ED had earlier attached properties worth Rs.1,412 crore of the Wadhawans in connection with a separate money laundering case investigation being conducted against them in the Yes Bank alleged loan fraud case.

“DHFL in connivance with UPPCL officials had illegally received Rs.4,122.70 crore of GPF and CPF funds of UPPCL’s employees in fixed deposit in DHFL. Out of this total investment, Rs.2,267.90 crore of the principal amount of provident fund (GPF+CPF) of UPPCL is still outstanding to be paid by DHFL,” said the Agency.

These “illegal investments” had been received by the DHFL during the period when DHFL has engaged in the disbursement of high-value loans to its promoter-related companies.

“All such unsecured loans had been sanctioned as per the directions of the chairman of DHFL, Kapil Wadhawan and many of such loans have turned into NPA,” the agency alleged. Many of these loans, it said, have been siphoned off without utilizing them for the purpose they were sanctioned for.

“The proceeds of crime, amounting to more than Rs.1,000 crore, generated in this case has been siphoned off to the UK by the Wadhawans by seven levels of layering and laundering through more than 30 beneficially owned/ controlled Indian companies,” said ED.

The agency had earlier attached properties worth Rs.1,412 crore of the Wadhawans in connection with a separate money laundering case investigation being conducted against them in the Yes Bank alleged loan fraud case. It had also seized 5 SUVs, valued at Rs.12.59 crore, owned by them in the Yes Bank case.

In our country, there is “no service” after sales”! Customer care number does not answer our calls while emails none reads/replies! Similarly in all corruption cases thieves are caught especially pre-election campaigns and post election all such cases vanish because thieves are “innocent” and it’s a political vendetta at the backdrop of thieves also “developing chest pain” and further people like Chidambaram and Nehru Gandhi family to name a few are much more cleaner with ZERO LOSS certificates and as pure as snow in-spite of having bank accounts in 26 nations and double passports get Y and Z category protection from the ruling party itself! There has been a growth of HNIs in India laughing at SGDP/GDP rates!!

Another 1,000 years of courtroom activity…..total fatigue.