Following my article on FDI inflows[1], the Prime Minister (PM) Narendra Modi gave an interview to Zee News in which the interviewer complimented the PM on the investment growing to $60 billion[2]. This post is intended to clarify what I had written and what the PM had said and both are correct. How is this possible? Let me explain…

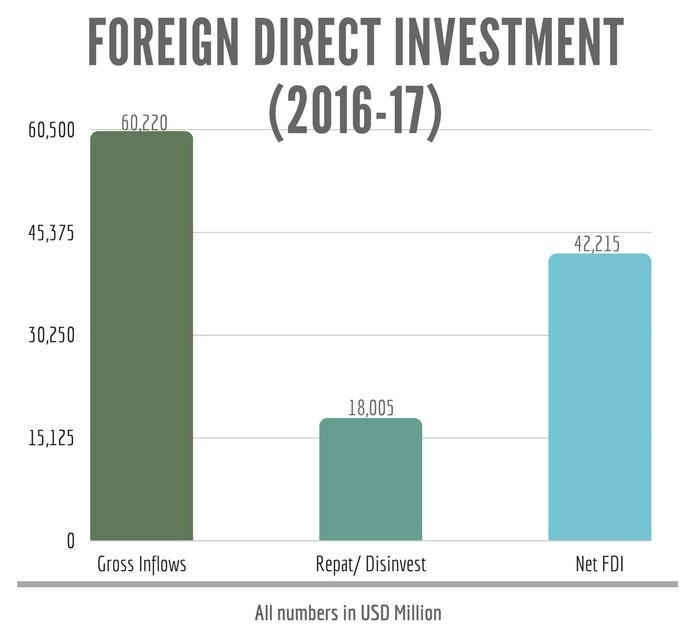

The data provided by the Reserve Bank of India (which I had used in my previous post too), states that for the year 2016-17, the gross inflows/ investments into India is $60,200 million (or $60 billion). At the same time, a lot of Indian companies are also investing/ acquiring companies abroad and this amount for the same period is $18,005 million (or $18 billion). This also includes profit-taking by investors who may have sold their companies in India (called as Repatriation). The net Foreign Direct Investment is the difference between Foreign Direct Investment inflows into India and the Foreign Direct Investment Outflows (from India to other countries)[3]. For more see Figure 1.

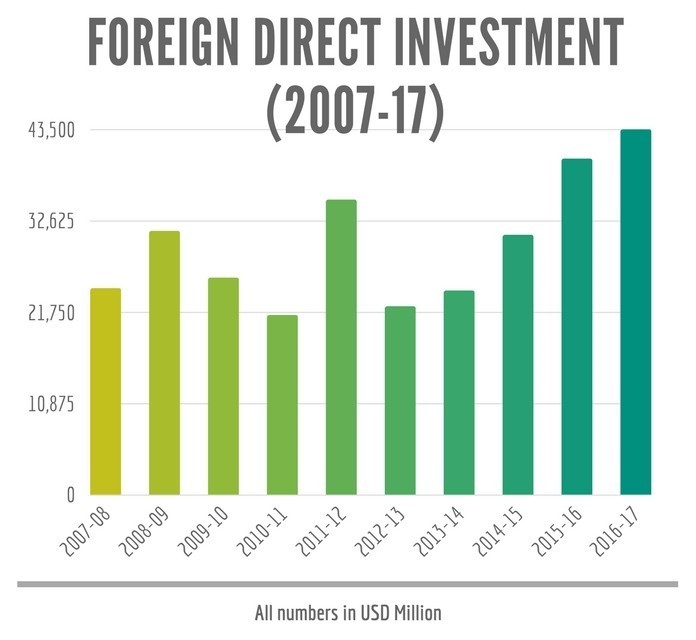

Let us take a step back and see how FDI has fared over the past 10 years to give us a good idea of when India was considered to be a good investment destination…

Figure 2 shows the net Foreign Direct Investment amounts (Equity inflows) into India[4] for the period 2007-17. The site Data.Gov.In is a goldmine of information that contains extensive details including visualization (graphics) for some data.

Since the Modi Government came to power, the FDI has been going up steadily. But this data only shows what came in – it does not show how much went out. For this, we will have to wait till it gets posted on the website[5]. From a foreign investor’s point of view, India is being viewed more favorably as an investment destination under the Modi regime than the previous one.

Foreign Institutional Investments (AKA Foreign Portfolio Investments)

FDI is not the only method by which money comes into India. The other method is called Foreign Institutional Investor (FII). FII means an institution established or incorporated outside India which proposes to make an investment in securities in India. FIIs are allowed to subscribe to new securities or trade in already issued securities.

However, FII as a category does not exist now. It was decided to create a new investor class called “Foreign Portfolio Investor” (FPI) by merging the existing three investor classes viz. FIIs, Sub Accounts, and Qualified Foreign Investors. Suffice to say, since June 2014, there is only one term and that is FPI. This route was preferred by institutional investors such as Goldman Sachs, Morgan Stanley etc. who could invest large sums of money through Mauritius (or Singapore) so they could make money off of interest rate arbitrage. Large US-based institutions got money at a low-interest rate of 0.25% and could then invest the money in India which was keeping its rates at above 8%. The difference in interest rates (of about 8%) coupled with the fact that these came in through tax-free sources (Mauritius and Singapore) meant that these companies could get a risk-free return of 8% or more. No need to pay capital gains tax in India because these funds originated from either Mauritius or Singapore. And no taxes were paid in the US either as the money was earned outside the US!

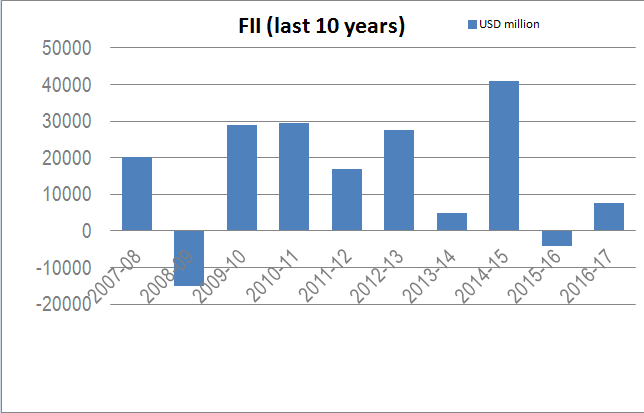

A quick look at the FII investment route for the past 10 years shows some interesting facts (see Figure 3).

An investment that comes in this route is dependent on not just India’s economy but the world’s economy at large – FII money chases the best returns on a particular time period (if say another country provides a better interest rate arbitrage, then it would go to that country instead). It would be interesting to know why FII went negative in the 2015-16 year (April 2015 – Mar 2016). This was before the Demonetization so that can’t be the reason. Suffice to say, FII is not as stellar as FDI.

What is the effect of Participatory Notes?

The data in either RBI or in Data.Gov.In website does not break out this information. Now to make things interesting, an FII, if it results in an investment into a company of greater than 10% is treated as FDI! Clear as mud?! Well, the reason I am mentioning this here is to say that P-Notes could have come in as Equity in FDI or through the FII route. P-Notes can result in wild swings in the stock prices as a chunk of money moves in and out of a particular stock. Is this what is happening in India today? Well, I don’t know the answer. But for the good of the country, this pernicious financial instrument must go. Now.

References:

[1] FDI into India up! Really? Data doesn’t seem to suggest this – Jan 17, 2018, PGurus.com

[2] Modi interview on Zee News – Jan 19, 2018, YouTube.com

[3] No. 34 Foreign Investment inflows – Jan 10, 2018, RBI.gov.in

[4] FDI Equity inflows – data.gov.in

[5] FDI Factsheet – data.gov.in

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] FDI inflows into India – Part Deux – Jan 21, 2018, […]

People at large are being cheated by the Government so brazenly….

The fact that the RBI would not publicly inform the infamous P-note investments specifically is a problem. If RBI is truly autonomous, independent of political influence, it should want to shed light on it. Something is just not right. It makes you wonder if the hawala racket is intact as ever.

Arun Jaitely is a crook & Prime Minister deliberately does not to antognize him for unkown reasons & keeping the “deletion” & “erasing” laws relating to “Promisory Notes” as investment instrument, seen only in India & no where else on earth!!

If it has come by way of 10% of FPI, isn’t there a lock-in period?

If it has come by way of 10% of FRI, isn’t there a lock-in period?