Further to the PGurus article on Millions of dollars flowing into India illegally[1], I have been looking for data that would tell me that FDI is on the rise.

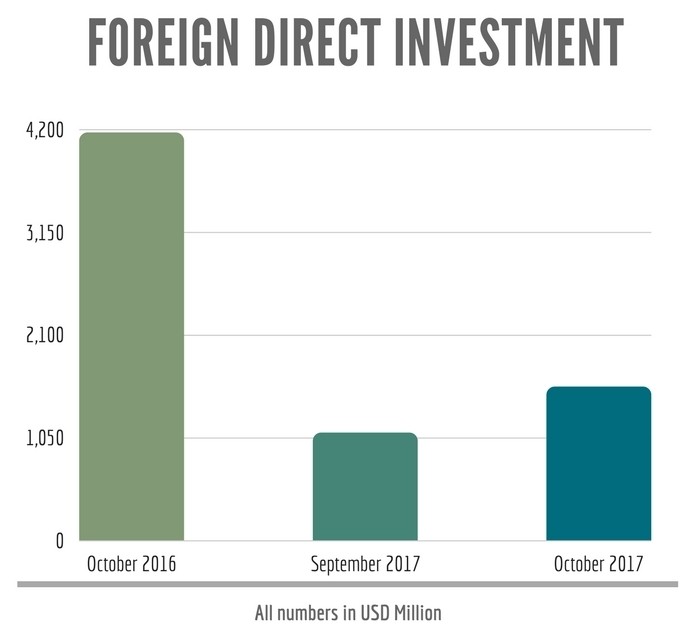

The data put out on January 4, 2018, for October 2017 investment numbers show a decline in FDI from Year-over-year and a slight increase in Month-over-month (see Figure 1)!

The numbers quoted above is the difference between Foreign Direct Investment inflows into India and the Foreign Direct Investment Outflows (from India to other countries)[3].

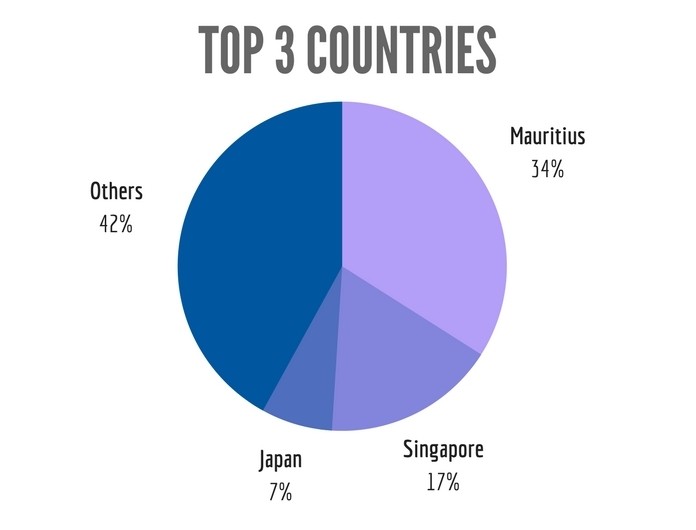

In terms of top investing countries in FDI equity inflows, the top three countries were: Mauritius which had the highest share of 34%, followed by Singapore (17%) and Japan (7%). Additionally, services sector (17% of the total inflows) continued to be the top sector attracting highest inflows, with telecommunications and computer hardware & software coming in the second position[2] (8% respectively).

On a cumulative basis, FDI inflows in the first ten months of 2017 have slowed to 27.4 billion USD as compared to 33.8 billion USD for the same period, a year ago.

Let us look at the top three countries from which these investments came (see Figure 2).

The fact that more than 50% of the FDI is coming in via Mauritius and Singapore indicates that the activity in the stock market using Participatory Notes is still happening.

Outward FDI

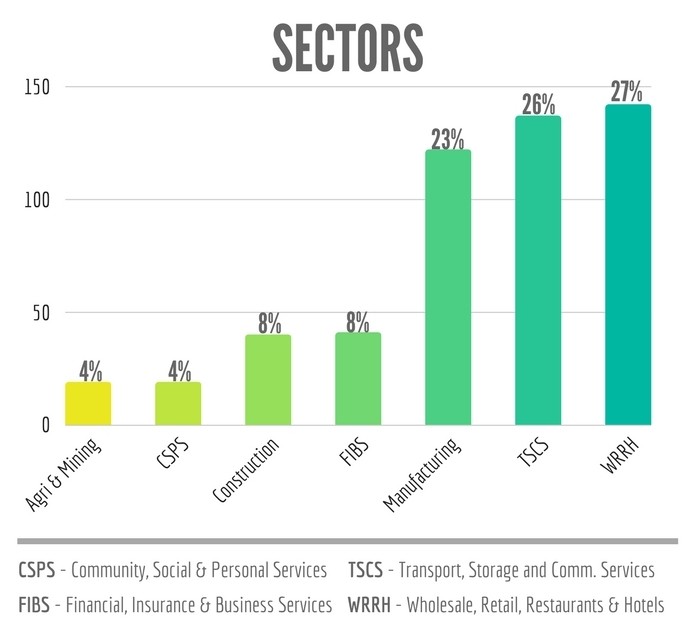

Figure 3 shows the various sectors into which money flowed from India to other countries. USA with 99 investments was the biggest beneficiary. These are sectors into which India invested in the month of November 2017.

Which sector got the most investment?

About 25% of the equity investment is going into the Manufacturing sector, almost all of it connected with ONGC Videsh Ltd. About 12% is going into The Financial (FIBS) sector.

Conclusion

Worldwide the stock markets are going up, thanks to the lower tax rates announced by the United States but in India, there is no such phenomenon that should cause the stock market to rise. The fact that more than half of the Foreign Direct Investment into India is coming through Mauritius and Singapore indicates that there is significant influence of Participatory Notes (P-Notes). This can cause volatility in the Stock Markets. Not only that, the arrest of a political leader who may have played the market using P-Notes could lead to a pull out of his/ her investments, causing a run on the Stock Market. The Stock Market draws the gullible when it is nearing or at its peak. Now is one such time. In fact the market is frothy.

References:

[1] With millions of dollars flowing in illegally, is India in for a Security crisis? Jan 16, 2018, PGurus.com

[2] FDI and Portfolio investment in India – Jan 4, 2018, IndiaMacroAdvisors.com

[3] No. 34 Foreign Investment inflows – Jan 10, 2018, RBI.gov.in

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] Foreign inflows (FDI) into India up! Really? Data does not seem to suggest this – Jan 17, 2018, […]

[…] FDI into India up! Really? Data doesn’t seem to suggest this – Jan 17, 2018, […]