[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]he Goods and Services Tax (GST) can have an adverse affect on a group of companies that GST terms as Service Exporters. Imagine an Indian company (let us call it as Alpha Imports) that is representing the interests of a Foreign product manufacturer, who makes say high precision cutting tools. A number of German companies specialize in this niche and such tools are used in any number of infrastructure projects – a metro railway line or a Heavy Electricals plant and so on.

It needs to be borne in mind that if Alpha establishes itself in Dubai’s DMCC Free Zone, its corporate tax and income tax of its employees is 0%!

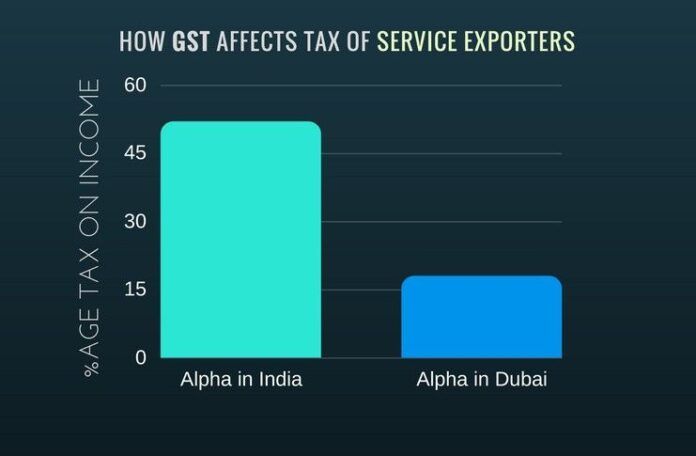

Till date Alpha Imports would book the business from its customers in India and then place the order on the Foreign Product manufacturer, using a process known as a Letter of Credit (LC). This LC has to be opened by the bank of the Indian customer, which in turn Alpha Imports relays to the Foreign Product manufacturer, whose Bank will then allow the shipment to take place. This arrangement has been in place for years now. Once the shipment is made, Alpha Imports gets its agency commission (a certain percentage of the shipping price of the product) which is essentially its revenues. Since Alpha is incorporated in India, it pays a corporate tax of 34% on its taxable income.

The GST bill now wants to tax such companies, which it labels as “Exporter of Foreign Services” an additional 18%. The net tax bracket for these companies now becomes 18+34 = 52%! Alpha Imports is balking at its ballooning tax bill and is wondering if it should re-locate itself to a third, less taxed country such as Dubai or Singapore from where they can operate with a significantly reduced tax footprint. From a year back, an additional Service Tax of 14% is being levied on these companies (so they are at 48% currently).

These companies have written to their Member of Parliament but no action appears to be forthcoming. They want this removed on Export of Marketing Services provided to Overseas Principals because of the following reasons:

-

This will result in double taxation on FOREX commission earned by such Service Exporters, as it forms part of the value of goods imported into India, on which also, IGST will be payable anyway by the importer.

-

Is against the fundamental principle of GST i. e. ‘destination based consumption tax’ – IGST on commission will have to be borne by service provider, as they cannot pass on the same to their overseas customer (service recipient).

-

It is against the international practice of not levying GST / VAT on Service Exporters.

Alpha’s (and similar companies of this category) move to a foreign country would result in loss of jobs in India and corporate and income taxes of the employees working in these companies. This will also lead to a loss of after sales support for the Indian companies, which may need training in the operation and maintenance of these products, most of which are expensive.

It is important to note that this 18% tax is not levied on Indian exporters (think the process in the opposite direction). Is this a sleight of hand to tax imports?

It is hoped that the GST Council, which is meeting in Srinagar today and tomorrow will exempt this service from GST Taxation. It needs to be borne in mind that if Alpha establishes itself in Dubai’s DMCC Free Zone, its corporate tax and income tax of its employees is 0%!

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

The new GST regime in so far as it applies to taxing commission agent’s income from commission received from foreign supplier is not consistent with the objectives of demonetisation last year to tackle black money for the simple reason that the commission agents are required to pay 18% GST in addition to 34% income tax on foreign commission due to insertion of illogical clause in Place of Provision of Service Rules. Hope the GST council in its next meeting make suitable amendments to treat the commission agents as exporters of service and exempt them from GST.

Timely article which reach the ears of the concerned ministers and GST council members. Remove service tax to ensure the foreign exchange earners are getting a fair treatment and not moving their offices to tax friendlier countries and discourage opening of laison offices of foreign suppliers where GOI will lose not only service tax but income tax as well.

It is totally discouraging business as what we earn is paid back to govt, grossly unfair taxing. It is against the basic principals as explained above by Sree Iyer, govt must reverse this tax to encourage bringing back FOREX and protect exporters of services in nations interest.

Grossly unfair tax on export of services

Nice article Mr. Iyer, as rightly explained with good reasoning. It is grossly unfair taxing and huge burden on service providers, it will only add to cost of imports. When no other country is following this tax practice why only in India ? Any idea if some group of companies has made representation to Govt for reversing this tax ?

Congratulations to author Mr. Iyer for a critical article, and a timely one.

This part of the GST regime – i.e. the taxes on the export of services – seems to have fallen through a big crack. I know of several businesses affected by it having left India and relocated abroad, trying to get away from this business-killing Indian double-taxation.

It is sad that the finance ministry acts as though it just doesn’t understand what’s at stake here or does not care.

Hope Mr. Jaitley intervenes in time to stop the exodus of the affected businesses that would surely deprive the GOI of a good source of not only tax revenues but also of precious foreign exchange.

Sir, tax on commission (intermediary service) is levied in current indirect tax regime also. If the Government wants to keep revenue neutral, they ll have to tax intermediary in GST also

Once GST goes into effect, tax goes up to 52%. Currently it is at 48%.

The question is about services rendered overseas and commissions paid by overseas companies to their Indian Agents in FOREX.. it is not to be compared with intermediary service rendered locally where intermediary can collect GST from local service receiver.

It is totally discouraging business as what we earn is paid back to govt, grossly unfair taxing. It is against the basic principals as explained above by Sree Iyer, govt must reverse this tax to encourage bringing back FOREX and protect exporters of services in nations interest.