Time for a takeover by CBEC?

When Senior BJP leader Dr. Subramanian Swamy had warned about the perils of GSTN several months ago, he was scoffed at. Most did not know the nuances of how GSTN was to have worked and somehow assumed that things would work, once GST was deployed. Ignorance of how complex software works?

When the GSTN is unable to deliver without rocking the boat of GST – what do you expect the Government to do?

Now what the BJP leader and economist was alerting about GST’s private companies controlled network GSTN for the past one year has come true. On September 9, the GST Council of the entire group of Finance Ministers from the states were complaining about the chaos created by GSTN. Pacifying their anger, Union Finance Minister Arun Jaitley said that a committee will be constituted to look into the rectification of GSTN.

When the GSTN is unable to deliver without rocking the boat of GST – what do you expect the Government to do? The last thing you wanted the Modi Sarkar to do was set up a Committee. It is time for the Government to take over the GSTN by exiting all private companies and placed this network under Central Board of Excise and Customs (CBEC). Let us look at the current chaotic scenario…

The last date for payment of GST for the month of July 2017 was 20th August 2017. The GSTN server crashed. Responses were slow. The grievance redressal mechanism of GSTN could not handle the overwhelming inflow of complaints. Clearly, the writing was on the wall. But then again, the Revenue Department blamed the Bihar floods, delayed ordinance in Jammu and Kashmir and the last minute rush to file the GSTR 3B returns (which led to server problems in GSTN) as the reasons for the extension. The dates were further tweaked to permit all taxpayers who have availed credits in TRANS1 form to file the 3B returns by 28th August and the rest of them by 25th August.

It is interesting to note that the GST 3B itself was a creation only because GSTN failed to deliver the GSTR 1, GSTR2 and GSTR3 in time. Again, no one whispered about the role of GSTN even then.

Again, a flashback. In the month of June 2017, the GST Council decided that the dates for payment and filing of returns for July 2017 will be pushed to August 2017 only because the GSTN was not ready. The Revenue Department blamed the tax payers and their ill-preparedness for the extension.

A senior consultant who did not want to be named said the GSTN has been taking a lot of decisions which are against the rules and the GST laws.

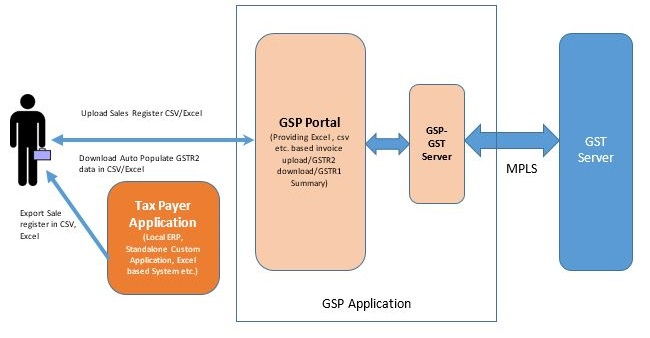

GSTR1 for July 2017 was supposed to be filed by September 5, 2017. This extended date had to be extended further to the 10th of September 2017. GSTR 2 and GSTR 3 for the month of July 2017 were extended to 25th and 30th of September 2017 respectively. There was chaos as the GSTN did not even respond to the problems being faced by taxpayers. And these tax payers who are at present filing GSTR 1 are the Multi-national Corporations (MNC)s. If this was the attitude of the GSTN towards the major assesses one can imagine how they would respond to the small and medium tax payers in days to come. For more on what GSTR 1, GSTR 2 mean, see Figure 1 below:

The problem did not end there. The GST council met in Hyderabad on September 9, 2017. This time they have extended the filing of GSTR 1, 2 and 3 for the month of July 2017 to 10th October, 31st October and 10th November 2017 respectively. The notification in this regard is expected to be issued on Monday. Well, if you thought the tax payer had to file only these returns, hold on. The GST payment for the month of August 2017 is due 20th September 2017 and so are the GSTR 3B for the month of August.

But the Government of India does not blame the GSTN for any of this. It is the holy cow… In this holy cow, Government is having only 49 percent and 51 percent is with private banks like ICICI and HDFC, LIC Housing Finance and NSE Brokers consortium etc.

A senior consultant who did not want to be named said the GSTN has been taking a lot of decisions which are against the rules and the GST laws. One such instance is the issue of making part payment of the tax. GSTN module does not have any provision to permit part payments of the tax whereas the law permits the same.

Exporters are the other group of people who suffer because of GSTN. Any exporter who has paid the IGST on exports is to be provided a refund immediately. In the present scenario, it is all held up because the GSTN does not have a handshake for this module with the Customs ICEGATE and the PFMS of the Department of Expenditure. This is expected to take another 20 days at the least. Which means, close to 50,000 exporters will have their money locked up with the Government of India without any interest, because GSTN does not function effectively.

The issue of credits and the TRANS1 was another tale in itself. This took a lot of time to resolve in the month of August 2017, again because of the GSTN and the dates were extended to 28th of August 2017 for filing the returns. A lot of tax payers who could not avail the credits for the month of July 2017, were condescendingly asked by the GSTN to do so in the month of August 2017. The capital of the taxpayers gets locked because the GSTN does not care.

The TDS module for the Drawing and Disbursing Officers (DDOs) across India has not even commenced yet. The reason is – GSTN is not prepared.

A GST Suvidha Provider (GSP), who did not want to be named, said – “there was chaos in the meeting called by the GSTN CEO Mr Prakash Kumar on the 30th of August 2017. They have not even circulated the minutes nor have bothered to respond to our queries. The GSPs are frustrated with the kind of responses they are receiving from the GSTN”. Incidentally the main stream media (MSM) has been very silent about criticizing the GSTN on some of the specific issues. Only the Hindi newspapers have carried certain stories explaining the plight of the small and medium taxpayers.

When the MSM fails, twitter becomes the platform for the taxpayers to respond. A cursory glance of many tweets (mostly posed by Chartered Accountants, Lawyers, and Consultants) in the official handle, @askGST_GoI elicit a response – Ask @GSTech. It is important to note that the @askGST_GoI handle is being operated by the officers of the Central Board of Excise and Customs whereas the @askGSTech is being handled by the officials of the GSTN. Surprisingly, GSTN in most of the cases has not replied to the queries re-directed by the officials of the Finance Ministry. If this is the degree of response for the re-directed tweets from the Ministry officials, one might as well imagine the state of response to general taxpayers.

In a recent tweet, the Revenue Secretary, Dr. Hasmukh Adhia, known to be the man behind the GST mission of the Government of India, communicated that the additional charge of the Chairman GSTN will be with the UIDAI chief Mr Ajay Pandey. The immediate response from 300 plus replies to a couple of tweets was nothing short of anger and irritation bordering on frustration. This is not an isolated incident. When one reads through the tweets / replies received in the official handles – @askGST or @askGSTech, they are all filled with abuses and complaints. The social media otherwise also has been expressing the attitude with which GSTN has been treating them.

It is very surprising that at a crucial time, the Government has not appointed a full-time Chairman to the GSTN.

Underlying this entire picture is a fierce battle brewing in the Finance Ministry between the Central Board of Excise and Customs (CBEC) and the GSTN. The GSTN, till recently, was headed by Mr Navin Kumar, a 1977 batch IAS officer, who retired as the Chief Secretary of Bihar. The CEO of GSTN is Mr Prakash Kumar, a 1985 batch IAS officer from the AGMUT cadre, who quit the Government around 10 years back to work as a consultant in the private sector. The general criticism has been that Revenue Secretary Dr Hasmukh Adhia, 1981 batch Gujarat cadre IAS has been extremely soft on GSTN because it is headed by the IAS officers.

For the uninitiated, the GST module on imports (IGST and cess on imports) and the backend infrastructure is being provided by the Directorate of Systems, CBEC. A senior official of the CBEC, who spoke on the condition of anonymity said – “Customs collected the first GST payment at the stroke of the midnight once the Prime Minister dedicated GST to the nation. This happened every day and night starting 1st of August 2017 across all ports, airports and SEZ etc., The transition was absolutely smooth barring a few teething problems. No one recognized it because if they did, the larger question as to why is GSTN not delivering would naturally come up. Interestingly, teething problem is a proper word to be associated with the issues faced in the customs module of GST being handled by the CBEC. What the GSTN is dishing out to the taxpayer is not a teething problem but is a torture”.

In the middle of all this chaos, only 24.5 lakh (out of 60 lakh) taxpayers have filed the GSTR1 returns for the month of July 2017, owing to which the last date had to be extended again. This is the GST that is now functioning on extensions only.

Will the CAG be permitted to carry out a performance audit of the GSTN? Will Infosys be asked to deliver? Will someone at the senior level in the Ministry listen to the taxpayers and their plight?

If you thought GSTN and controversy are not synonymous to each other, you are wrong. From the Infosys bid to the service tax evasion, from not allowing CAG to audit to not following GFR – this list is actually endless.

What happens to Ease of Doing Business if all that the taxpayers are expected to do is file so many returns every month and end up fighting with GSTN on a daily basis?

Is the beginning of curtains down for the GSTN? The only remedy for this is a take over GSTN by Government by kicking out the private companies and hand over the administration to Central Board of Excise and Customs (CBEC).

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

Hi, this is Sanjay Amberkar, I am frequently following up with GST Update. My Personal view is that Government in order to implement GST URGENTLY by passed 34 GSP Vendors and opened the Gate of GSTN directly to everyone. Problem started here, data to be uploaded are in KB’s (only invoice wise details, no scan images or any mandatory details in form of PDF) but looking at our huge population, everybody is trying to swim in GSTN river, as every state finance minister are involved, there are changes every day. Govt. should come up with a decision and ask tax payer to pay their tax liability and after December govt officers will audit the same, they should show some faith in Individuals and penalty and late fees should be waived off, Also every one should show courtesy to pay their tax collected to government by other online means and make our GST a successful one, as other countries are watching us and we need to set an example before them, as NOW there is no way where we can UNDO GST.

In your opinion the GSTN should be handed over the CBEC and what do you expect from them. Worse than the present. These Government Servants are most inefficient persons in the world and nothing can be expected from these corrupt class.

Decision taken in a restless condition emerges only frustration. I admire my beloved PM very much for his great vision & action. What I personally feel there is only lacking of validation & deliberation. Being myself a very small chap, may I request our PM & his team to take adequate rest to deliver successful results. Mano ya na mano, physical, mental, emotional & spiritual are essential ingredients for taking correct decision. Forgive me for this posting.

And Modi ji wonders why Gdp id going down..? Stupid decisions like Gst implementation where entire india productive business’s time is spent in being free data entry operators for the revenue department !

As I understand from the core team (Tech) the problems are manifestation of hurried implementation. The development team has more new change requests than the time to resolve bugs. Also, the IAS officers behaving like feudal boss is creating huge discontent. Somehow the planning of having the load spanned across GSP and GSTN isn’t happening. The GSTN portal taking near 100% hit while GSP remains unused. This again points to poor planning & execution.

As long as head strong people are at helm the GSTN will have challenges and will impact the operations. It must be handled by professionals who can deliver results (It doesn’t matter if they are from x or y department).

The migration of corrected data from VAT was also taken casually by business. While the CA has given their mobile number in the contact number, the OTP reaches them and business is stuck. All these results in last minute rush and infrastructure isn’t configured adequately to handle rush of this volume.

Its time, the structured team is taking the grievances seriously and responding in time. The tickets management (complaint management) must be made public so that people know the total complaints received, responded in time, resolved in time kind of information. Hope GSTN delivers the desired result than being mired into problems.

The core problem is that those who were involved in designing gstn system did not consult actual users and I believe that these experts have never done business not have filed real returns like vat / excise / / service tax etc. They should select 1000 regd persons of all types – small medium large / traders- retail wholesale / manufacturers/ service providers etc and gst officers should adopt these selected taxpayers. Officers should file their returns at least for 3 months to gain real experience.

The very inception of GSTN is anti-national even then PM Modi allowed this to go under the compulsion of Arun Jaitley’s bonding. Though Dr. Swamy alarmed PM Modi for such kindly of chaos to be obvious if this would go in same format.

It’s complete failure of PM Modi no one else. Dr. Aadhia always sound stupid and arrogant while asked about the intricacies of GST compliance.