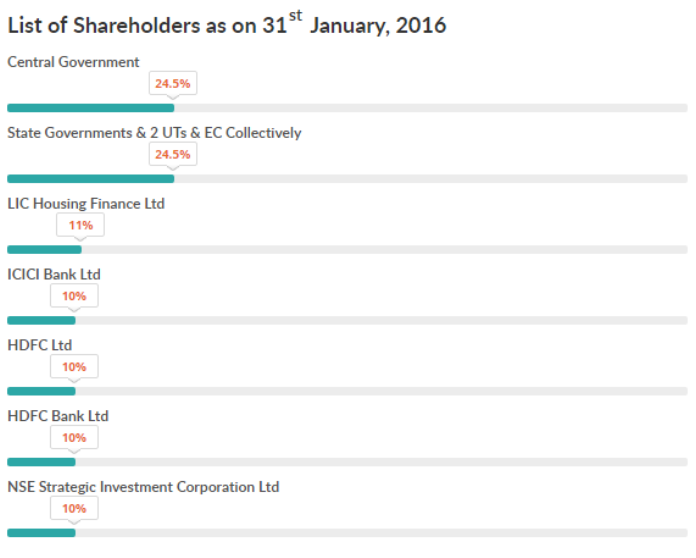

Was it clairvoyance on part of the UPA Government to float a Section 25 company in 2013, called Goods and Services Tax Network (GSTN) to control the accounting and tax collection management of Goods and Services Tax (GST)? For a government that tended to be slow, it was a swift move to float this company with 51 percent private shares (see the graphic below). Centre and State Governments have only 49 percent in GSTN. Being a Section 25 company, GSTN is a not-for-profit organization. Then why do private entities have a majority stake in it? What is in it for them? As of Jan 31st, 2016 the list of shareholders in GSTN is:

Creation of GST involves Constitutional Amendments and this GST administration and tax management company should have been ideally created by a consortium of Centre and State Governments. After all they have all the data and it is a matter of pulling them together for computation of GST. The question then is why the then Finance Ministry under P Chidambaram took this decision to outsource such a strategic activity to the private sector?

On first looks, the most significant player in this tax collection effort should be the one who has the Data. In this case, that would be the Central and State Governments. Everything else such as adjusting the percentage of GST for various states is just a matter of programming, which could have been done by the Government itself. After all, it has codified Income Tax! This cannot be more complicated than that!

A closer look at the private partners reveals that entities such as the HDFC Bank, ICICI Bank and LIC Housing Finance Limited have shareholding of several foreign investments companies. In LIC Housing Finance Limited, among the 59 percent private shares, Abu Dhabi Investment Authority, Bank of Muscat, Mawer International Equity Fund, ICICI Prudential are the major private players.

In our opinion, tax administration is a sensitive matter dealing with sensitive information. Being a shareholder, would this automatically mean that HDFC and ICICI will be the bankers of public money collected through taxes? If yes, that would be a large amount of money passing through these banks! Also has the Home Ministry approved GSTN operators to allow them access to tax data?

The GST Bill has a long way to go. Only the constitutional amendments have been passed in the Parliament. States have to come on board and the final bill needs to be drafted and agreed to be made into law. Adequate security has to be established to ensure that this data does not fall in the wrong hands. There is still time to put the right structure in place. Will the Narendra Modi government do it?

Note:

1. Text in Blue points to additional data on the topic.

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

I am so glad that we have such a highly competent, patriotic team like pgurus. As a citizen I am grateful to them. Without their expertise and exertion in the service of the country, we common lay people would have continued to be cheated by people like Chidambaram. Kudos and gratitude to Subramznian Swamy.

no PIL yet? Surprising.. someone should file PIL (I dont have power or background on this.. feel shame on myself..)

Maha papies ever ready to sell mother India for personal gains. AJ will toe PC and Modi as spectator will praise AJ.Swamy’s lone fight as usual. Wishing him well.

why the private players in the public tax money?

Interesting. It so well tailored to keep data access to private players and possibly the tax money. Hope the Modi govt. will act on this snag when GST comes into place.

Shocking truth hidden under upa rule. .. trust Subramanian swamy takes it to a logical end.

WOW

Pgurus is undoubtedly the best in the business. Always top notch analysis. All the best team.

Vande Matram!

I doubt Jhootly will disband any creation of PC and Modi as usual will be a mere spectator. Modis inaction against the corrupt is seriously damaging his governments and well has his personal image, peoples patience is wearing thin, he must realize 2019 could be difficult.

If Chidambaram has done something definitely there must be some criminal intent to it. Better Modi government scrap it or change the ownership.

ha ha, to the benefit of benami crooks holding shares in these banks? Good interesting information to emerge out of you guys.It is becoming clear, better read pGuru every day instead of muck that pass off as english media or the shouting channels in TV

Agree. Modi Gov. must Scrape current scam GSTN & fully replace Government owned Network under Ministry of Finance only, Connected with all state & Union Territory’s finance Departments. Can assist to modernize, local government departments to streamline it with assistance of Local Tax Offices with special dedicated & trained Team of Specialists appointed by Finance Ministry to Co-ordinate the whole processes of GST Collections from all remote locations. May have all IT & Central Servers all Under Central Gov. control only.

A look at the Board of Directors as well the employees drawn either from VAT depts of various states or privately recruited, not one of them hails from South India,except one person by the name of Rasel Das Solomon.All others are either Biharis,UP Wallahs, Delhites or other sundry states from North India. Something is realyy rotten here.

Wonder why Private players in this GST management firm? It should have been a fully Govt unit. Not even a company. It should be a technical unit under CBEC. This is doubtful and dubious operation. By the by why UPA Govt formed this company? This should be disbanded and re-create as a high end technical unit under Central Board of Excise and Customs (CBEC)