Part 1 of this series, The GSTN saga – The pain of doing business in India, talks about the teething pains of GST and wondered if the problem could be the backend. This is Part 2.

“If your experiment needs a statistician, you need a better experiment” – Ernest Rutherford.

On a day when the former Finance Minister Yashwant Sinha wrote an article in the Indian Express criticising the economy, PGurus continues doing the job of placing threadbare the facts about the Goods and Services Tax Network (GSTN) and the Goods and Services Tax (GST), which the mainstream media, comfortably buries. Finance Ministry issued a press release on the GST Revenue figures for August 2017. We do a complete analysis of this press note, which suppresses more than it reveals to the public. Let us get the numbers straight.

The Government of India is under a constitutional obligation to provide Compensation to the states and union territories, post the implementation of the GST (1st of July 2017).

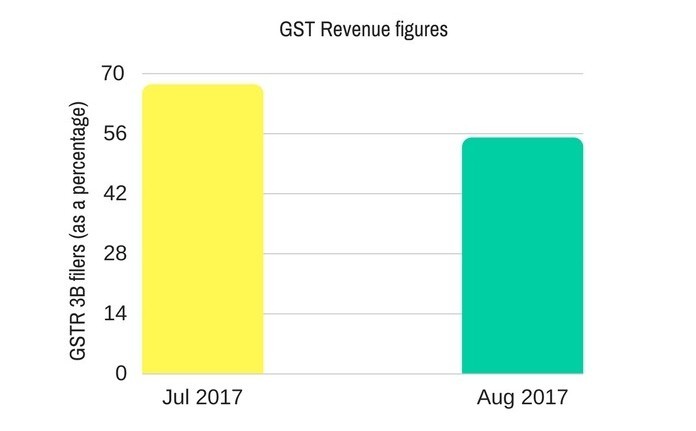

For the month of July 2017, as per the press note (dated 29-08-2017) Rs. 92,283 crores GST revenue was collected from around 38 lakh taxpayers (out of 57.5 lakh taxpayers who are required to file GSTR 3B). Department of Revenue comfortably avoids stating as to what is the total number of taxpayers who filed the GSTR 3B as on 26th September 2017.

If 20 lakh taxpayers had not filed July returns as on 29-08-2017, was a performance audit of GSTN done to find out why such a huge number of taxpayers could not file returns? How many of these taxpayers had to file returns because GSTN has not yet initiated the cancellation module? What was the revenue accrued from this 20 lakh returns, if at all this was filed? The press note is silent on this.

Curiously, the Revenue figures released on September 26, mentions the tax collected as Rs. 90,669 crores (up to 25th September 2017). It is unclear as to what exactly is the GST revenue for August 2017! And this figure of Rs. 90,669 crores pertain to which specific period? 37.6 lakh taxpayers out of 68.2 lakhs have filed the GSTR 3B returns for August 2017. This figure in itself is worrisome. A simple math reveals that at the time the Department of Revenue decided to do the press release (after the deadlines for the respective months got over) in July 2017, 67.4% of taxpayers had filed 3B whereas, only 55% of the taxpayers have filed the 3B for August 2017 (see Figure 1 below). This figure must be a grave cause for concern. Was GSTN pulled up for the same? What are the efforts being made to ensure that there are facilitation windows to enable small traders to file their returns?

Owing to the mega GST sales in the month of June 2017, the VAT / CST revenue figures in July 2017 posed a relatively less troublesome scene. The general observation was that the Revenue trends would show upwardly positive mobility and will gradually pick up. The revenue figures put in the public domain do not live up to this logic.

IGST (Integrated Goods and Services Tax) revenue is to be shared between the center and the states / Union territories through a devolution mechanism. Press note is totally silent on these figures. Ideally, the press note must have the state-wise allocation between the CGST (Central Goods and Services Tax) and SGST (State Goods and Services Tax), to the extent that they have been utilized. No website of the Finance Ministry provides these details.

Exporters are at present the most disgruntled lot in the GST mess.

The revenue press note talks about taxpayers who have availed the Composition scheme (around 10.24 lakh in number) who are yet to pay their taxes and are required to file their returns every quarter. It is not very sure if any of the major taxpayers have availed of the composition scheme. If they are small and medium taxpayers, the revenue figures are not expected to increase dramatically. And in case of the small taxpayers, is GSTN putting in place any mechanism to make their tax payment exercise any less torturous?

The Government of India is under a constitutional obligation to provide Compensation to the states and union territories, post the implementation of the GST (1st of July 2017). The press note is again silent about these figures. This is very important as this figure for the period July-August 2017 is expected to be considerably high running into thousands of crores.

Exporters are at present the most disgruntled lot in the GST mess. The export committee has held meetings which were jointly chaired by the Revenue and Commerce Secretaries wherein close to 10 export promotion associations were asked to make presentations. The Finance and the Commerce Ministers have also held meetings to appreciate the difficulties faced by the exporters and to have them resolved. Unfortunately, there seems to be no respite in the offing. Things have come to such a pass that in the post-GST scenario, exporter associations are literally running from pillar to post for ensuring that refunds are sanctioned. Someone needs to explain to the Ministry that this is not some charity but is actually a legal right of the exporter. Imagine if these associations file writ petitions before various High Courts for obtaining their refunds – what will result is absolute chaos. This is all because of the fundamental fact that the GSTN has not been able to deliver a system wherein the filing of the GSTR 3B, GSTR 1, 2 and 3 is smooth. As mentioned earlier by us, GSTR 3B owes its existence to the failure of the GSTN to deliver returns in a timely manner. From Bihar floods to Jammu & Kashmir ordinance, everyone bore the brunt, other than GSTN.

The GST council has provided a facility for revision of TRANS 1 form before 31st October 2017 in order to resolve any errors or other related issues. In a press release dated 22nd September the Revenue Department has again white-washed the entire issue of transition credit and tried to suppress the truth by stating “all is well”. If there are sections of the media speculating on the numbers why does the Finance Ministry not come clean with the transition credit numbers for July 2017? It has been more than 1 month since the expiry of the deadlines for July and can GSTN not even provide the nation with these figures? If 1.27 lakh crore of credit of central excise and service tax was lying as closing balance as on 30th June 2017, what is the position of the credits utilized for July and August 2017? This figure is very important as it will have a definitive impact on the CGST revenue.

To sum up – can someone from the Finance Ministry answer the following?

- Why are lakhs of taxpayers not filing their returns? What are their difficulties?

- What is the reason for the August revenues dipping and what exactly is the August revenue?

- What is the refund amount that needs to be given for July and August?

- When will the refunds be sanctioned?

- What is the IGST settlement figure and how much is the center getting for both the months?

- What is the compensation amount for the two months that need to be given to all the states and union territories for the months of July and August?

- What is the exact story of the transition credit? Will the numbers ever be made public?

- Finally, after factoring in all the above issues, what is going to be the net revenue of the Central Government for the months of July and August 2017?

If there is a movie to be made on the economic downturn, GSTN must be the poster boy. Is GSTN responsible for the dip in the revenue figures? Watch out this space, we will continue with our GSTN Saga.

Someone needs to scream to the Finance Ministry – “it’s the Revenue, stupid”!!!

- Elon Musk postpones India visit. Non-clarity in Tesla partner and Starlink license might be the reasons - April 20, 2024

- NIA confiscates Pak-harboured Khalistani terrorist Lakhbir Singh Rode’s key aide’s land in Moga - April 19, 2024

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

[…] 1 of this series can be accessed here. Part 2 talks about The mystery behind missing numbers. This is Part […]

Swamy for FM- everything will be solved!! and P Gurus will stop criticising GSTN

This analysis on GSTN is done from a different angle and from a purely financial and audit perspective.

You had raised many questions but we are worried as no one is bothered to answer from Finance Ministry.

We are continuously watching this space for more authenticated news.

Thanks very much !