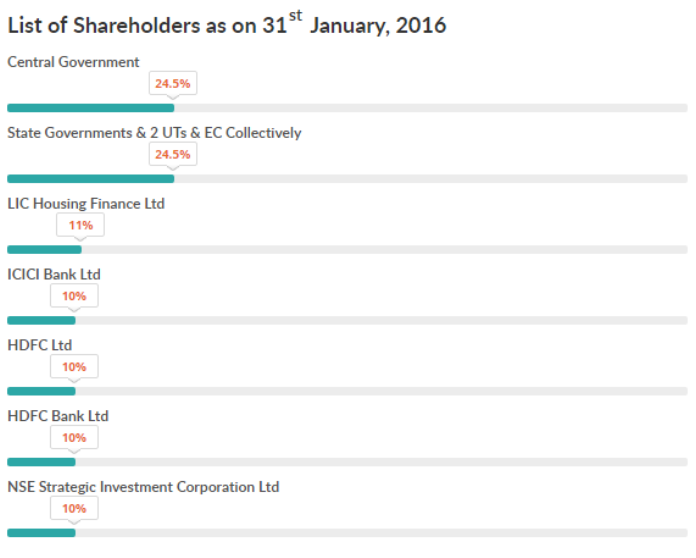

March 28 – is the foundation day of Goods and Services Tax Network (GSTN), floated by the then Union Finance Minister P Chidambaram in 2013. GSTN is a company formed to act as a network to collect and administer Goods and Services Tax (GST) regime. In GSTN, as much as 51 percent is owned by private banks and the remaining 49 percent is owned by the Central and State Governments. How Chidambaram came to know in March 2013, that NDA Government led by Narendra Modi is going to implement GST is an intriguing question. Why Modi Government allowed Chidambaram floated private company GSTN to handle GST collection is another curious question.

Grave doubts were expressed about the arbitrariness of the tender process which led to Infosys getting the contract.

The Central Board of Excise and Customs (CBEC) officers WhatsApp groups across India are calling this a black day for the Government of India. In the epicenter of all this is one man – Hasmukh Adhia. In the Modi regime, GSTN is nurtured by and enjoys the patronage of Finance Secretary Hasmukh Adhia in a big way.

Hasmukh Adhia joined as the Revenue Secretary on 1st September 2015. A Finance Ministry official, who was associated with the GSTN process files, narrated to us the tearing hurry in which Adhia went ahead and pushed the process of awarding the contract to Infosys in September 2015. On condition of anonymity, the officer said, “Even the Expenditure Secretary Ashok Lavasa had his doubts and the entire CBEC was against this GSTN. Grave doubts were expressed about the arbitrariness of the tender process which led to Infosys getting the contract. But Adhia would not listen. It was a one-man army (assisted by Uday Singh Kumawat) who rolled out GSTN by even bulldozing the Department of Expenditure. Why were these two officers entertaining GSTN floated by Chidambaram in 2013?

CBEC has been consistently opposing the idea of GSTN from day one. An officer who was present in the initial meetings pertaining to GSTN told us that Adhia not only insulted CBEC and their capability to run a major project but also explained to all that the GSTN would deliver on Day One in the best possible way. Adhia’s case was simple – GSTN was competence personified and CBEC was absolutely worthless to handle this. The CBEC leadership meekly surrendered but the seething anger is alive and kicking to this day.

The officer said, “The Customs module of GST prepared by the department was rolled out immediately after the Prime Minister dedicated GST to the nation and there was a smooth transition across India whereas even after 8 months, GSTN has still not delivered”. He further added, “Will Adhia eat his own vomit and give credit where it is due?”

CBEC from the beginning has been saying that the entire tender for the GSTN has been flawed and that Infosys obtained the contract illegally. No surprises for guessing who handled all the matters pertaining to the GSTN in the Finance Ministry – Uday Singh Kumawat. Did Kumawat know certain details about GSTN because of which Adhia has been shielding him all throughout? Why not hand over the GSTN files to the Comptroller and Auditor General (CAG)? After all, this issue involves our national interest! Which companies participated in the bidding process? Who qualified the technical bids? Was there a deliberate attempt to suppress and reject the technical bid of a particular Multi-National Corporation (MNC) in order to make sure that Infosys gets the contract? Did all companies who bid get a chance to fight on a level playing field?

Did the other participants to the bid register a complaint post the completion of the bidding process? Did the Ministry of Finance suppress the details of these complaints? Was Kumawat even sharing these complaints with the then Additional Secretary in the Finance Ministry?

An officer of the Ministry, on condition of anonymity, said – “the entire GSTN bidding is a sham process and is a scam. Either place all the files – with all the relevant records and objections – in the public domain or hand them over to the Central Bureau of Investigation (CBI). Many skeletons will come tumbling out”.

A lesser-known fact is that Adhia has been associated with GSTN even from his Gujarat days when he was Additional Chief Secretary (in charge of Finance). Of all people associated with GSTN now, Adhia has had the longest bonding.

The Government has 49% shareholding in GSTN but has already pumped in more than Rs.5000 crores for this Chidambaram-floated project. When such a huge expenditure is incurred from the public exchequer, is it too much to ask for the CAG to dig deep into the matter?

A senior officer in the CAG HQ, on condition of anonymity, told PGurus, that there is absolute secrecy that has engulfed the GSTN tenders and they have not been privy to any information, forget audit in this regard. What is Hasmukh Adhia trying to suppress from the Nation?

This tender, according to the CAG officer, reeks of many similarities with the tender scam in the Common Wealth Games (CWG) which attracted national attention. The tender was given to a private body in the CWG case also by flouting the norms and the same has happened in the case of GSTN too.

Will the GSTN go the CWG way? If all the files are called for, the truth will be exposed.

CAG audit – Who will bell this cat? Is it true that there is a nasty fight that is ensuing between the Office of the CAG and Hasmukh Adhia on GST files and GSTN data? Is it true that Kumawat who is the Joint Secretary handling the GSTN matters in the Finance Ministry suppressed all these details and is not cooperating with the CAG? Is it correct to state that Kumawat is acting under the strict directions of Adhia? Is that why Adhia is mightily obliged to Kumawat?

Adhia indulged in a façade stating that CAG has the powers to audit GSTN whereas, in a devious and scheming move, he limited the exposure of the CAG only to audit the decisions of the GSTN board. This precisely keeps the auditors away from most of the other crucial issues including the bidding process, associated files and all the relevant GSTN issues in the Finance Ministry. Why are all financial issues pertaining to the expenditure being incurred from the Exchequer kept away from the CAG audit?

Was there a deliberate design to do this so that the CAG does not expose the illegalities in which the GSTN is shrouded? Where does the buck stop in the GSTN audit? Is it true that the CAG officers posing tough questions pertaining to GSTN are either being threatened or silenced by the Finance Secretary Adhia? One senior officer of CAG, told PGurus, that in a meeting held in North block, Adhia insulted the CAG officers even questioning their capability and more significantly, the need to audit GSTN.

Rs.1400 crores Actual User Charges – a fraud on the Union Cabinet?

The Actual User Charges to be paid by the taxpayers to the GSTN has been shared by the Central and State Governments. Intriguingly, the amount of Rs.1400 crores was approved by Adhia. As the matter involves an expenditure of more than Rs.1000 crores, why was this not placed before the Union Cabinet for consideration, as per the rules? Is this not a fraud on the cabinet?

Did Finance Secretary Adhia illegally indulge in this approval and overstep his mandate? Is this very akin to what P Chidambaram did in the Foreign Investment Promotion Board (FIPB) clearance in the Aircel-Maxis scam? Chidambaram unilaterally decided on the approval of the FIPB clearance in the Aircel-Maxis case without sending the proposal to the Cabinet Committee on Economic Clearance (CCEA). Adhia has done something very similar to that. This case reeks of absolute flouting of rules. Did Adhia keep the Finance Minister Arun Jaitley in the loop? Why was the Department of Expenditure bulldozed and the officers there forced to reconsider and rewrite the note sheets? Is it true that two objections of the Expenditure officers have been surreptitiously removed from the files and they were asked to rewrite their opinion? Did one senior officer of Expenditure Department object to this proposal of Adhia because of which he back channeled this entire process? What was the necessity for him to suppress this proposal from the Union Cabinet? Did he think that the Prime Minister Narendra Modi would not have approved this especially in the light of the controversies surrounding GSTN? Did he feel that the Prime Minister would have held everyone – starting with Dr. Adhia – accountable and responsible for this GSTN mess?

General Financial Rules (GFR) applicability to GSTN

Every expenditure pertaining to the GSTN is paid from the public exchequer. The private stakeholders have contributed nothing to the expenses of the GSTN. This being the case, the GSTN arrogantly decided to “inform” the Finance Ministry, apparently, on the informal directions of the Hasmukh Adhia that the GFR may not be made applicable to them.

The GFR is a Rule approved by the Union Cabinet that governs any expenditure that is made from the exchequer. It is reliably learnt that Adhia approved the non-applicability of GFR to GSTN and instead accepted a set of rules drafted by GSTN themselves. Why Mr. Adhia and do you have the power to do it? Does the Finance Minister or Finance Secretary have the power to overrule a decision of the Union Cabinet on a matter as significant as the applicability of the GFR to GSTN wherein there has been more than Rs 5000 crore expense from the exchequer? One more fraud on the Union Cabinet?

Is it correct that all officers below Kumawat handling this file refused to toe this line and put up note sheets as desired by Adhia? The GSTN has spent around Rs.5000 crores from the public exchequer till date. Why are they not expected to follow the GFR? When they decide to frame new rules (on their own volition and terms & conditions) why was the Union Cabinet not in the loop?

Talk to any trader, businessman, lawyer, chartered accountant or bureaucrat dealing with GST. One thing that they all agree on – irrespective of their ideological connotations is that – GSTN is a disaster. It is time for Government to fully take over GSTN by kicking out the private banks like ICICI Bank and HDFC Bank and other private financial firms from the tax collection activity, which is the sole work of the Government in a democratic country. The ownership structure of GSTN is as follows:

Much has been spoken and written about GSTN and PGurus has documented the GSTN story over a period of time, through various articles. Even after nine months, the GSTN has shown hardly any progress.

Famous tax Advocate and constitutional expert Arvind Datar warned the Government about the disastrous impact GST could have on our economy. BJP leader and Economist Subramanian Swamy have repeatedly been posing serious issues that concern national security and economic integrity.

Data security

When the matters of Cambridge Analytica and data theft/ breach is making headlines and the Government of India is making efforts to damage control on many fronts, there is a studied silence on data security and related issues of GSTN. Why Mr. Adhia? Should there not be an informed debate on all security matters pertaining to GSTN? Why is the CBEC not being provided with the data dump of the GSTN? Why has Adhia directed GSTN to deliberately not provide the data to CBEC? What is the reason for trusting a special purpose vehicle like GSTN more than the CBEC? PGurus has access to many note sheets of the CBEC files in which there have been heated arguments about the concerns pertaining to GSTN. Adhia, according to a senior officer, who spoke on condition of anonymity, always brushes this under the carpet and even gets hysterical.

GSTR 3B – Adhia’s lie to the Nation?

Did Hasmukh Adhia lie to the GST Council in the meeting held in June 2017? GSTR 3B was never envisaged as part of the GST law. Adhia made a sudden announcement in the GST Council meeting stating that to facilitate the trade and industry a simple return is being introduced and the GSTR 1-2-3 returns will happen in due course. The fact of the matter according to insiders, is that the GSTN was not prepared with any of the 3 returns which necessitated the preparation of a new return, GSTR 3B. In the meeting chaired by the Prime Minister in June 2017 to take stock of the GSTN readiness, did Adhia lie to the Prime Minister about the absolute preparedness of the GSTN? If GSTN was ready from day one, as Adhia has always claimed, why this shoddy performance even after 8 months? What is the truth? Is it true that the decision of GSTR 3B was made after Vishal Sikka informed the Finance Minister Arun Jaitley and Hasmukh Adhia that Infosys is not ready with the returns? Did Adhia suppress these details from the PMO and also from the meeting that was chaired by the Prime Minister?

Collapse of the tax returns cycle

It is an open secret that the returns cycle – GSTR 1-2-3 – as envisaged in the GST law has collapsed. The extension on extension is just a façade that Adhia has been pushing to buy time. When will tell the world this reality? The trade and the industry have suffered enough? Do they have to continue suffering till Adhia achieves his naked ambitions to move forward in his career?

Credits issue

The matters pertaining to transition credit and credits utilized have been the biggest pain points post-GST implementation. A GST officer has informed PGurus that there have been many instances where wrongful credits have been assigned to the taxpayers and Adhia suppressed these issues when analyzed in the file. It appears that Adhia has abused and even threatened CBEC officers handling these matters of dire consequences if they speak out against GSTN. Is this true?

Rectification of mistakes

To err is human. Not according to the GSTN. If you make mistakes while filing returns, there is no immediate mechanism to rectify your mistakes. When a trader happened to place this grievance before Adhia, he appears to have haughtily replied – why do you make mistakes? Learn to do it the right way! Mr Adhia, who will bell the GSTN?

Exporters and their plight

A senior member of the exporters association has told us that Adhia has no intention of resolving the refunds problem of the exporters which has led to the blocking of working capital. Their plight has turned into an unending circus. Does anyone care about this in the Finance Ministry other than indulging in optics and media management?

Lack of leadership

If there is a case study that ever needs to be documented on how not to implement a project – Adhia and GST will be the perfect example. In a surprising move, projected by his Coterie as a masterstroke, Adhia took over as additional work, the responsibility of being Chairman of GSTN. In just over a period of two weeks, realising the monstrosity of the chaos, he ran away and dumped GSTN in the hands of AB Pandey who happens to be in the midst of everyday pandemonium that has engulfed the Aadhar project.

In conclusion, it is easy to see that Adhia no longer is engaging with twitterati, as he used to before. During the run-up to the launch of GST, he was extremely excited and famously tweeted replies to GST queries in the middle of the night earning appreciation from business community who wanted to keep him in good humour. But then, post GST chaos, he has almost vanished from twitter. The reason? Any tweet of this since the launch of GST has been replied with abuses, allegations and accusations. Those affected by the shoddy and bizarre implementation of the GST are hitting back at him with full force. It is pay-back time.

Will Adhia care to respond to the public on these important questions? It is in the national interest to have an informed debate on GSTN.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 crores allotted bypassing the Uni… Mar 29, 2018, […]

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 crores allotted bypassing the Uni… Mar 29, 2018, […]

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 cr allotted bypassing the Union C… Mar 29, 2018, […]

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 cr allotted bypassing the Union C… Mar 29, 2018, […]

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 crores allotted bypassing the… Mar 29, 2018, […]

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 crores allotted bypassing the… Mar 29, 2018, […]

[…] GSTN tender scam – Will Hasmukh Adhia speak now? Why was Rs.1400 crores allotted bypassing the… – Mar 28, 2018, […]

Fear not pgurus and don’t make ppl get frustrated,angry.

Breed optimism,trust/hope,calmness,serenity that things will fall in right place at right time in due course of law.

For if not Modi none can ensure a much needed course correction as above.

Modiji is watching/meditating like lord Vishnu sleeping on serpent or cosmic dancer lord nataraja showing his “Fear not” abhaya mudra pose.

Modiji needs to observe carefully all the reach of cartel/cost club before he can strike/unleash the most potent action like Sudarsan chakra to kill all evils to usher a new era in time for upcoming polls.That mega event of his final action will pull all voters to him to win again confidence of ppl

PM FM and FS are to be prosecuted under Prevention of Corruption act by Rahul Gandhi in June 2019

The GSTN has played a lot of havoc in the life of entrepreneurs and business community. The Karnataka Govt VAT website run by National Informatic Centre [NIC] functioned properly without any hassle. Thousands of sale invoices can be uploaded in a fraction of seconds from Excel to XML mode without any problem. Uploading of voluminous Sales datas through Jason file in GSTN portal is a headache ever after eight months of commencement of GST and it is causing lot of troubles. The Central Govt has deferred the filing GSTR-2 & GSTR-3 owing to invoice – matching problems encountered by the GSTN. As a result, filing of GSTR-1 Monthly Return and GSTR-3B Monthly Return has to be filed by all GSTN registrants except assessees falling under Composition scheme under GST. The filing of GSTR-1 and GSTR-3B Returns will continue till June 2018.

Under the erstwhile Karnataka VAT system, in an Invoice if there are more than one items having two different rates of VAT, the system will ensure that the input tax credit availed by the Purchaser should NOT exceed the total amount of VAT paid by the Seller. There is no one to one co-relation. Besides, there is no provision in Karnataka VAT for reversal of VAT amount by the Purchasing dealer on account of issue of Credit Notes by the Seller, as credit note is issued for the basic sale price only.

Even the Refund of IGST to exporters are given by CGST Commissionerates / Customs by adopting Manual mode in order to lessen the financial burden of Exporters and the GSTN role in facilitating online Refund and direct credit of IGST Refund to the Bank account of Exporters remains a mere promise.

In the ACES website run by CBEC, Assessees have filed their Monthly online Returns in Form ER-1 for Units in Domestic tariff area [DTA] / Form ER-2 Returns for EOUs without encountering any problem. Besides, these ER-1/ER-2 Returns contained a Remarks coloumn, where the Assessee can mention their important observations and any problems encountered by them, not exceeding 300 words. That is very useful to ALL the Assessees, where the can mention their difficulties delayed payment, non-payment of duty or payment of interest etc., and it was very useful whereby they can obviate the charge of suppression of facts. Under GST, there is no REMARKS coloumn provided for in GSTR-1 / GSTR-3B Returns.

In short, the Karnataka VAT run by NIC and ACES website managed by CBEC website are very much successful. People / Assessees are NOT against paying proper Taxes, but the method and mode of collection and compliance of multiple complicated return filing procedures MUST be made easier and simpler.

Finally, Tax Collection is the sovereign function of the Government and this vital function MUST NOT be sub-contracted / given to the Private body / Organisation. The sooner GSTN is taken over by the Central Govt it is better for the entire Country.

JAYASANKAR. V

Adhia is not a capable person at all ! dont know why he is blessed by Modiji, People like adhia are responsible to give a bad name to our PM.

insanity to acquire sanity …..

OK, I do agree there is a sham and scams in GST, Demonitisation, Adhar etc. etc., but the question is even after knowing all these naked truths and the corrupt officials using their evil powers to reign on the common people, we all know nobody is going behind bars, no one will be made accountable- as you know 95% of the civic service officials, lawyers, judges and policemen are hand in glove with the crime. Of the rest 5% approximately 2-3% will be murdered and the final 1% will transferred to an unknown hostile locations. This game has been going on for a long time, the complexity of the web is so immense that it would need a fire to burn it down. I’m sorry to say these scums will not go down until you finish them off.

Yes let the military come in, it may be about time. There was a reason why Parashuram reigned in, he knew this could not be fixed. Modi is a nice gentleman but very naive and rustic.. sorry!!

I know Prof. Swamy has been struggling hard for a long time to put numerous criminals such as PC, BC, TDk etc., behind bars, but my question to him always has been, why should he ‘try’ ?. A situation where we a private person ‘trying’ to put the criminals behind bars is another name of ‘anarchy’ in the state. When a private person is doing the job of the Govt., then we should all know that we are in deep trouble- this is the height of Adharma, depicted in our history. And all of this time it was fixed with a war !!!

Why Modi Government considered a private company (GSTN) floated by Chidambaram? This question is very intriguing. Adhia kind of officers are the problems for every Government. Instead of advising or giving inputs to political boss (Ministers), they just carry forward and now GST suffers with this useless network GSTN. It was the job of Adhia kind officers to alert the Modi Govt about the controversial firm GSTN. They just kept quiet and people started suffering and started blaming PM and FM.