With barely a few days to go before the revolutionary GST scheme of indirect taxation is rolled out across the country, there appear to be two instant issues to contend with.

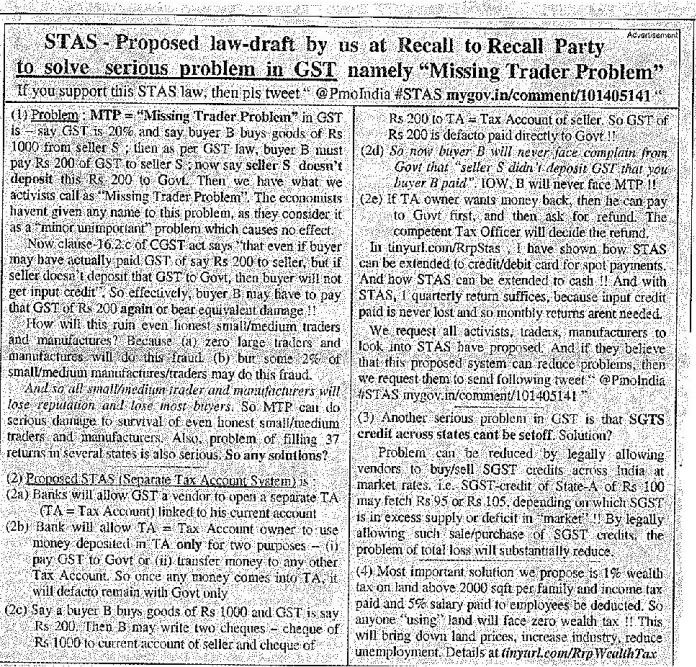

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]he first concerns “The Missing Trader Point” flagged by an as-yet unregistered political party whose recent advertisement in a major newspaper is attached. The top of the ad (shown here) indicates the party’s name as being “Recall to Recall” while at its bottom (deliberately hidden from readers to prevent undue publicity to the individual who has issued it claiming very high technical qualifications) the name shown is “Right to Recall Party”. This basic dissonance in names is one reason why the whole ad seems queer. And the main issue it raises seems to be quixotic.

Why it should have raised the “Missing Trader” problem in a newspaper ad, just nine days before the GST begins to play out is also queer. One would have thought that the problem should have been straight away sent to the GST Council in New Delhi and response sought, instead of a brazen attempt at hogging some limelight. albeit purchased at a price. But being a democracy, one thought our bright young technical gurus would like to react to the two problems and solutions mentioned in the ad and tweet on the handle given at the top there.

But ours is a liberal democracy where even the high-powered Pappu can blur out anti-Modi blah blahs and get attention, why not, at this stage a chance to PGurus readers to tweet on “The Missing Trader” and the GST problems?

But the second issue of “The Missing State” is worrying, having, as it does, a connection to the abnormally long debated Article 370 of the Indian Construction applicable to the Jammu & Kashmir State of ours. Yes, the GST law is not yet ratified by that arrogant and pampered State, and therefore the GST law will not be implemented there from July 1 when it will be in force in all other territories of our country.

The following excerpt from the First Post reportage of June 21 from Srinagar makes the situation clear:

“No, we will not be able to meet the 1 July deadline to implement the GST. We, however, hope that the GST is implemented at the earliest in the state, but there are difficulties. We had to adjourn the Assembly session since some political parties have opposed the GST implementation,” said Minister of State for Finance, Ajay Nanda. The BJP has been pressing on its coalition partner that the GST regime should be implemented at the earliest, but since the PDP is expecting that the new tax law will trigger an agitation its implementation has been deferred. Although government earlier said that a committee headed of different political parties will look into the extension of GST into the state, no orders have been issued to constitute it. The Hurriyat Conference has voiced its opposition to the GST law and has termed it as “tantamount” to the weakening of state’s economy, while the different industry bodies have opposed it stating that this would erode the special status of the state. Both the National Conference and Congress have voiced their opposition to the GST law. NC has even charged the government of eroding the special status of the state and lack of any roadmap.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]B[/dropcap]ut the Hurriyat, the National Conference, Yasin Malik and the PDP-BJP coalition are not the real villains blocking the GST in Jammu & Kashmir. They are just the supporting villains. The big bad boy is Article 370, the original Ogre masterminded by our first Prime Minister, Jawaharlal Nehru, who created the monster which still stands as a “Temporary” part in our Constitution even after 67 years of its creation.

Time has come, once and for all, to abrogate Article 370, to pick it out of the “Temporary” status and dump it in the morgue, or the kabristan, if you will.

That Article, you see, requires that any law of our Parliament can be made applicable to that wretched State only after

(a)“Consultation” with the State government if the law to be made applicable comes in the purview of “Defence”, “External Affairs” and “Communication” (as laid down in Instrument of Accession to the Indian Dominion)

(b) “Concurrence” of the State Government if the subject of the law falls beyond the purview of Defence, “External Affairs” and “Communications”.

Because the GST law requires concurrence as per (b) above, and because Mehbooba Mufti, the Chief Minister of J&K, doesn’t have the will and the strength to bypass her weakness for the so-called friends in the so-called “stakeholders” group in the State, she has been only twiddling her fingers and adjusting the dupatta on her head since the GST law was passed by our Parliament in April 2017.

Time has come, once and for all, to abrogate Article 370, to pick it out of the “Temporary” status and dump it in the morgue, or the kabristan, if you will.

Our legal eagles know how exactly to do that. What they need as a preliminary step is the imposition of President’s Rule in J&K from—tomorrow!

Are you listening, Honourable Prime Minister Modi?

Copy of The Missing Trader ad:

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- To Editors’ Guild; May we also have our say… please? - July 17, 2019

- Farooq Sahab is either down with dementia or he is a congenital liar? - July 8, 2019

- Shah Bano, Muslims in gutter &Zakaria’s secularism - June 30, 2019

It is pertinent to note that the Finance Minister Mr Drabu has supported GST

Obviously sitting in a tight schedule notwithstanding Our P.M has alerted the Fin Min to move at lightening speed and solve the problem.I do not know whearther the Surat textile problem of not joining the GST is political or genuine but it is better that it is also nipped in the bud.This matter is reported in TOI today. Arvindji you can throw more light on the subject.

Arvindji,,in your long observation of Indians in general, you would have noted that the large chunk is a dumb driven cattle.Educated ones don’t vote,many confused with ideologies of whiteman and the uneducated vote on the basis of what is relevant to their needs.Deaf Smith and Johnny Ears got away with the demonitisation bungle as it pinged with the collective anger against looters( when i suffer is fine as long as the looter suffers more) and the same logic will work when people face difficulties thinking atleast the system helps government to collect more money.GST will be a mess definitely in the short term but the lutyen bungler’s star at the moment is bright and he has the death do up apart grip with the one who gets the maximum votes.Nothing will dissuade this arrogant duo.

Just FYI people still haven’t given their verdict on Demonetisation misadventure/gimmick and IMHO it is wrong to conclude on basis of UP state elections that too in hindi-belt where local politics/issues esp anti-incumbency against SP was main factor. Also probably what Demonetisation did was to damage donations/black money of UP local state parties that would have got the credit against SP but BJP kinda grabbed it.

Also no matter what Swamy & media try to deflect the media away from GST teeting issues and a list of growing issues they would face significant anger from BJP’s typical vote base.

Moreover Swamy & his men think themselves as smart by tryin to be a critic from within the rulin party by jumpin on issues to the point of neutralisin or hijackin real issues then they would be in for a rude surprise imho. For GST ‘s main purpose as it appears to me is the sole aim of increasing tax compliance/revenues for Govt in the face of possible diminishing direct personal income taxes due to job cuts in IT sector.

my 2 cents