[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]I[/dropcap] had the opportunity of reading my fellow writer Shubhendu Pathak’s piece on pgurus.com aptly titled One Chart That Justifies Sacking of the RBI Governor. I have a few more points to say on this issue.

Naturally, the schemes and issues have been definitely structured to be complicated to save from the eye of the unsuspecting common man.

- The External Commercial Borrowings (ECB’s) “Invisible” Subsidy

Subsidies to common man such as on petroleum products or routed through Public Distribution System (PDS) or to farmers on fertilizers and the Minimum Support Price (MSP) are always at the receiving end of “liberal” economists, media and often Finance Ministers who find tapering such subsidies as the preferred mode to cut the burden of fiscal deficit on the exchequer. Corporate subsidies such as tax-exemption and tax revenue foregone find concern in India’s far-left. However, there is one subsidy for which surprisingly no one is claiming any credit.

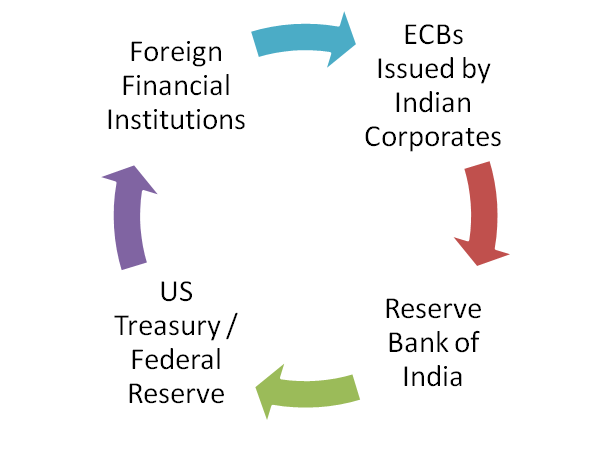

Large borrowers, primarily Indian corporates borrow from international markets in foreign currencies at lower than domestic interest rates as RBI has permitted ECBs. The differential in interest rates (between domestic and international interest rates) is their savings and effectively a state-sanctioned interest subsidy scheme. They sell these dollars (or other foreign currencies) in the forex market which through intermediaries end up with the RBI, which buys them through open market operations as foreign exchange reserves. The RBI then invests these foreign exchange reserves in US Treasury Bills (or bonds) at near-zero interest rates. The US Federal Reserve then invests / lends this money to foreign financial institutions which in turn buy the external commercial borrowings of India and this cycle continues.

Depiction of Flow of Funds (Dollars)

In this arrangement, the losers are

-

Indian commercial banks (largely State Owned) who are left to finance to sub-prime corporate borrowers,

-

Small and Medium Enterprises who are unable to compete with large enterprises borrowing in foreign currency due to high interest rates,

-

Savers – small or big,

and the beneficiaries are large prime corporate borrowers and foreign financial institutions who share the benefit of differential interest rates between them.

A metric used to justify high foreign exchange reserves is the coverage of External Debt (largely ECB’s and Government borrowings) to prevent the sudden outflow of “precious” foreign exchange as happened during the Asian Financial Crisis in 1997. This leads to a vicious cycle of ECBs inflows leading to the requirement of higher foreign exchange reserves to ensure security cover for the same ECBs.

- Impact on External Trade.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]A[/dropcap]s I also noted in my piece on, Impact of Rupee Depreciation on Make In India, India imports a lot of items – raw materials / inputs (e. g. crude oil, scrap steel, precious metals and stones – gold and rough diamonds, computer / electronic hardware, etc) and machinery for the purpose of processing exports (refined petroleum & petrochemicals, steel, polished diamonds and jewelry, computer software). A substantial portion of our imports are in reality, imports for processing exports and this explains the simultaneous rise and fall in Import, Export and Current Account Deficit (CAD).

In the year 2013-14, mineral fuels (Imports 181.38 billion USD, re-Exports after refining 64.69 billion USD) and Gold and its finished items (Imports 58.46 billion USD, re-Exports after value addition 41.69 billion USD) together constitute 53% total Imports, 34% total exports and nearly 100% of total trade deficit. (Source: Wikipedia)

The point here is that only the net value addition (exports less imports for processing these exports) is what in true sense constitutes our exports and we deploy a lot of “precious” foreign exchange for this purpose as circulating (working) capital as stock of raw material and finished goods and export credit. A cost benefit analysis is a must for this arrangement.

Secondly, our requirement (Import Cover) for dollars / foreign currency (which at present is at 10 months of our gross imports) is understated because we use the metric of gross imports. Import cover measures the ability of a country to meet its imports for “x” months with zero exports. If there are zero exports our requirements for imports will also fall – why pile up inventories of raw material imported for export unnecessarily and at considerable financial cost?

- RBI benefits from devaluation of rupee

RBI’s reporting currency is the Indian Rupee. RBI benefits / profits from devaluation of rupee in the sense that the value of foreign currency reserves in rupee terms increases with devaluation of rupee. So we have RBI stepping in the market to protect the appreciation of Rupee on the pretext of protecting the interest of exporters when it is in fact benefiting from the arrangement but not with equal vigor vice versa.

India’s forex reserves currently stand at around USD 363 billion, the 7th largest held by any country in the world. India’s external debt stood at USD 483 billion, 22nd largest in the world. India stands at 20th rank in Exports at USD 264 billion and at 8th rank by Imports at USD 508 billion. India had the 3rd largest Current Account Deficit (CAD) in 2011 at USD 154 billion. We definitely have more foreign exchange reserves invested in poorly yielding US treasury bills than would be required in the normal course if properly determined.

A vaccine is a biological preparation, typically containing an agent that resembles a disease-causing microorganism that provides active acquired immunity to a particular disease and is often made from weakened or killed forms of the microbe, its toxins or one of its surface proteins. In rare cases, where the human body does not develop the immunity, vaccine containing disease-causing microorganism can actually lead to the disease.

Note:

1. Text in Blue points to additional data on the topic.

- Social Security Payments : Tax or Savings - September 28, 2017

- India Uninc set for a giant leap post Demonetization & GST : A Contrarian opinion - September 3, 2017

- India Myanmar Strategic Economic Cooperation - September 1, 2017

Brilliant merry go around.In this forex circus, is it not RBI loosing us lot of money in the name of procuring forex? Buy at high rates and then invest in US Treasury at near 0 inter rate? Whole things appears to be a big con game.

DrBhalla in a series of tweets is mocking at Drswamy claiming DrSwamy’s “time bomb” is crap.None of the so called economists -DrBhalla,Virmani,TCA Srinivasa Raghavan,Sanjay Baru have taken kindly to DrSwamy’s accusations.Will it be possible for you guys analyse threadbare the counter opinions of these people vis a vis DrSwamy’s accusations on R3 and write an article so a financial illiterate like me can under stand what the game is going on.

Also MohandasPai/Chitra subramaniam are in love with R3..why so much love on this guy?

Brilliant. Looks like Indian economists have only now started to think from a global perspective?!

While big businesses must be aware of these and making a mincemeat of the loopholes, wonder how RBI allowed such a thing to prosper for so long. Either it’s due to lack of ability to think beyond local challenges, or a political & global traders/lobbyists nexus that deliberately kept things in the dark.

Rajan has got a brilliant academic record. But unfortunately he hasnt done anything markedly different from what his predecessors have done.