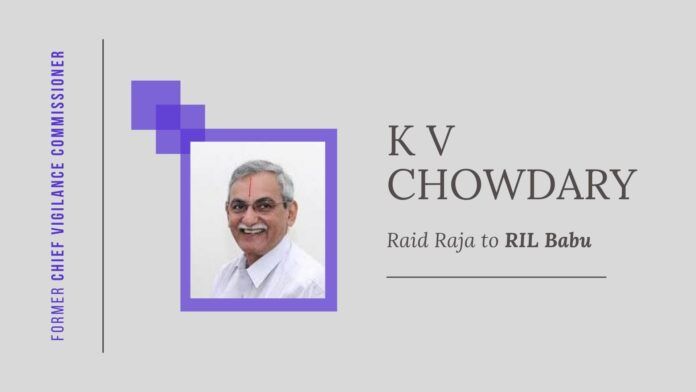

Largely, even the middle-class households in India have now discounted the power and reach of Reliance Industries (RIL) with any government in the centre. It is common knowledge to the extent that the topic is considered a dull issue to be discussed at the dining table. But when former Central Board of Direct Taxes (CBDT) member K V Chowdary, joined RIL as an independent director a few weeks ago, it still raised many an eyebrow among the intellectuals[1].

The Indian Express reported on Dec 1, 2019, that the Income Tax Department has served notices to members of the Mukesh Ambani family under provisions of the 2015 Black Money Act…

Chowdary, who was once responsible for investigating black money and round-tripping of funds related matter as a CBDT member, is now enjoying the hospitality of RIL (his nickname was Raid Raja!) The company promoted by Mukesh Ambani, the eldest son of the late Dhirubhai Ambani, which has black money and round-tripping of funds related matter against it that was under investigation by the CBDT even when Chowdary was at the helm. Hence his joining the company has now invoked heightened emotions even amongst the most jaded and cynical of bureaucrats.

Why Chowdary’s appointment at RIL is controversial

According to The Caravan Magazine, Chowdary had held the post of chairperson of the CBDT since August 2014[2]. He was inducted into the SIT [Special Investigation Team] on Black Money in October 2014, the same month he stepped down as the head of the CBDT but such was his influence in the department that he continued as a de facto member (investigation) in the board under successor Anita Kapur. He had even retained his North Block office.

An investigation into secret accounts of a branch of the HSBC Bank in Geneva, allegedly used to park illicit funds abroad, had dragged on under Chowdary’s watch for close to three years, Caravan reported. I-T investigation into HSBC’s Bank accounts in Geneva was mainly important as it involved a Mumbai based company called MoTech, which is closely linked to RIL and has been under the Income Tax (IT) investigation since 2011 for holding accounts in HSBC Bank, Geneva.

The investigation wing of Mumbai I-T had first issued summons to MoTech’s directors in August 2011. Right from the outset, MoTech denied holding the accounts that were attributed to it in the leaked HSBC Bank documents. Proceedings moved to the assessment unit of the department in November 2011 and several hearings took place later. In 2007, MoTech was one of twelve entities that came under SEBI scrutiny over charges of insider trading in the shares of Reliance Petroleum.

A report by The News Minute suggests that MoTech is a company promoted by RIL group and promoters[3]. MoTech was run by Sandeep Tandon, a who had also joined RIL, and Congress leader Annu Tandon. Sandeep Tandon was a former officer of the Indian Revenue Service (IRS) who worked with the Enforcement Directorate looking into foreign front companies including RIL. Subsequently, he resigned from MoTech as its director in 2009, a year before he passed away in Switzerland in 2010.

Allegations against MoTech are that it held ₹2,100 crores in a branch of HSBC Bank in Switzerland. Reportedly, the company was said to be a beneficial owner of four offshore entities – namely the Monaco-registered Infrastructure Company Limited and HRJ Holdings NV, HRJ Holdings NV2, and Aberdeen Enterprises, all registered in the Netherlands Antilles, a clutch of islands in the Caribbean Sea that serve as a tax haven – which collectively held about Rs 2,100 croreS in accounts with HSBC Bank.

Investigations by I-T and ED had revealed that a holding company named Bartow Holdings NV, registered in the Curacao Island of the Netherlands Antilles (the group of islands in the Caribbean Sea comes under the sovereign control of the Netherlands government) was the ultimate beneficiary of Capital Investment Trust and the structure under it. Bartow Holdings, in turn, is a subsidiary of MoTech Software.

Links of MoTech investigation reaches Biometrix, a Singapore company that invested directly into the RIL group of companies.

The same Sandeep Tandon, who promoted MoTech, a company that held accounts in Switzerland, was also a promoter of Biometrix. The Singapore-based Biometrix a few years ago had announced one of India’s largest foreign direct investment into India into Reliance Ports and Terminals, Reliance Utilities, Reliance Gas Transportation Infrastructure, and Relogistics Infrastructure by acquiring compulsorily convertible preference shares (CCPS). This matter too has been under the I-T scanner since 2011 as investigators suspected round-tripping of funds[4].

Biometrix allegedly took a loan from ICICI Bank Singapore and lent to four RIL group companies during the Financial Year 2007-08. The four-year loan was repaid with interest out of remittances from RIL group companies “other than those it had lent to”. CCPS of four RIL group companies held by Biometrix was purchased by other RIL or promoter group companies to bail Biometrix out of its loan obligation.

Biometrix trail went cold

According to a report in Business Line quoting sources, the Biometrix FDI trail went cold for four years after a few officials were transferred. But the Comptroller and Auditor General questioned the I-T Department’s approach towards RIL, after which the matter was to be taken to its conclusion, Business Line had reported.

The newspaper further said that the I-T investigation report, reviewed by it (BusinessLine), alleged that the source of the interest payment on the loan by Biometrix was not clear. Also, clarity was required on the source of funds of entities that bought CCPS from Biometrix, the use of Rs 6,500 crore by RIL or group companies and the tax implications. Companies that bailed out Biometrix may have taken a hit on the currency fluctuation as the loan was in dollar terms but the remittances were in rupees.

Biometrix was allegedly a shell company. Reliance Genemedix Plc UK bought 9 percent stake in Biometrix by investing $9,900 in 2007. The due diligence report on Biometrix submitted by ICICI Bank, which gave loan to it, showed one Thakur Sharma, then President of RIL in the US, as Biometrix director, the I-T report said according to Business Line. Reliance Genemedix and Strasbourg Holdings, owned by Atul Shanti Kumar Dayal and Sandeep Tandon, promoted Biometrix, which was liquidated after the loan repayment[5].

If rounded up, it could give a picture that MoTech’s HSBC Bank, Geneva account and Biometrix have too many common links and allegations of round-tripping are not just straws in the wind. All this was under investigation even when Chowdary was a key CBDT member and handled the investigation portfolio. He later moved on to become Chief Vigilance Commissioner (CVC), a body that can direct probe and hold CBI director and CBDT officials, responsible for corruption.[6] His joining RIL now only show how things have come a full circle[7].

IT notices to Reliance First Family

The Indian Express reported on Dec 1, 2019, that the Income Tax Department has served notices to members of the Mukesh Ambani family under provisions of the 2015 Black Money Act[8]. The article goes on to say that when contacted, a Reliance spokesperson replied, “We deny all the contents of your email including receipt of any such notice”.

This probe began after the government received details of an estimated 700 Indian individuals and entities holding accounts in HSBC Geneva in 2011.

References:

[1] Former tax dept head KV Chowdary joins Reliance Board – Oct 19, 2019, Economic Times

[2] The murky past of central vigilance commissioner KV Chowdary – Nov 23, 2018, The Caravan

[3] Largest Indian Swiss account trail leads to Andheri based software company, promoted by RIL – Feb 15, 2015, The News Minute

[4] I-T Dept widens probe into Rs.6500-cr FDI by Biometrix in RIL group entities – Apr 19, 2018, The Hindu Business Line

[5] I-T notices to Mukesh Ambani’s wife, children for undisclosed foreign assets; RIL refutes – Sep 14, 2019, Business Today

[6] K.V. Chowdary, first IRS officer to serve as CVC, is no stranger to controversy – Jan 16, 2019, ThePrint

[7] “Unfortunate”: Jairam Ramesh on Ex-Vigilance Chief Joining Reliance – Oct 20, 2019, NDTV.com

[8] Income Tax serves notices to Reliance First Family under Black Money Act – Dec 1, 2019, The Indian Express

[…] खबर को अंग्रेजी में यहाँ […]

The big Vaishav tilak on forehead of the person speaks of his duplicity in life… pray in morning, indulge in black deals by the day & night. He is no different from the conmen Babas what Hindu society is plagued with.

When individuals do not have morals nor principles, they would even join the payrolls of Dawood Ibrahim. Looking at justice system in India, as an individual do not have any hesitation to approach any of the Dawood ibrahim gangs to resolve the businessma cheats who robbed me off by Rs.20 lacs through bounced cheques & false promises, instead of running around courts for past 10 years. It is the principles which is holding me. The day I lose patience, it will be story in newspapers of successful retrieving of money from business cheats