Those of us who are thinking that the Nirav Modi scam related to the Fake Letters of Undertaking (LoU) by the Punjab National Bank (PNB) will be shocked to know that details are now emerging about the extent and depth of the LoU’s issued[1]. Frankly, it is frightening.

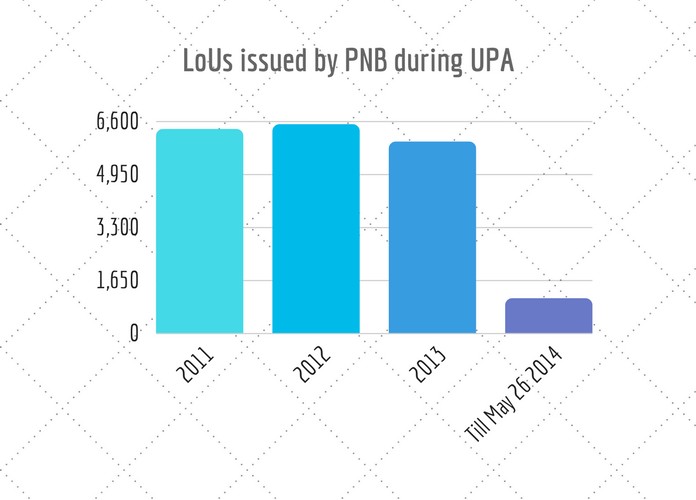

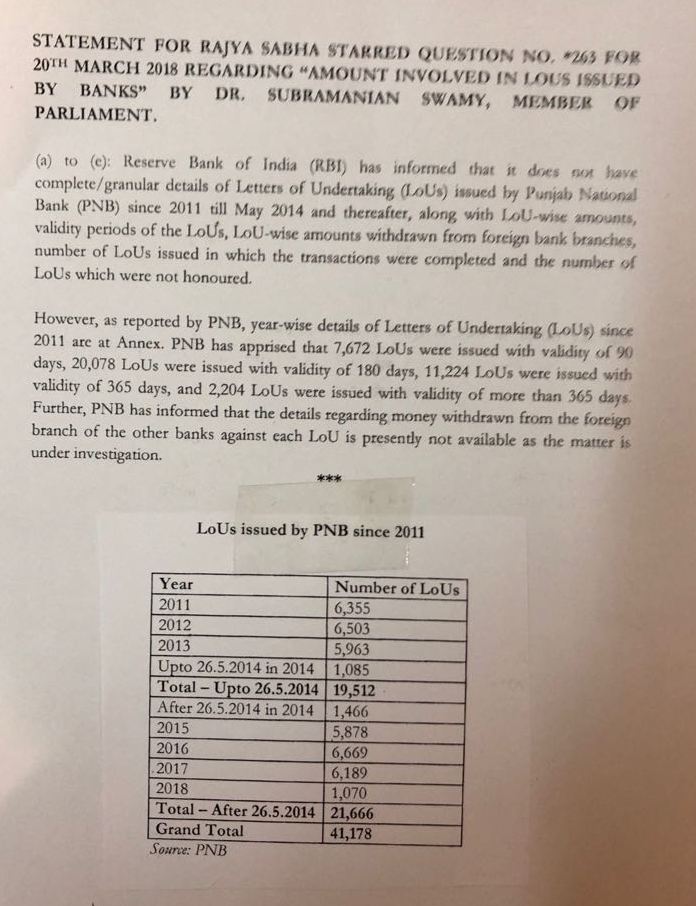

A quick look at the number of LoUs issued by the Punjab National Bank(PNB), the second largest Public Sector bank, shows that these did not stop after the National Democratic Alliance (NDA) came into power. While one should not tar every LoU as being questionable, the fact that no safety procedures were put in place points to the continuation of unchecked LoUs. Figure 1 shows the number of LoUs issued by PNB since 2011 under the United Progressive Alliance (UPA) rule.

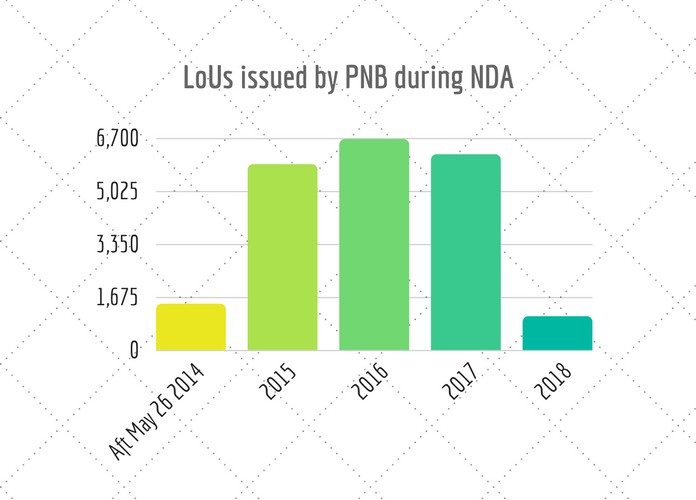

Did this stop after the National Democratic Alliance (NDA) of Narendra Modi came to power? See Figure 2 below:

It is more or less the same. Why was it so important for the Modi government to continue the status quo? Those who sang praises of the Phoren-educated Raghuram Rajan at the helm of the Reserve Bank of India (RBI) should reflect as to why all this happened under his watch. Now the blame game has started between the Finance Ministry and the RBI with each pointing fingers at the other. So who should be blamed?

To answer this question, let us look at a statement made by the then Governor of RBI, Y. V. Reddy.

Y. V. Reddy, Governor of the Reserve Bank of India (RBI), who retired in September 2008 after a five-year term, uttered a classic oxymoron at an international conference that year. Responding to a question on the autonomy of the central bank of India, he said that his reply was “The Reserve Bank of India Governor is very independent[2]. And, I took the permission of my Finance Minister to say this…”

Enough said. The ball is in the court of the Finance Ministry and the sooner they accept their responsibility and start acting, the better for the country.

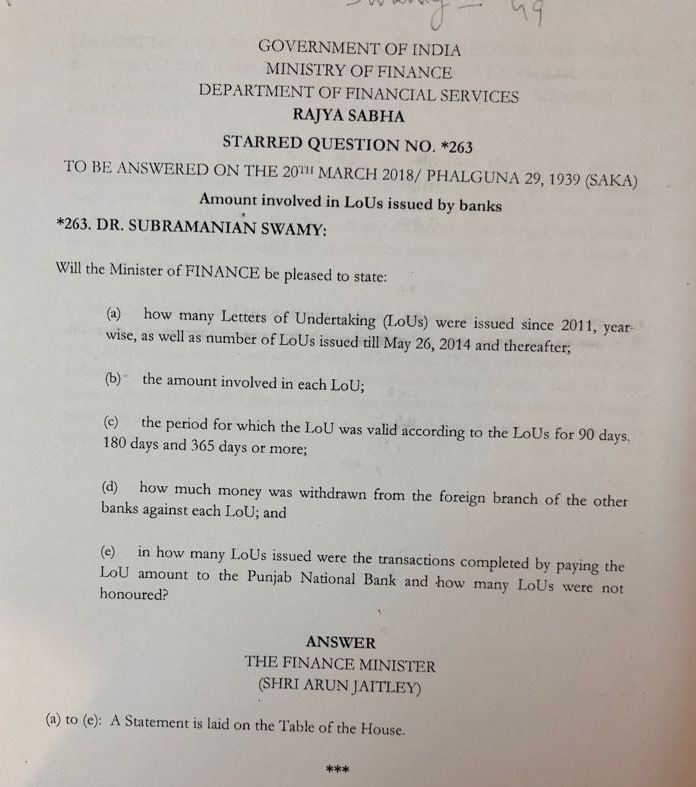

All this information came out from a question raised by Dr. Subramanian Swamy in the Rajya Sabha (see below for details):

References:

[1] Banking scam has UPA era roots – Feb 25, 2018, Sunday Guardian

[2] RBI not as autonomous as Parl. Committees believe – Jan 26, 2017, PGurus.com

- NIA confiscates Pak-harboured Khalistani terrorist Lakhbir Singh Rode’s key aide’s land in Moga - April 19, 2024

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

There is no fear of punishment and therefore this continues forever. The game is to keep involving more people and big people and across parties.. This will ensure nothing consequential will ever happen

Even if the answers were provided on how many LOU were not honoured, the situation is unlikely to change in so far as attributing cause and blame.. When the system is the cause and reason, no one will be proclaimed guilty., Issuing LOU is no crime as long as the liabilities are booked against the party and flag is raise on the first ever delay or default. The chief aim is to book the guilty by jailing them but even more important is recovering public money lost.. High time all illegal and undeclared assets are attached and nationalised as this is the easiest and only recovery mode. Quick and swift reset.

Those who keep telling that banks must be privatised are trying to use this opportunity to buy PSU banks cheap and there will be plenty within the govt who will love to have a cut in such a deal. shareholders bring only Rs12 of every Rs100 of the capital required to do business. The rest is brought in by depositors. So PSU banks atleast declare NPAs, the private banks will try to roll over and hide as much as they can so that the profits are paid back as dividends and they earn their bit back. It is the depositors who stand to lose – both in terms in poor returns on deposits and higher loan rates..

This game needs a hard reset and nothing else will work as well

Issuing LOUs is not a fraud but issuing it without sanction by designated sanctioning authority is IRREGULAR. Issuing LOUs without margin is not a fraud as it is left to the discretion of Bank Manager. Not only PNB, most of the nationalised banks issued LOUs. The question is how many LOUs have not been settled ? In case of N Modi, fate of 6000Cr LOUs will be known by 31 st march only and in such an event how the agencies have confirmed the fraud at 11500 Cr.

The reply by finance ministry shows only the No of LOUs issued by PNB. But they have refused to confirm the No of LOUs settled and how many are active. Not only N modis firms but other parties were also issued LOUs having more than 365 days validity. The FM officials should confirm the amount involved in Unsettled LOUs of ALL BANKS as on 31 st march so that public are aware of the amount tax players lost.