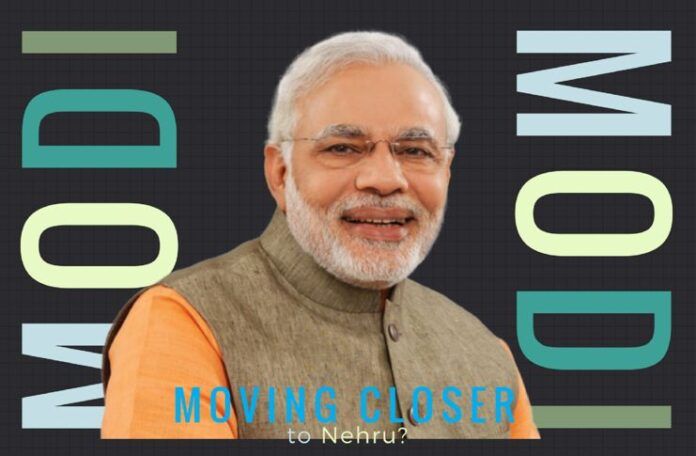

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]hat the Narendra Modi government is essentially Nehruvian is becoming clearer by the day. It is not only comfortable with the discredited non-alignment doctrine in the domain of foreign policy but also statist when it comes to the economy. Its recent decisions on disinvestment, which rule out privatization, are yet another testimony to the Modi’s dirigiste mindset, notwithstanding his earlier slogan that the business of government is not business.

This is an attempt to fool the votaries of liberalization. For the retention of 51 per cent equity actually means state control over a company, the natural corollary being that a state-run entity would continue to remain so.

The Cabinet Committee on Economic Affairs (CCEA), headed by the Prime Minister, on Wednesday gave its approval to an “alternative mechanism,” which would decide on the quantum of disinvestment in Central public sector undertakings (CPSUs) on a case-by-case basis, said an official release. This, however, will be “subject to government retaining 51 per cent equity and management control.”

This is an attempt to fool the votaries of liberalization. For the retention of 51 per cent equity actually means state control over a company, the natural corollary being that a state-run entity would continue to remain so. It doesn’t matter how much stake government has in a company above 51 per cent. In BPCL, it is 55 per cent, in Engineers India 58 per cent, and in ONGC 69 per cent. But all of them are CPSUs, with all the afflictions associated with the public sector like political interference and bureaucratic sloth.

Privatization of these and other CPSUs will not only free them from the red tape and open up new vistas for them but also bring enormous amounts from sale—the money that could be used to retire public debt and thus reduce the burden on the taxpayer. Unfortunately, the Modi government has not done anything to privatize major PSUs which would have been a great economic reform; however, by using terms like “alternative mechanism” it is still trying to present itself as a champion of market economy. But Modi is unlikely to hoodwink anybody anymore as far as reforms are concerned. His statist proclivities are now well known; he is unlikely to pass himself off as a leader in the likeness of Margaret Thatcher and Ronald Reagan.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]H[/dropcap]e is trying very hard, though. Listing of general insurance companies is another such step he has taken. The CCEA also gave its in-principle approval for the listing of The New India Assurance Company Ltd, United India Insurance Company Ltd, Oriental Insurance Company Ltd, National Insurance Company Ltd, and General Insurance Corporation of India.

Further, there would be an improvement in improved corporate governance as also in risk management practices, thus positively impacting growth and earnings.

The government holds the entire equity in these public sector general insurance companies (PSGICs). It has decided to bring down its stake in these companies from 100 per cent to 75 per cent. This will be in one or more tranches over a period of time, Finance Minister Arun Jaitley said after briefing the media on the decision.

An official release mentioned the benefits of the listing of PSGICs. “Listing on the stock exchange necessitates compliance with a number of disclosures and accounting requirements of Securities and Exchange Board of India (SEBI), which acts as an additional oversight mechanism. The disclosures bring about transparency and equity in the company’s functioning.”

Further, there would be an improvement in improved corporate governance as also in risk management practices, thus positively impacting growth and earnings. “Listing,” the release says, “will open the way for the companies to raise resources from the capital market to meet their fund requirements to expand their businesses, instead of being dependent on the government for capital infusion.”

All this is correct, but the question is: if the government is so keen on PSGICs’ compliance with SEBI rules, corporate governance, and revenue growth, why doesn’t it just sell them off? Their sale, apart from the above-mentioned benefits, will also enrich the public exchequer and help the taxpayer. The answer is simple: Modi won’t go for privatization because he has now openly started espousing the doctrines of the Left, one of them being the class-war theory. The other is more of a commandment: Thou shalt not sell a CPSU.

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- Liberty Is Penalized, Violence Goes Untouched - December 21, 2019

- Rahul’s Howdy bloomer - September 22, 2019

- Chidambaram’s hypocrisy - August 22, 2019

Please do not insult Nehru.