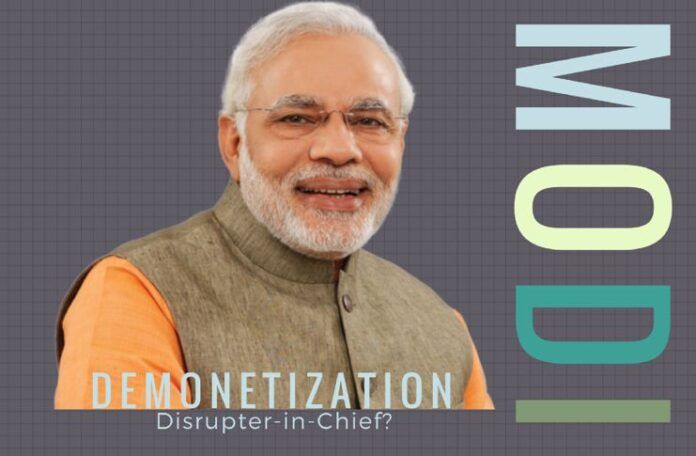

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]wo and a half years into his term, when hopes of big bang reforms were fading, Prime Minister Narendra Modi delivered the mother of all big bang reforms – Demonetization–-that has caught the imagination of voters, silenced many of his vociferous critics and dealt a death blow to opposition parties. The secrecy surrounding the decision to withdraw Rs.1,000 and Rs.500 notes at the stroke of midnight on 8th of November caught everyone by surprise, left opposition parties in disarray and staunch critics hanging.

Many in Government insist that it is one of the many policy measures being implemented to deliver on the BJP electoral promise of “war on black money”.

Overnight, Prime Minister Modi has shed the tag of the current NDA government being UPA III, reinforced his anti-corruption image and reclaimed the campaign narrative of waging war against “black money”. More importantly, it confirms the widely held view that the Prime Minister is indeed a Disrupter-in-Chief and is serious in transforming the way business is done in India.

There is much speculation on what led to this bold decision. Many in Government insist that it is one of the many policy measures being implemented to deliver on the BJP electoral promise of “war on black money”. But others attribute it to possible political dividends that the ruling party can reap based on the amount of money exchanged. Many black money experts believe that 20% of Rs.14 Lakh Crores ($204 billion) that is in circulation many not be replaced. And the Reserve Bank of India (RBI) might declare the amount that is not replaced as a dividend to Government of India which in turn can use the funds either to stimulate the economy or make cash deposits in Jan Dhan accounts of the poor. In the past twenty days, RBI has declared that approx Rs.8 Lakh crores ($117 billion) has been exchanged or deposited and a clearer picture will emerge closer to 30th December deadline when the period for current note exchange ends.

Although effects and efficacy of the policy will not be known for at least a couple of years, its reverberations are being felt across the country. It has certainly ended the much dreaded terrorist financing that was thriving on printing fake notes. There are media reports that violence in Kashmir has seen a drastic reduction since many of the troublemakers were being paid to create chaos. Other collateral benefits include banking for poor, cheaper home prices, lower interest rates, and more importantly chorus demand for election funding and donations to political parties become more transparent.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]he Government is hoping that this bold move will reduce activities in the parallel economy and force the transition to formal economy, compel the poor to engage in banking system, move India to a cashless society and bring in substantially more income earners into the tax net. If the Prime Minister and central government follow up with more precise surgical strikes in the upcoming budget and calendar year 2017, it will indeed send a clear signal to all stakeholders– Consumers, Manufacturers, Investors both domestic and foreign, Political Parties– to shed past practices and adapt to new ways in the functioning of Indian economy.

If Prime Minister Modi succeeds in his efforts, India will soon transform itself from the much dreaded crony capitalism to conventional capitalism.

In the budget for financial year 2017-18 that will be presented on the February 1st 2017, the Finance Minister must raise the limit on income to Rs 10 Lakh and introduce measures to tax agricultural income. He must also launch “Earned Income Tax Credit” benefit that will force every worker to deposit their earnings in a Savings Account. Instead of pay slips, workers must be asked to provide bank statements as proof of monthly or weekly salary along with an annual income tax return to claim their tax credit. For someone earning less than two Lakh rupees, a 10% credit could be offered while workers earning above two Lakh rupees could be paid a 5% credit. This will certainly incentivize many in cash economy to utilize the banking system. It is also important to pass the Mudra Act that will be immensely benefit sectors not currently financed by banks.

More of the services of central government must be digitized in order to lower corruption in bureaucracy. And Prime Minister must also use a carrot and stick approach in order to induce the state governments to do the same. Finally, all important electoral reforms must be carried out to introduce transparency in political party’s finances and election spending. Banning donations from unknown sources, bringing political parties under the ambit of Right to Information (RTI) Act and removing limits on election expenditure are a sine qua non to disrupt the electoral process.

If Prime Minister Modi succeeds in his efforts, India will soon transform itself from the much dreaded crony capitalism to conventional capitalism. That ipso facto will make Narendra Modi the greatest Prime Minister of India and one of the tallest leaders of the world in 21st century.

Note:

1. The conversion rate used in this article is 1 USD = 68.63 Rupees.

2. Text in Blue points to additional data on the topic.

3. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- Biggest Economic Accomplishment – Ending Crony Capitalism - December 13, 2019

- Mr. Rahul Gandhi must first become a Chief Minister - April 4, 2019

- How Congress lost Karnataka - May 15, 2018

Already 11 lakh crores accepted as deposits and note change,and only 3 lakh crores left, which may creep in before deadline. Where is the windfall gain to RBI.Moreover reserve currency notes of 500 and 1000 re notes with RBI and banks and other Governmental agencies are estimated to be 5 lakh crores.Will the RBI be poorer by 5lakh crores.I don’t know if it is going to be a trap. Can you pl explain.