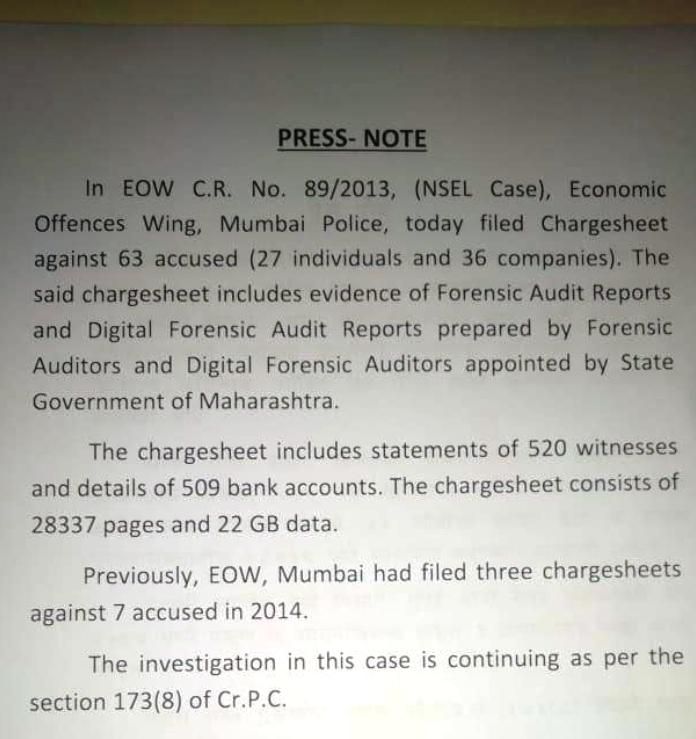

Jignesh Shah can breathe a sigh of relief. The founder of Financial Technologies India Ltd (FTIL), now 63 Moons, would have been pleased to see the Press Release of the Mumbai Economic Offence Wing (EOW) which stated that it has filed a charge sheet against 63 (27 individuals and 36 companies) in Case No. 89/2013, (NSEL Case). NSEL stands for National Spot Exchange Limited. A copy of the Press Release is attached at the end.

The chargesheet includes statements of 509 witnesses and details of 509 bank accounts. The chargesheet consists of 28,337 pages and is 22 gigabytes in size! A massive effort, by the EOW.

NSEL crisis was a manufactured one – an attempt by the C-Company to ensure that only one Stock Exchange, the National Stock Exchange (NSE) be viable in the country. Readers can read my book on this[1]. The mindless pursuit of Shah, decimation of a technological empire that he built using the FTIL crucible will make your blood boil.

Some of the prominent names in the chargesheet are Anand Rathi, Geojit and India Infoline (see below).

Anand rathi, Geojit and India Infoline are named in the charge sheet in #NSEL case https://t.co/oFIYlIxIVs

— CNBC-TV18 (@CNBCTV18Live) December 27, 2018

It, therefore, comes as no surprise that Anand Rathi Wealth Services has withdrawn its Initial Public Offering (IPO)[2]. The cleansing of Aegean stables? What about the 800-pound gorilla in the room, the NSE? None of the 14-accused in the Co-location scam has been indicted!

NSE and the Co-location scam

NSE wants to do an Initial Public Offering. Some estimate that NSE may be worth close to Rs. 80,000 crores ($12 billion at Rs.65 to a USD). About $4 billion of this money (or one-third) is owned by FDI/ FIIs and is going to be the in the hands of the secret investors whose identity is yet to be established. If it is proved that any of it belongs to a politician or a bureaucrat of India, then that is really people’s money unless they can prove it otherwise[3]. The minions of C-Company have managed to keep Securities Exchange Board of India (SEBI) from handing down any indictments to the 14-accused executives of NSE. In my opinion, these crooks should be put away in jail and the key thrown away. Under their watch they allowed a select few to plunder the wealth of many a shareholder, who cannot even see that he/ she is being robbed.

SEBI, are you listening?

References:

[1] C-Company – How Jignesh Shah became the No. 1 target of P. Chidambaram – Amazon

[2] Anand Rathi Wealth Services decides to withdraw proposed IPO – Dec 27, 2018, Business Today

[3] C-Company – Part 11 – The Way Forward – Dec 5, 2017, PGurus.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Are you the same team who said no bad words ? Guys journalist should be open to views not behave like gods. You have your view which is right as per yourself that doesnt make others wrong. Anyone who know how the exchnage works will know that its a gap of responsibility in the said case. NSEL WAS NOT A PLATFORM BUT A SPOT EXCHANGE. Cover ths stories from both the side with all due respect.

It probably cost scamster Jignesh Shah a few hundred rupees to buy idiots like you.

How do you even look at yourselves in the mirror every morning!

Doctor…wake up!!! Money isn’t everything. Lose the people running a racket in your name before they ruin you.

Moron, NSEL was a platform. There were buyers and sellers. And the government goes and arrests the guy running the platform, leaving the offenders scotfree. For five years, Jignesh Shah has done nothing but fight to clear his name (and recover the dues – read the NSEL website). Are you one of the low lives who ripped people’s money, masquerading as an NSEL victim?