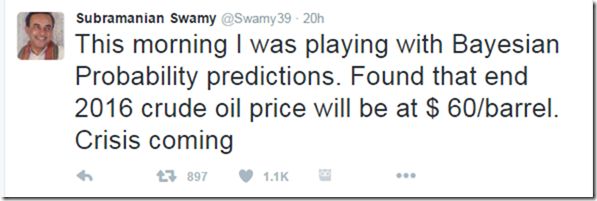

Crude oil prices are rising again, at last count they were hovering at around USD 50 per barrel and the maverick Dr. Swamy playing with Bayesian Probability predictions found that at the end of 2016 will be at USD 60 per barrel. Is it a crisis coming?

As I had mentioned in my previous piece on then falling crude oil prices, “the cyclical trends in crude oil price are but obvious. Crude has fallen to lows of USD 10 in 1998-99 during the Asian financial crisis and to lows of USD 40 in 2009 during the global financial crisis only to hit new highs thereafter.” I also opined that “the new Indian government has had a golden opportunity in falling crude prices knocking its doors. It is incumbent upon them, to make the most out of it with accelerated economic reforms and translate this into high growth.”

Sadly, all the Government did was to increase excise duties on crude oil, keep the benefits in rupees with itself and pass benefits in paise to the consumer citizens. This has particularly contributed to the exchequer of the Government with buoyant indirect tax revenues in-spite of a slowing economy and helped it maintained its target of fiscal deficit. Structural reforms in the oil and gas industry such as ramping up domestic production of crude oil to act as a long-term hedge by ironing out the implementation issues in the National Exploration Licensing Policy (NELP) or aggressively building up strategic petroleum reserves as well as securing crude oil supplies by investments in under-production exploration blocks in the short-to-medium term have been entirely missed.

Impact on Twin Deficits – Fiscal and Current Account

The deregulation in pricing of oil and gas products, left to market forces will mean that the Government does not see a massive increase in its subsidy burden but if the Government chooses to pass on the benefits of excise duty hike to the consumer to moderate oil prices increase, the impact will be on the exchequer and the fiscal deficit.

India’s imports and exports show a synergistic trend of simultaneous fall and rise. Given higher oil prices in 2016, as compared to the preceding year 2015, we are more than likely to see an expansion of external trade – both imports and exports – and also an increase in the current account deficits. Till Crude oil prices don’t rise to very high levels such as above USD 100 for a prolonged period of time, the current account deficit will be at manageable levels as compared to the GDP and also on account of our vast foreign exchange reserves.

Consumption – Demand side of the problem

Generally, all discussion on crude oil prices is limited to the supply side of the problem, we need to discuss and debate the consumption aspect of fossil fuels – crude oil and coal. Government’s emphasis on non-renewable sources of power generation – wind and solar are delivering returns in power generation. However, for urban transportation the only alternatives the Government has chosen are capital intensive Metro rail-based transit projects or Bus rapid-transit systems in large urban centers. The Government needs to also look at comparatively less capital intensive commuter rail systems (sub-urban railways) and mass public transportation for all urban centers to address the demand side of the problem.

Conclusion

Without doubt, the government has missed the bus when it comes to raking in the benefit of low oil prices for the Indian Economy. Nevertheless, the government needs to get out of the policy paralysis mode in the oil & gas industry, rather indulge in big bang reforms. A long term policy perspective on both fronts – production and consumption – is the need of the hour – if we wish to see Indian economy to be resilient from oil price shocks.

- Social Security Payments : Tax or Savings - September 28, 2017

- India Uninc set for a giant leap post Demonetization & GST : A Contrarian opinion - September 3, 2017

- India Myanmar Strategic Economic Cooperation - September 1, 2017

i have always found it amusing that Metro is being preferred to Urban Transport systems. while segementatin could be achieved through AC trains, the common man has no access to affordable transport