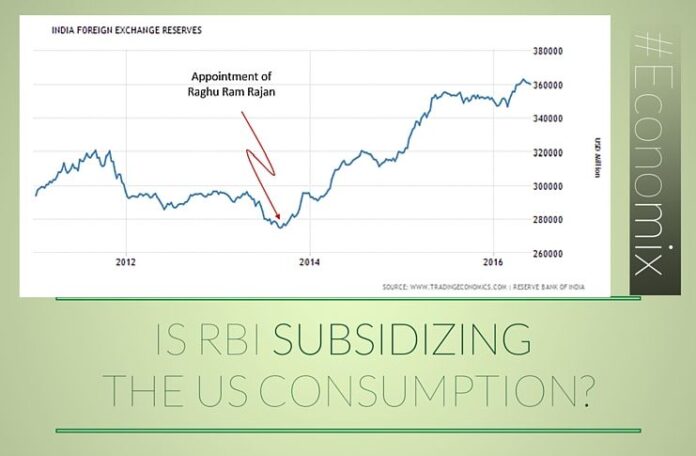

The Reserve Bank of India (RBI), under Raghu Ram Rajan, has accelerated the lending of poor people’s money in India, at near zero percent interest rate, to the U.S. government (see the graphic above). The RBI is effectively subsidizing consumption in the U.S. at the expense of producers and savers in India. Any RBI governor who increases our fiat reserves deserves to be sacked. If you want to understand the implications of his actions in layman’s terms read this article: Republic of Ghaziabad – Part II. We strongly recommend that you read the entire post on Republic of Ghaziabad. A portion of this article is reproduced below:

Before 1971, and more so before 1934, one could go to a bank in the U.S., produce a dollar bill on the counter, and demand the amount of gold promised on the note. With the Gold Reserve Act of 1934, the U.S. changed the nominal value of the U.S. dollar from 1.505 grams of gold to 0.888 grams of gold. With a single stroke, the U.S. government slashed in half the amount of gold the Federal Reserve owed to the world. Finally in 1971, after printing an enormous amount of dollars without any backing of gold, the U.S. completely de-pegged the dollar from gold and defaulted on its obligations. Since 1971, the Federal Reserve has had the liberty to print as many dollars as it wants. The Federal Reserve is printing more and more and more.

In 1926, Montagu Norman, head of the Bank of England and Benjamin Strong, Governor of the Federal Reserve Bank of New York, used all the resources at their disposal to defeat Basil Blakett’s plan to establish a full gold standard in India. After the push from the U.S. for central banking in India, the RBI was established on April 01, 1935; perhaps the biggest April Fool of the Indian population. Later in 1944 at the Bretton Woods agreement, the U.S. dollar was accepted as the reserve currency. However, in 1947, the British, lacking resources after they were brutally hammered by the Axis powers all over the globe, relinquished their influence over the subcontinent to their war ally, the Soviet Union. Under the Soviet influence, the RBI did not collect the notes printed in the U.S. After the collapse of the Soviet Union in 1991, the RBI started collecting dollars as reserves. The U.S. printed the dollars, and the RBI collected them from exporters, transferring the wealth of savers and producers (weavers and fishermen) in India to consumers in the U.S. (people of Atlanta) and a few exporters (masseurs) in India. Strange as it may sound but it is true: The foreign exchange reserve policy of India subsidizes consumption in the U.S.

The foreign fiat reserves with the RBI is the cumulative purchasing power stolen from the poorest in India to benefit essentially two set of people, exporters in India and consumers outside India; both enjoy at the expense of the poorest in India. Total foreign reserves stand at more than $300 billion. That is about Rs. 15,000 for every man woman and child in India. That is somebody’s education you stole. That is somebody’s healthcare you stole. That is someone’s new born child’s milk you stole. Can there be anything more insidious than that? Can there be anything more foolish than collecting fiat notes of a foreign country? The saddest part is that politicians come on national television and brag about how sound our foreign reserves are.

When you see a Rs.120 crore fancy BPO or IT building in a city in India, don’t delude yourself by calling it development. It is just that the building is visible and the mechanism with which Rs. 1 was stolen from each of the 120 crore poor Indians is not.

Export is not an end in itself. It is a means to import goods and services that are produced more efficiently elsewhere. Printing notes to collect foreign fiat currencies does not create employment. It only changes the pattern of employment. It might look like a virtuous cycle of investment, employment and demand creating prosperity for all, but that is far from true. Visible is the employment in sectors that benefit (masseurs and eucalyptus farmers). What is not easily visible is the misery brought by the devaluation.

Also killed in the process is a genuine price discovery, the soul of free market, that enables people who provide value ride up the ladder. A masseur suddenly becomes valuable for the society and a farmer toiling in heat and dust is forced to commit suicide.

Confront an exporter and he will start squawking like a parrot “If we don’t export, the foreign businessmen will import/ invest and take all our money. China also collects reserves. How will we buy oil? The interest rates in the U.S. are so low; it is an unfair competition for our businessmen who don’t have access to cheap capital, so we should at least give them this cushion. The income of the poor has risen because of the note collection policy.”

What will the foreigners do with our currency notes? Eat them? No, they won’t eat our money. They will use it to buy something of value that we create for them. And when they spend the money they earn, productive and valuable jobs will be created in sectors that are truly valuable. Collecting reserves is one wrong thing that the Chinese have done; they have started realizing their mistake and are moving away from their peg. A country does not buy oil, the people of the country do. Except for strategic defense purposes, it makes no sense for the government to collect fiat reserves to secure future purchases of oil. If the Federal Reserve is printing notes and keeping their interest rates low, an inflow of dollars will make the rupee rise against the dollar (demand and supply). Foreigners will find it difficult to purchase the rupee. In other words, the amount of FDI will be driven by what is valued by the 1.2 billion people of India and not a few bureaucrats in the government. “The income of the poor has risen because of the note collection policy.” Really? Tell that to the weaver who is not able to afford milk for her new born child. Tell that to the rice farmer who is not able to afford medical care for his mother.

The fear of the foreign investor, the government is trying to lure, is not unfounded. The state of our judicial system is not the best. The government is more than $1 trillion in debt and there is nothing stopping the government from simply taking on more debt and monetizing it (printing notes). It is natural for the investor to expect some form of solace from the government. It is natural for a foreign investor to expect it, but is criminal for the government to grant it by collecting reserves.

Investors are better attracted by rule of law and a reliable judicial system that resolves conflicts efficiently. Majority of the resources available to the government should be dedicated to that cause. Confidence in the rupee ought to be restored by a prudent fiscal policy (possibly a constitutional amendment that does not allow the total government debt to exceed 10% of the GDP in the future i.e. post a default which is likely imminent if the government does not pick the road to hyperinflation, killing the economy once and for all) and a reliable monetary policy (limiting the ends towards which the RBI can carry out open market operations, preferably limiting its mission to being a lender of last resort). And finally, the RBI should return the purchasing power stolen from the poorest in India by selling its fiat reserves in a time bound fashion.

Yes, fiscally responsible road is not an easy one to tread on. Yes, a reliable monetary policy calls for restraint and patience. Yes, it is a mammoth task to achieve rule of law and establish an efficient judicial system. But an “easy way out”, which is not even a way out is simply criminal.

- Solution to Kashmir: A Lesson From The Prairies, the Pampas and the Kashyaps - February 12, 2019

- Kartavya,Adhikaar And Skill. A Worthy recipient of Skill India Scheme? - October 16, 2017

- Demonetization Has Opened A Window Of Opportunity For Modi - December 21, 2016

I can see his vision and what US FEDERAL RESERVE has done with dollar all over. You people commenting here read some history about ROTHCHILD AND ROCKFELLER families, then after proper research comment something. US IS THE MOST EVIL NATION ONE CAN THINK OF. THEY IMPOSE EVERYTHING ON THE COUNTRIES WHICH ARE POOR AND DONT HAVE ARMS.

AND US FEDERAL RESERVE PRINT DOLLARS OUT OF NOTHING , NO GOLD, YES NOTHING.

So in that case we also are in debt because of increasing foreign reserve.

THIS INFLATION AND MONETARY POLICY CAN ONLY BE CURBED BY ISSUING GOLD AS THE NATIONAL CURRENCY, BUT I HAVE THE QUESTION TO TEAM PGURUS, BY THAT THEORY CAN WE ABOLISH TAXES ON OUR PEOPLE? THEN HOW INFRASTRUCTURE WILL DEVELOP. AND THE GOVERNMENT ROLE THEN?

The sad part is majority of the people including so Called “Financial Experts” do not understand Macro-economics and how vested interests have been controlling it for Decades and Centuries now. If India trades with Russia, China and other countries in Rupees and Roubles/Yuan by making them convertible, why do we need large “USD” reserves. Of course, this is difficult as US has ensured any country/leader trying this, gets into trouble !!! By ensuring that USD remains as world Reserve currency, the US has ensured that the demand for USD does not go down. So they can keep printing irrespective of the fact that they consume more than they produce as a nation state !!!! Any person with basic common sense understands that no individual, state or country can sustain by adapting this model in the long run. But they have been surviving only through “Reserve Currency” factor. They ensure the puppet regimes in the Gulf (GCC countries) are protected and ensure OPEC is under their control through them (Also all the GCC countries have their currencies pegged to the USD, no surprises here). US policy does not harp on Democracy needed in these countries (with slave labour still continuing in the 21st century). The control these vested interests have on Mainstream Media is complete. So the common public are fed news which is controlled. So Mr. R3 (RaghuRaman Rajan) is just one of the people in the long list of Governors of RBI and economic advisers who are “Deputed” to countries like India from IMF/World Bank, etc so that they can carry on their “Masters'” agenda. It would be difficult for even leaders like Mr. Modi to change this system easily. Internet is the last hope to ensure common people understand these aspects !!!

You aren’t wrong. You aren’t even wrong.

You may be correct be to some extent. But if you want to change this practice of accumulating reserves, you’ll to change the fundamental of Indian and global economy. India is a net importer, our CAD has always been a cause of concern. How do you expect India to pay its bills if it doesn’t have the currency required? You cant pay your oil bill in rupee to some country which doesn’t recognize your currency! Rajan is doing what he can within the framework of global economy and its functioning. It’s not just India that accumulating dollar for rainy days. Brazil, Saudi, Russia, China (just see the freaking list) is accumulating dollar. Yes USA keeps printing money cause they can! but they also have 75% (8000+ tonnes) of the worlds gold reserves. Hypothetically speaking you get rid of fiat currency, what then? Fall-back to the gold standard? Got a better idea? Easy to blame someone then providing solutions. #NOTRAJANSFAULT

I have taken just two eco courses in my life and I say this with utter confidence, this article is pure bollocks and the author is a special kind of stupid. The website wants us to rebut it with facts, lol. I wonder what kind of nefarious agenda these guys have, taking money from SuSu?

Shubhendu Pathak, this article is pure rubbish, you don’t have a basic understanding of this issue. I suggest you do some research before writing. I can’t comprehend how stupid a person you are. This article of yours makes u look like a fool, and the company you are working for should fire you for your sheer incompetence, and this crappy website should bury the server on which this article is hosted and blow it up, so nobody else can read it and become stupid.

If you want to rebut, please be substantive. You can start by reading the source URL, http://shubhendupathak.blogspot.com/2015/01/republic-of-ghaziabad-part-ii.html.

why sack, directly kill him for this, just kill kill and chill chill

Keep the comments civil please.

You frickin’ idiot, that money is needed to pay for current account deficit if we don’t have reserves it would be the repeat of “1991 Indian economic crisis” where India didn’t have any foreign currency to pay and govt had to sell all the gold reserves.

Dear author, you also used poor peoples money to study in IIT and then went to work for US financial sector. Don’t you that’s ironical ?

The ironical thing is how much illiterate you are on the subject how foreign reserves work. This is not the quality of work that one would expect from someone who has graduated from IIT. You are not only doing disservice to this news site but also for your current employer, country that your are in and country where you have grown up.

Sincerely an Indian with commonsense.