Part 1 of this series can be ‘accessed ‘ here. This is Part 2.

The story of Gupta Family of Saxonwold, South Africa is nothing short of a Bollywood kaleidoscope. It began sometime in the late 80’s when Shiv Kumar Gupta (SKG), a small time businessman of Rani Bazar, Saharanpur (UP) decided to send his son Atul to a modest technical institute in Delhi to learn to assemble, repairing and maintaining of Apple hardware. Soon after the course, Atul made a trip to China to understand the nuances of computer trade, as it was a complete departure for the business family of selling rations and groceries.

SKG was visionary of sorts. Other than computers, he bet his money on Africana, and moved Atul to establish a small computer venture “Sahara Computers” in South Africa in 1993; a time when Apartheid had just ended and the white minority rule was over. South Africa was opening up its gates to the world for business and there was hardly any red tapism. Atul used things to advantage and pushed the throttle; soon success became synonymous to the Guptas’. From a ration store in Rani Bazar to Gupta Empire of mining, air travel, energy, technology and media in South Africa; all in a span of 23 years was extraordinary.

Guptas’ have a long association with Mr Jacob Zuma, the President of South Africa; and are commonly known as the “Zupta” conglomerate. Rajesh and Zuma’s son Duduzane are very close friends and business partners

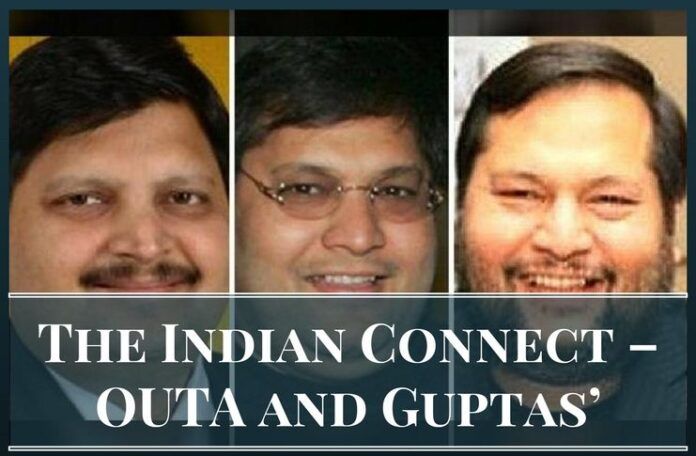

SKG didn’t live long enough to see the jackpot he gambled on Computers and Africa. Today the Gupta Empire is administered by the brother trio of Ajay (eldest), Atul (richest) and Rajesh (aka Tony & youngest). Atul is the 7th wealthiest man in South Africa with an estimated worth of US$773.47 million. In April ‘13, the family name shot up for holding an extravagant Indian wedding, where President Zuma allowed a charter flight of guests to land at the South African Air Force base at Waterkloof.

Guptas’ have a long association with Mr Jacob Zuma, the President of South Africa; and are commonly known as the “Zupta” conglomerate. Rajesh and Zuma’s son Duduzane are very close friends and business partners. Zuma’s daughter Duduzile was a director at Sahara Computers and his wife worked at a mining company owned by the Guptas’. With numerous allegations of corruption and a ‘state capture,’ the family has now met with deep scepticism and open anger by South Africans, as many see their asymmetric ascent full of lies and deceits.

State Bank of India (SBI) has generally maintained itself scandal free over the years

OUTA, the ‘Organisation Undoing Tax Abuses’ of South Africa, has recently exposed another Gupta scandal which involves two of India’s public sector banks – Bank of Baroda and State Bank of India. Both the banks have been accused of suspicious transactions since 2002 and providing inexplicable sums of bonds to Gupta’s’ against overvalued properties. For properties worth R245 million (Rs 116 Cr), they got bonds worth nearly R1 billion (Rs 474 Cr). Bank of Baroda provided bonds valued at R811 million and the State Bank of India provided bonds of R176 million.

Two examples of misappropriation reported by the OUTA involves Gupta properties being inflated over 8-10 times. Two Cape Town flats of Gupta’s’ purchased in 2006 for R2.8 million each, were provided bonds worth R24 million by the State Bank of India; nearly 8.5 times the purchase price. In another instance, the Guptas’ company Confident Concept bought a farm in Mpumalanga for R40 million but a year later this was bonded by the Bank of Baroda for R426 million; more than 10 times the purchase price.

It is not new for Bank of Baroda to be found involved in overseas forex corruption scandals. In October ’15, an assistant general manager (AGM) and head of the foreign exchange division of the bank were arrested by the CBI in the Rs 6,000 crore suspicious remittances case executed through one of the bank’s branches in Delhi. The remittance was for import of dry fruits, rice and pulses but allegedly there were no actual imports. Even during the demonetization exercise, some of its employees were prima facie found to be indulging in illegal activities by violating the rules and regulation of Central government and the Reserve Bank of India.

The Banking Ombudsman should take cognizance of the OUTA’s report and must initiate an inquiry into the case to ascertain the depth of this racket before it becomes too late to retrieve the hard earned tax payers money from the South African Guptas’

State Bank of India (SBI) has generally maintained itself scandal free over the years. The bank was founded by the British Imperial Bank of India in 1806 as the Bank of Calcutta, making it the oldest commercial bank in the Indian subcontinent. Recently on 1st April 2017, SBI merged five of its Associate Banks (State Bank of Bikaner & Jaipur, State Bank of Hyderabad, State Bank of Mysore, State Bank of Patiala and State Bank of Travancore) and Bharatiya Mahila Bank with itself. It is now in the league of top 50 global banks with a balance sheet size of Rs.33 trillion, 278 thousand employees, over 420 million customers, and more than 24,000 branches and 59,000 ATMs.

Public Sector Banks account for 70% of the Indian banking system and are barometers for its economic health. The Non-Performing Assets (NPAs) of these banks have skyrocketed over the last decade (approximately Rs 1.54 lakh Crore) because of indiscriminate lending to corporate who had support from powerful politico conglomerates; and a combination of misfortune, miscalculation, and over-ambition. The overhang of bad debts has marginalised the profitability of all the PSU banks and has also depreciated their loan books. India’s overall credit growth has been seriously hampered as state-owned banks account for 2/3 of the overall credit disbursement.

Incidents of inappropriate lending, such as those to Gupta’s’, highlight the malfeasance and rottenness in the Indian banking system. The Government of Indian and the Banking Ombudsman should take cognizance of the OUTA’s report and must initiate an inquiry into the case to ascertain the depth of this racket before it becomes too late to retrieve the hard earned tax payers money from the South African Guptas’.

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- हिन्दू धर्म – एक तबाह अन्तः मन और उसके जीने का संघर्ष - August 17, 2017

- Kashmir – Diagnosis and Cure - August 16, 2017

- Hinduism – A Ravaged Soul and the Quest for Survival - August 13, 2017

Have you ever investigated a possible link between Mukesh Kumar Gupta (cricket scandal) and Shiv Kumar Gupta?

Please do a study on the Gulf Indian Banks lending policies, especially those Indian Banks in Dubai International Financial Center. You will be in jitters to see the bad loans in the portfolio.