In this ongoing series on Tax Havens, we describe the role PHCs play in Part 4. The previous parts can be accessed here.

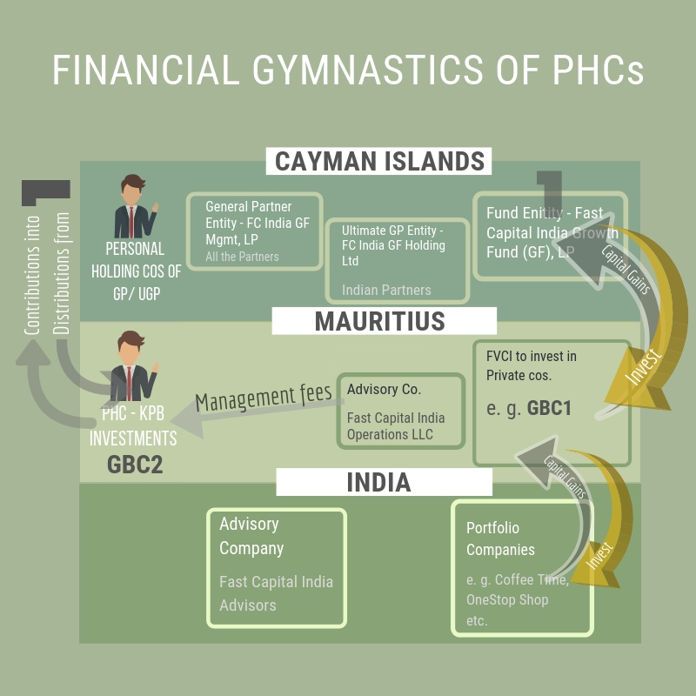

In Part 2 of the series, we went through a complex structure set up by a fund to invest into India. The structure had a bunch of entities called Personal Holding Companies (PHC) in various jurisdictions. As the name implies, a PHC is a shell company that is created for an individual and creates a level of indirection, usually to hide the beneficial owner (i.e. the individual). For example, the PHCs in this structure is for individual partners – both the General Partners (GP) and Limited Partners (LP). Usually, the individual is made the primary shareholder of the PHC and nominee directors are appointed on its board (the individual may not be shown as a director). The control and ownership of the PHC, is thus practically with the individual, but since in many tax havens the register of the shareholders is not required to be made public, it is impossible to detect that the true owner of the PHC is indeed the individual. These PHCs can be used to launder money as well.

Cayman Islands – As easy as apple pie

It is very easy to set up such PHCs in places such as the Cayman Islands – it barely takes a few thousand dollars and a few days. There are service providers in Cayman who provide creation and administration (including providing nominee directors) as an end to end service. One can get this done online.

The partners (GPs and the LPs) of funds create PHCs in tax havens such as Cayman and Mauritius. They use these PHCs to route their contributions as well as receive distributions (and management fee) from the fund. In fact, it is the PHC that enters into all the agreements with the various entities of the fund on behalf of the individual partner. Creating such layers is very common in the offshore industry – e.g. we have found the following recommendation in an offering document of a leading venture capital fund:

In particular, “Know Your Customer” regulations imposed by Mauritius, India and Cayman Islands authorities may be substantially more intrusive than regulations which are applicable to investors in United States funds. Under the terms of the Fund’s Partnership Agreement as well as applicable laws, such information may be made available to other Limited Partners, third parties that have dealings with the Fund, and governmental authorities (including by means of securities law-required information statements that are open to public inspection). Investors that are highly sensitive to such issues should consider taking steps to mitigate the impact upon them of such disclosures (such as by investing in the Fund through an intermediary entity).

It may seem that the PHC business is a simple one – after all it is just about incorporating a company in a tax haven providing secrecy and then making the individual (the real owner) a majority shareholder. Actually, it is not all that straight-forward. In Part 3 we had referred to a news story of KP Balaraj (partner of WestBridge Capital and ex-partner of Sequoia India) being investigated by the Enforcement Directorate (ED) in the context of the Vasan Eye Care case. The story refers to the ED finding two entities ‘owned’ by KP Balaraj – KPB Capital and KPB Investments in Cayman and Mauritius respectively[1]. Here we provide more information on those entities, and it will show the extent to which some people go to hide the ownership through these PHCs[2].

KP Balaraj episode

KP Balaraj is a graduate of the Harvard Business School and is an ex-Goldman Sachs employee. He is rumored to be close to the Chidambaram family. In 2000, he started Westbridge Capital, an India focused venture capital firm. In 2006 Westbridge Capital merged with Sequoia to form Sequoia Capital India. In 2011, the original principals of Westbridge (including KP Balaraj) left Sequoia and revived Westbridge Capital again.

He has created PHCs to stash some assets in the tax havens and to manage his transactions with the various funds he is part of. Here is the story of two of his PHCs:

- KP Balaraj got a PHC – KPB Capital incorporated in the Cayman Islands on September 25, 2000. Mr. David Whittome and Ms. Susan Harper were the directors of this shell company till 2005.

- On September 25, 2005, both Mr. David Whittome and Ms. Susan Harper resigned and Mr. KP Balaraj and Ms. Priya Balaraj (his wife) were appointed as the directors.

- KPB Investments was incorporated as a Global Business Company Type 2 (GBC2) company in Mauritius on December 29, 2008. KP Balaraj was a director of KPB Investments from January 23, 2009, to March 20, 2010, but later became an ordinary shareholder (with extraordinary powers – see below). KP Balaraj entered into a service agreement with International Financial Services Limited, a Mauritius based Services Company to administer the company. Mr. Couldip Basanta Lala and Ms. Rubina Toorawa of International Financial Services Limited were appointed as the (administrative) directors of KPB Investments. At a later stage, KP Balaraj must have gifted some shares to his brother so that it doesn’t appear to be a single shareholder company. For more, see Figure 1.

- Towards the end of 2009, the winding up of KPB Capital (Cayman) was initiated and the PHC was finally liquidated on February 15, 2010. However, prior to that, around January 2010, KP Balaraj transferred the cash balance of USD 1,642,301 and assets of KPB Capital to KPB Investments and received shares of KPB Investments (and nominal cash payment of USD 100) in return.

Live in India and don’t pay taxes!

Subsequent to the transfer of assets from KPB Capital to KPB Investments, KP Balaraj’s interest in the various Sequoia funds (management fee, contribution and distribution) and other investments were represented by KPB Investments. That is, KP Balaraj could invest in India via GBC1 entities of Sequoia (capital gains from these investments will not be taxed in India due to DTAA benefits available to GBC1 companies). It is worth noting that GBC1 entities have to pay 3% tax in Mauritius, whereas GBC2 companies don’t have to pay any tax in Mauritius (but don’t get benefits of DTAA). Thus, with this structure KP Balaraj managed to avoid paying any tax anywhere. As to why such complex regulations were formed in the first place, trust people like Mr. P Chidambaram to draft such regulations that only he can understand and exploit!

A question that arises is – why did KP Balaraj move his offshore assets from KPB Capital to KPB Investments? One of the reasons could be that due to certain omissions in the way KP Capital was constituted, it was clearly controlled by KP Balaraj and his wife, both of whom are Indian residents. This makes KP Capital liable for tax in India, as it is a company controlled by resident Indians. But KPB Capital never filed tax return in India (and thus KP Balaraj evaded paying taxes in India). Besides given the secrecy in Cayman, it will be very difficult to find if money from ‘unknown’ sources moved into KPB Capital prior to its liquidation.

While KP Balaraj was a director of KPB Investments from January 23, 2009 to March 20, 2010, it was eventually re-structured to show KP Balaraj as a mere shareholder and not running it. Initially, there were a few more ‘mistakes’ but they were ‘rectified’ – e.g. initially all capital call notices were sent to his address, his approval was required for operating the bank account / HSBCnet system, board of directors only had administrative directors without any relevant experience, the service agreement with International Financial Services Ltd was signed directly with him, the asset transfer agreement with KPB Capital seemed to indicate that he had injected capital into KPB Investments and received shares consideration, and he had broad powers to remove directors and amend constitution. Furthermore, it was ensured that no board meeting of KPB Investments (and KPB Capital) were ever held in India to avoid showing India as the place of management.

So if you thought it is easy being a fund manager, you are mistaken! They have to work hard not just to scout for investment, but to ‘manage’ their own finances – something which requires a whole army of service providers. As mentioned in the stories referenced above, ED did find some clues about these PHCs. We are curious to know what the outcome was of that investigation…

Continued…

References:

[1] Under ED’s Karti Chidambaram scanner: 2 top VC firms with a revolving door between them – Apr 29, 2016, Indian Express

[2] More trouble for Karti Chidambaram: ED questions ‘aide’ Balaraj – Apr 28, 2016, CatchNews.com

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

A tax audit report of KP Balaraj that substantiates this story:

https://www.docdroid.net/8lPNvXi/kpb-capital-phc-audit-report-june-2-2010-doc

Here is an audit report that substantiates this story:

https://www.docdroid.net/8lPNvXi/kpb-capital-phc-audit-report-june-2-2010-doc

[…] Parts 1, 2 and 3 we looked at shell companies, and in part 4 we specifically dwelled into Personal Holding Companies (PHC). There is another skew peddled by the offshore tax evasion and money laundering services industry […]

With such clear evidence of tax evasion and money laundering, I wonder how Karti Chidambaram and his buddies such KP Balaraj are still roaming free and enjoying life? Why have authorities not been able to take even a single case against such folks to some advanced level? One of these has to be true:

1. Authorities are being pressurised to not act

2. Authorities are being bribed

3. Authorities are lethargic

4. Authorities are incapable

5. Or Karti and company have done nothing wrong

Another possibility is the authority is being blackmailed. For if he proceeds to prosecute some skeletons may tumble out of his cupboard.

Sri Iyer Ji, the link to your 37 patents is broken – http://www.sreeiyer.com/index.php/template/articles/category-list/114-list-of-patents, kindly fix it, so that we could read an know your achievements.

Your work is commendable

I join with you there Mr Himanshu Sekar Mishra. I expect Sri SreeIyer to TRUTHFULLY and without any bias / animus, explain as to who is honest and who is dishonest among Spl Director-Asthana and Director-Alok Verma of CBI.

I presume, what ever PGurus is projecting is the info provided by S Swamy received through certain officials. Almost every officer in key institutions has worked under UPA ministers and they have their God fathers.As reliable officers are few, Modi picked max Gujarat cadre who worked under him. Asthana was forcefully parachuted by Modi to keep a tab on handling of cases by Verma, against laters desires. Corruption cases are handled by CBI and the Director can throw a case in Dustbin/ cold store. Asthana once stated ED didn’t act against PC for 10 years.

The provocation came from Varma, who filed FIR against Asthana. Smartly Asthana was building up documentary evidence against Verma and gave written complaints to Cabinet secretary.As a chief Verma could have handled his team in a inclusive manner, instead created grouping in CBI. Verma may be honest but someone in UPA used him to their advantage.

It is a bogey created that Asthana took bribe thru a middle man thru transfer in Dubai and Delhi. Evidence in bribe case is impossible unless a trap is laid and beneficiary is caught in person or a money trail is established. Perhaps middlemen may have taken money in the name of Asthana.

If reports are true, Quereshi is classmate and good friend of Verma and one can draw own conclusions.Double crossing in Spy agencies is a silent affair ,which is projected in Hollywood movies.At least half truth will be known on Monday.

Sir. Hong Kong Banking rules insist that even an entity borrowing funds (for raising ECB) need to state list of individuals who hold beneficial interest in excess of 9% of the borrowing entity. (mere description as MF/Trust etc.m would not suffice, the real persons who ultimately receive dividend etc. would require to be in the know of lender) The KYC details of individuals who own in excess of 9% of say – some PE firm, or Trust etc. will have to be shared. GoI/RBI can insist on some similar measure infusion to know the “beneficial interest” of any PE Investor funds in an Indian Corporate entity, to check on such routes for laundering. Also Private Limited companies own huge properties – without any business activity and suddenly the ownership changes (National Herald route). The transfer of land property takes place without stamp duty etc. which is applicable for non-influential and law abiding citizens. Ownership of Private Limited companies with assets or with only paper activity – but on paper suppliers to cash surplus companies (with genuine activity) need to be focused upon.

Sir, Everyday I am opening the site with an expectation to read something new about the CBI issue especially about Asthana vs Alok Verma. Earlier you used to write regularly demonizing Asthana and praising Verma. What I read and see in visual media is different, where Asthana is being pictured as honest and pro BJP and Verma as devil and pro congress. By reading your articles I formed an opinion that Asthana is corrupt person and helping Chindambaran and Verma is an honest person and trying to get Chidambaran punished. Therefore your silence on the issue baffles me. i would like read your views on this issue. Hope, you will not disappoint.

I am a regular reader of P Gurus , I admire you and your writings.

Himansu Mishra