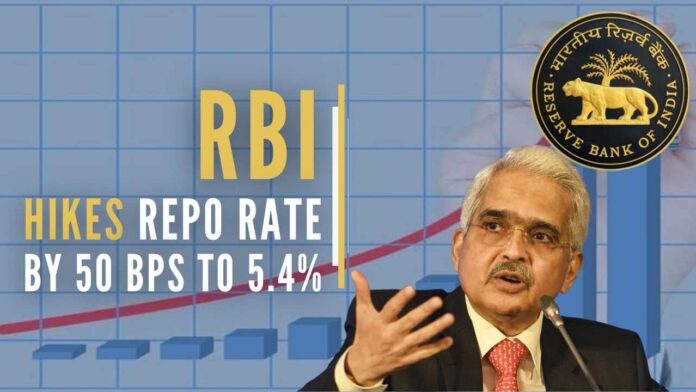

Loan EMIs to go up after RBI hikes rates by 50 basis points to 5.4%

Reserve Bank of India’s (RBI) Monetary Policy Committee (MPC) headed by Governor Shaktikanta Das on Friday announced the rise of the policy rate by 50 basis points to 5.4 percent which it lends to commercial banks to rein in inflation.

The repo rate is the interest rate at which the central bank lends funds to banks.

Announcing the decision of the MPC during its three-day meeting, Das said it has been decided to increase the policy rate by 50bps to 5.4 percent with immediate effect. “MPC decided to focus on withdrawal of accommodation to keep inflation within target while supporting growth”, Das said.

Marginal Standing Facility (MSF) and Bank rates have been adjusted to 5.65 percent from 5.15 percent, Das announced. He also said the domestic economy is showing signs of broadening and the rural demand has shown mixed trends.

Das said that the MPC has projected inflation at 6.7 percent in 2022-23; CPI-based inflation for Q1- 2023-24 is projected at 5 percent. The real GDP growth rate has been retained at 7.2 percent for FY23. The bank credit growth accelerated to 14 percent y-o-y. RBI Governor Shaktikanta Das said that the CPI-based inflation is above a comfortable level.

Das said that successive shocks to the global economy taking a toll on the Indian economy as well. The IMF has revised the global growth projection downwards. He further said that the globalization of inflation is coinciding with the de-globalization of trade.

Adding on, Das noted that the financial market has remained uneasy despite intermediate corrections, however, India is expected to be amongst the fastest-growing economy in the world.

“Rise in term deposit rates should increase liquidity for the financial sector”, Das said. He said pointed out that edible oil prices are likely to soften further.

[With Inputs from IANS]

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- Rajasthan: PM Modi launches scathing attack on Congress; says ‘My 90-Sec Speech Created Panic’ - April 23, 2024

- Delhi Court extends Arvind Kejriwal, K Kavitha’s judicial custody till May 7 in money laundering case - April 23, 2024

- India’s economic activity surges to 14-year high in April: HSBC survey - April 23, 2024

The only thing Shaktikanta Das can tame is his dog.

He himself acts like one and follows orders.