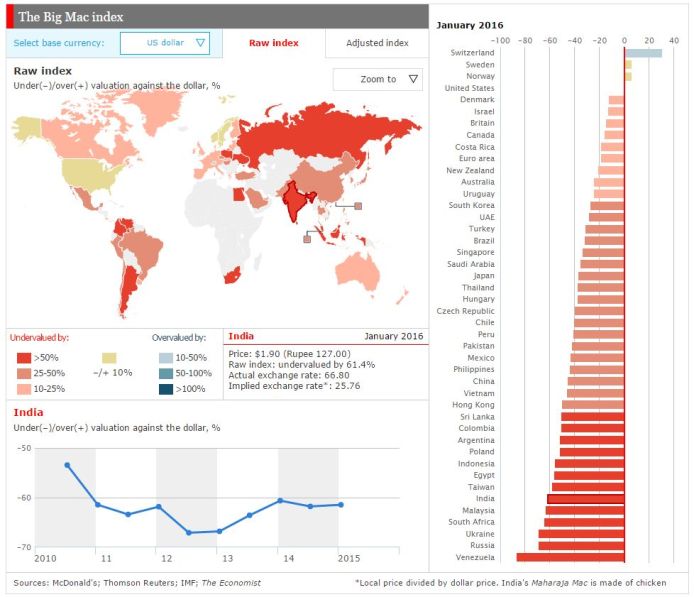

In his speech on India: Economic & Political Outlook at IMC Mumbai 16 June 2016, Subramanian Swamy remarked that the exchange rate of the Rupee vis-a-vis the Dollar should be closer to ₹30 (today it is ₹67). How did Dr. Swamy arrive at the number of 30? There are several ways to determine this and the first one we will look at is the Big Mac Index.

Every year, around January, the Economist publishes a Big Mac Index as a lighthearted guide to whether currencies are at their “correct” level. It is based on the theory of purchasing-power parity (PPP), the notion that in the long run exchange rates should move towards the rate that would equalise the prices of an identical basket of goods and services (in this case, a burger) in any two countries. For example, the average price of a Big Mac in America in January 2016 was $4.93; in China it was only $2.68 at market exchange rates. So the “raw” Big Mac index says that the yuan was undervalued by 46% at that time.

Similarly, in India, a Big Mac costs $1.90, which implies that the Rupee is undervalued by 61.4%, thereby indicating that if PPP were the only criterion to determine exchange rates, the Rupee would have an exchange rate of ₹25.76.

The relative version of PPP is calculated as:

“S” represents exchange rate of currency 1 to currency 2

“P1” represents the cost of good “x” in currency 1

“P2” represents the cost of good “x” in currency 2

What are the factors that are preventing the exchange rate from reaching this level (or something close to it, say ₹30)? First let us look at the pros and cons of an appreciating Rupee:

Pros

-

A rising tide lifts all boats. As the Rupee starts appreciating, the net worth of every citizen will go up.

-

It would cost less to purchase essential commodities and the artificial hoarding effected by some elements will disappear quickly as they will realize that their goods will be worth less with every passing day. Consumer Price Index would get very close to the Wholesale Price Index. To measure purchasing power, you would compare against a price index such as the Consumer Price Index (CPI). A simple way to think about purchasing power is to imagine if you made the same salary as your grandfather. Clearly you could survive on much less a few generations ago, however, because of inflation, you would need a greater salary just to maintain the same quality of living.

Cons

-

An appreciating rupee will throw the inflation based (assumed) economic models off their axis as an appreciating rupee would keep prices steady or drift lower, giving the appearance of deflation. By being up-front with the messaging, the Government can handle this phenomenon.

-

Exports will cost more since the same amount of rupees will get fewer units of foreign currency. Exporters will need to get more efficient to adjust to this new reality.

So how does one bring down the Rupee vs Dollar exchange rate? In the same speech Dr. Swamy mentioned that the exchange rate is affected due to Foreign currency speculation, Black Money and Participatory Notes. Assuming that these are the prime causes, the sequence should be as follows (in my opinion):

-

Ban Participatory Notes: Also referred to as P-Notes, they have been causing a fair amount of volatility in the Stock Market. Banning them may cause a Stock Market correction but the true value of the stocks will be revealed, allowing for accurate Price Discovery.

-

Temporarily halt Foreign Currency Speculation: This is a must to get a grip on the Foreign Reserves. To ensure a smooth ramp up of exchange rate, any disturbing factor should be kept on hold.

-

Additionally, India needs to ink Energy deals (Crude Oil especially) with suppliers in non-dollar terms. This too will add stability to the exchange rate.

-

Lastly, pass a bill to Nationalize all assets of Indian citizens in Tax havens. This may lead to an exodus from the country of the wealthy but the law should have teeth to go after their assets even if they have transplanted themselves abroad. What about the Black Money inside India? This is mostly in the form of real estate, be it buildings or land. The stoppage of P-Notes will curb the generation of Black Money inside India (along with PAN card / Aadhar’s usage for more high value transactions). The owners of unsold housing may sit on it and try and ride it out but recently Vancouver Canada has proposed to tax the owners of unoccupied housing too. A similar law passed in India will bring down the prices fairly quickly.

All this requires political will and the ability to ride out storms. Will this happen? Only time will tell.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

will be disastrous on exporters”point of view.

will be disastorous on exporters”point of view.

Great ideas by Dr Swamy as always.I see him become India’s best FM after 2018 elections(it seems elections are 2018 state and national ,not 2019)

All these will go as greek and latin to the lawyer FM who can only continue UPA policies – he doesnt have the confidence not the knowledge to implement ground breaking reforms. Only thing he can do is increase taxes for the middle class and introduce a cess for every project like swachh bharat, krishi kalyan etc. he wont be fired either this term for sure !

To implement Dr.Swamy suggestions the Govt of the day must have the will to do these reforms even

if they are going to be opposed in a big way through Media and other means and also from the so

called economist living in USA and other countries crying wolf. The Prime Minister should take upon

himself this task on a high priority basis and summon the FM and advise him to do this immediately

and monitor the progress of this on closely. To start off he should introduce an ordinance to nationalize

all the black money held abroad in tax havens as suggested by Dr.Swamy on several occasions abolish the

Participatory Notes and speculation in money market.

The above tough stand has be taken immediately as suggested by Dr.Swamy this will improve our economy

but the Govt will have face many hurdles and obstruction but a firm PM should handle all this in his own way.

the best way to do this is induct Dr.Swamy as FM who will show him the way to do all this in a simple manner.

Map of India is wrong in the pic, shows POK in Pakistan. Please use correct map.

That map you are referring to, is the original post by The Economist.

Most of the black money is lying invested in real estate and under 3rd party names to avoid detection. The government should digitize all land records with the Aadhar / PAN numbers of the owners. Also property tax should be incremental. A single individual needs about 500 Sq feet of house to stay comfortably. If he owns any property more than the basic he should be charged in multiples. For example 500 to 1000 tax to be double. 1000 to 1500 should be triple and so on. This will be a disincentive for anyone to hoard property.

Rupee value lowered all along and gradually so that the black money siphoned out of India by Congress and their crony businessmen , can be brought in later fetching more rupees in India to cover loss of interest and much more. This cycle went on. The body of economy is to be slowly removed of this accumulated bad water of black money as a medical case. In a poor, mostly illiterate, rural agro based and self employed people economy threshold for banning cash economy should be higher and sector wise so as to not to impact rural masses. Land compensation law provides 4times compensation. this prevents raising govt prices for land registration and reduction of stamp duty to curb black monkey in the real estate transactions.

Correction: It is not the Economic Times who created the Big Mac Index.

You are right. It is not Economic Times – rather it is The Economist. Regret the error. Has been corrected.

Sir, do you think controlling the parameters namely Foreign currency speculation, Black Money and Participatory Notes will be effective in completely curbing the after effects of deflation and rise in export cost as a consequence of appreciation of Rupee?

How about Stopping printing & circulation of Rs.500 & 1000 denomination effect to curb Local Black money as we are mostly into digital payment by Credit, Debit Cards, ECS transfer ? This will make also vote buying process .

How can your wonderful suggestions be implemented without Shri Swamy actually becoming the finance minister?In other words why the Govt of is India incapable or unwilling to adopt the same measures?

However fourr things can start without any fuss. 1.All overseas assets of Indians can be nationalized forthwith.

2

.All transactions beyond rs 5000 must be through bank transactions or equivalent with established identity.

3.Paper momey beyond rs 100 must be withdrawn from circulation and must be illegal.

4.India can even burn midnight oil to start non-dollar transaction for oil withsimilarly affected countries.

Once the dollar supremacy bluff is called all economies will come down to mother earth and start behaving.