In a research paper, written for the EU, the author quotes

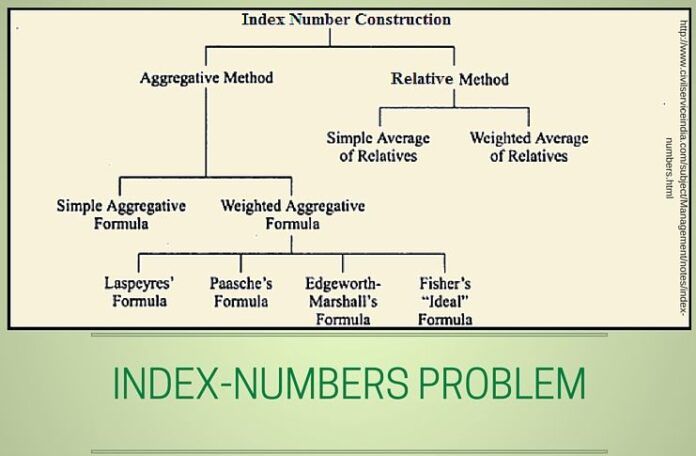

Invariable Economic Index Numbers and Canonical duality, by Dr. Paul Samuelson and Dr. Subramanian Swamy at least 15 times[1]. Note that the Swamy’s paper details show how index numbers can be used to compare disparate entities such as a dozen oranges and a kilogram of grapes.

In the paper Solving the Index-Number Problem in a Historical Perspective written in January 2009, the author Carlo Milana quotes the seminal paper of Dr. Samuelson and Dr. Swamy and explains how investment priorities get skewed and goes on to say how tricky it is to track monetary policy.[2]

“The fundamental and well-known theorem for the existence of a price index that is invariant under change in level of living is that each dollar of income be spent in the same way by rich or poor, with all income elasticities exactly unity (the homothetic case). Otherwise, a price change in luxuries could affect only the price index of the rich while leaving that of the poor relatively unchanged. This basic theorem was well known already in the 1930’s, but is often forgotten and is repeatedly being rediscovered”.

“Although most attention in the literature is devoted to price indexes, when you analyze the use to which price indexes are generally put, you realize that quantity indexes are actually most important. Once somehow estimated, price indexes are in fact used, if at all, primarily to ‘deflate’ nominal or monetary totals in order to arrive at estimates of underlying ‘real magnitudes’ (which is to say, quantity indexes!)”.

“The fundamental point about an economic quantity index, which is too little stressed by writers, Leontief and Afriat being exceptions, is that it must itself be a cardinal indicator of ordinal utility”.

– P.A. Samuelson and S. Swamy (1974, pp. 567-568)

Milana had written it as part of Productivity in the European Union: A Comparative Industry Approach series. An excellent introduction to Index numbers is provided in it.[3]

Note:

1. Text in Blue points to additional data on the topic.

References:

[1] Invariant Economic Index Numbers and Canonical Duality: Survey and Synthesis – Jstor.org

[2] Solving the Index-Number Problem in a Historical Perspective – Euklems.net

[3] Civil Service India – Index Numbers – Civil Service India

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Sir, kindly also post the document which Indra Gandhi has laughed about 10%growth rate of India in Parliament , written Dr. Swamy

Today, I read this article and its helpful for those who belong to. Rest will comment unnecessarily. Few people in this world are only to look negative point everywhere.

No wonder #BREXIT from EU happened ..thanks to swamy..just kidding!!

Difficult to understand. However, it reflects a deeper understanding of monetary indices.

can you write something a layman like can understand? why unnecessarily try to show off? Simple sentences are highly effective in communication

You are right, Ragu. We will work on de-mystifying the language of the EU Paper so the relevance of Index Number Theory with regards to gauging Monetary Policy becomes easy to understand.

@Ragu When you need something, make a request or know how to politely ask for it……. show off it seems….. tera baap ka naukar hai kya?