Chidambaram’s Stock Exchange manipulation scam bags coming out

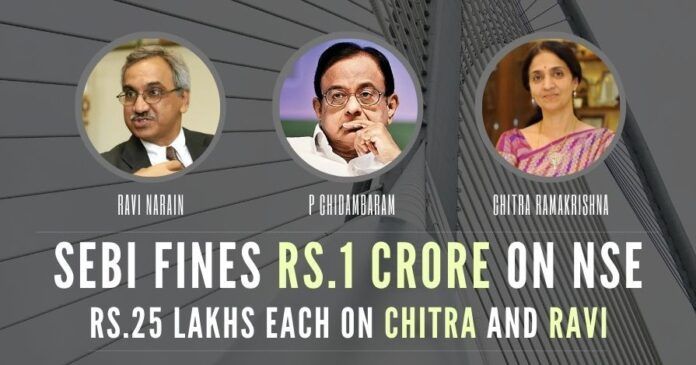

At last biggest, the stock exchange manipulation blessed by corrupt former Finance Minister P Chidambaram is coming out in the public domain. In the high profile Co-location case, markets regulator Securities and Exchange Board of India (SEBI) on Wednesday imposed a penalty of Rs One crore on the National Stock Exchange Scam (NSE) for failing to provide a level-playing field for trading members subscribing to its tick-by-tick (TBT) data feed system.

In addition, the regulator levied a fine of Rs.25 lakhs each on NSE’s former managing directors and chief executive officers Chitra Ramakrishna and Ravi Narain. Frauds and lapses in high-frequency trading offered through NSE’s Co-location facility came under the scanner of the watchdog after a complaint was filed in 2015.

The NSE flouted the principles underlying the conduct of the business of a stock exchange, pertaining to fair and equitable access to information.

PGurus published several reports on this fraud in stock exchange manipulation blessed by corrupt former Finance Minister P Chidambaram[1][2][3][4].

The National Stock Exchange of India (NSE) Co-location facility allows stockbrokers to take on rent specific racks and Co-locate their servers and systems within the exchange premises. The primary objective of co-location services of the NSE is to reduce latency for connectivity to the exchange’s trading systems for Direct Market Access (DMA), algo trading and Smart Order Routing (SOR).

In its 96-page order, SEBI said that unequal access was apparent at different stages of the technology process and NSE as a stock exchange failed to ensure a level-playing field for trading members subscribing to its TBT data feed system. Tick-by-Tick (TBT) data feed provides information regarding every change in the order book.

According to the regulator, many trading members had repeatedly resorted to accessing the secondary server without any checks and balances and actions on the part of the first- level regulator except for certain emails or advisories. The NSE flouted the principles underlying the conduct of the business of a stock exchange, pertaining to fair and equitable access to information.

“While implementing TBT dissemination architecture at NSE, the essence of ‘fair and equitable access’ was not attempted to be imbibed into the various stages of implementation of the technology and only ‘safety and reliability’ was taken into account,” SEBI said. By doing so, the exchange violated the provisions of Securities Contracts (Regulation) (Stock Exchanges and Clearing Corporations) Regulations or SECC norms.

The NSE has failed to comply with the provisions of SECC Regulations in letter and spirit and Ramakrishna and Narain are vicariously liable for the acts of omissions/ commissions committed by the exchange during the investigation period, SEBI said. Noting that the violations, in this case, are serious in nature, SEBI said such violation would compromise the regulatory framework and should be dealt with by imposing a monetary penalty on the entities so as to send an effective message to the market participants as a whole[5].

Accordingly, the Securities and Exchange Board of India (SEBI) levied fines on the exchange and its former officials. Earlier in April 2019, the regulator had directed the exchange to disgorge profits worth Rs.625 crore in the matter and had imposed a six-month ban on launching new derivative products.

[with PTI inputs]

References:

[1] C-Company Part-8 – NSE – The early years & PC’s first scam – Nov 07, 2017, PGurus.com

[2] C-Company Part-8 – The tipping point – MCX-SX becoming a full-fledged Stock Exchange – Nov 26, 2017, PGurus.com

[3] C-Company Part-10 – The Way Forward – Dec 05, 2017, PGurus.com

[4] Ajay Shah, an essential cog in the wheel of C-Company P1 – Entrenchment – Jun 13, 2018, PGurus.com

[5] NSE says no imminent IPO, SEBI confirms but… – Feb 10, 2021, PGurus.com

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

[…] SEBI fines Rs.1 crore on NSE, fines Rs.25 lakh each on fraudsters Chitra Ramakrishna and Ravi Narain… – Feb 10, 2021, […]

Chiddu is omnipotent