In my previous posts, I had discussed the Foreign Direct Investment[1] and Foreign Portfolio Investment[2] in to India over the past couple of years and their trends. In the second post, I had lamented the lack of adequate information regarding Participatory Notes (P-Notes) on various sites. Well, I am pleased to say that the Securities and Exchange Board of India (SEBI) has made available the latest data on P-Notes on their website[3] (Does someone read PGurus at SEBI?!). And it makes for interesting reading.

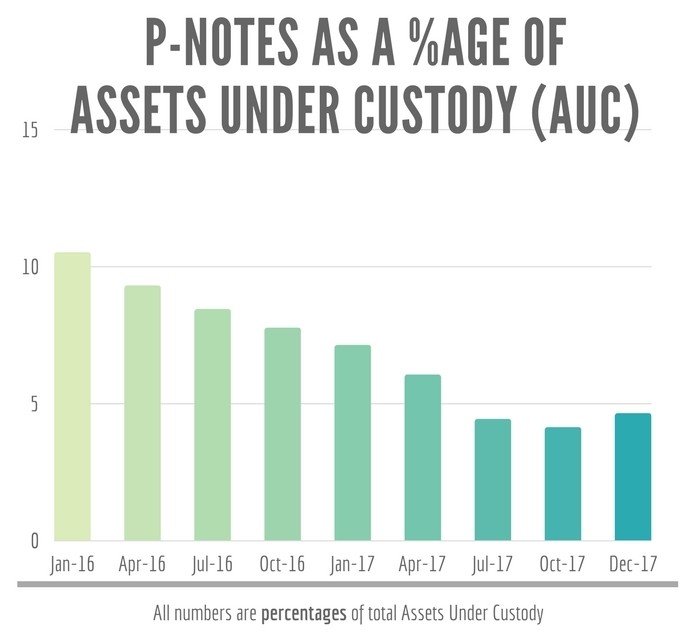

The proportion of P-Notes as part of the AUC show as steady decline although there is a slight uptick in December 2017. Since one part of the P-Notes is banned since July 10, 2017, let us see the impact of the same as a proportion of AUC.

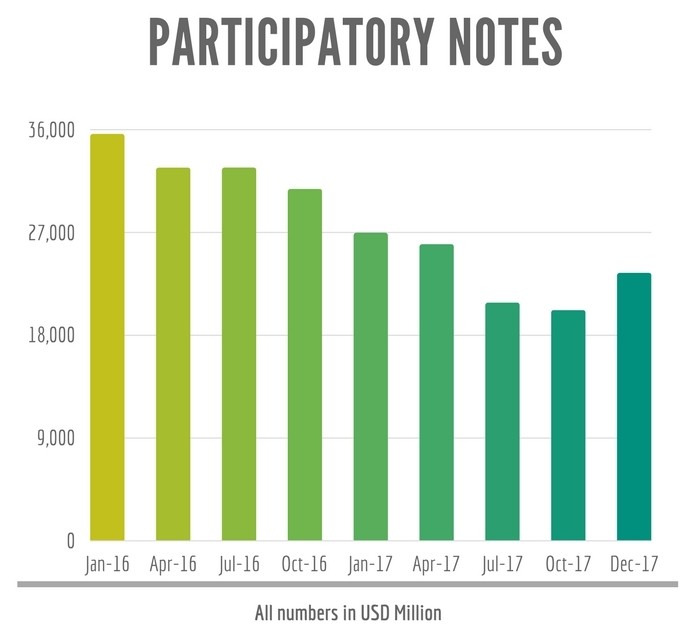

Since I believe strongly in the idiom, “A Picture is worth a thousand words”, let me start with a graphic of the actual value of P-Notes coming into India (in millions of dollars). Figure 1 shows it from January 2016 till the end of 2017.

P-Notes coming into India can be classified into three parts, based on the intended purpose – Equity, Debt, and Derivatives. The major portion of P-Notes comes into Equities. Starting July 10, 2017, SEBI banned using P-Notes for Derivatives except for Hedging. What does this mean? Let us back up a bit and explain what each of the three terms mean –

- Equity – P-Notes of the type Equity are directly invested into Indian Stock Market. A majority of these investments come through either Mauritius or Singapore (both of which enjoy a special tax treaty with India) and when the money is directed into a specific stock, the price shoots up. While going up, it draws the rest of the market along with it. Once the P-Notes based investor is confident that the stock is ripe, the investors sells his/ her stock and causes a crash in the market.

- Debt – P-Notes brought in to service the debt in a company.

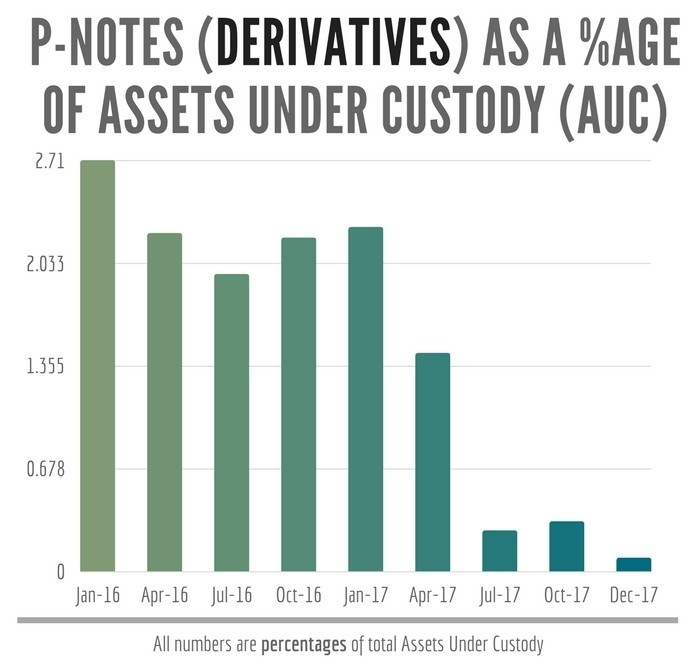

- Derivatives – These are exotic financial instruments often with no underlying stock as collateral. If I read the new regulations that came into effect on Jul 10, 2017, correctly, all derivates except for those used to hedge their positions are banned. The wording makes it sound like SEBI banned naked shorts. If this is true, this should have been done a long time ago.

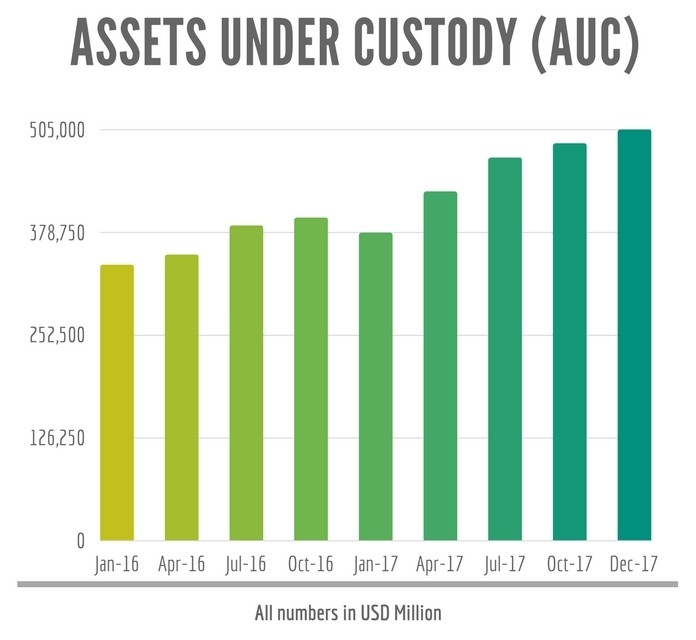

Next, let us look at how Assets Under Custody (AUC) has been faring over the same period (2016-17). AUC can be thought of like a Custodian Bank where all the assets are backed up by either cash or collateral[4]. In December 2017, AUC crossed an important milestone – it crossed the $500 Billion mark. Figure 2 shows this:

Next, let us look at how P-Notes are faring with respect to AUC. This gives an indication of the impact P-Notes create on the Stock Market. Figure 3 shows the figures for the years 2016-17:

The proportion of P-Notes as part of the AUC show as steady decline although there is a slight uptick in December 2017. Since one part of the P-Notes is banned since July 10, 2017, let us see the impact of the same as a proportion of AUC. Figure 4 shows this. You can see the percentages fall off rapidly from July 2017 onwards.

P-Notes are going lower but Stocks are rising higher

There is this perplexing dichotomy that is hard to explain. If P-Notes are diminishing, then there is less money to impart acceleration to stocks. Yet we are seeing the Stock indices reach new highs on a daily basis. What is the reason for this irrational exuberance? Is there a hidden hand at play that can crash this market at will?

Caution from an Auditor/ TV Commentator

M R Venkatesh, a noted TV Commentator. Chartered Accountant and author warned that India’s Stock Market is overheated. In a series of tweets, he shared his thoughts as follows:

| Stock Market is Overheating |

| A big bubble has built up there quietly. While the economy grew at 5-6% companies reported bigger growth. Importantly post Demonetisation, interest rates fell. People were compelled to park their savings in the stock market. Middle-class people are breaking their Fixed Deposits and putting money in SIP mutual fund thinking that it is 100% safe. Out of Rs.6,00,000 crore daily volume only Rs.10,000 to 15,000 cr is the delivery volume. Rs.50,000 cr per month is coming into a mutual fund from domestic savings. Therefore junk stocks are getting bought by fund managers at an inflated price of 35-40-50%. Since money is flowing from small investor no one is worried. The bubble will burst as soon it reaches an unsustainable level. PC & gang who control stock market will trigger collapse just b4 election. The sentiment of masses who will lose in the market will be totally negative on the present govt. The attack on Government through judiciary was a prelude. Next step attack middle class through the collapse of the stock market. Is the Government ready? |

References:

[1] Foreign inflows (FDI) into India up! Really? Data does not seem to suggest this – Jan 17, 2018, PGurus.com

[2] FDI inflows into India – Part Deux – Jan 21, 2018, PGurus.com

[3] Value of Offshore Derivative Instruments (ODIs) / Participatory Notes (PNs) – Jan 28, 2018, SEBI.Gov.In

[4] What exactly does a Custodial Bank do? May 15, 2014, Quora

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] of multi-billion dollar investors through tax havens and doing nothing about the identity of Participatory Notes (P-Notes) holders, the Stock Exchange Board of India (SEBI) on Tuesday has come out with a […]

Modi govt is no saint & is acting front for Reliance group of companies. BJP govt is equally unethical & full of inaction on sensitive issues.

1) Simply ban the P-notes

2) When it is known that govt coffers are empty, defense forces do not have money to buy a knife /kukri,

then simply tell the nation & tax to buy all ammunition that is required. No problem if enemy nations

know it. India will emerge stronger after 3-4 years once the ammunition starts reaching & army starts

using them.

3) Inaction on Robert Vadra, National Herald & many more. why it is required that only Mr. Swamy to file

& follow-up the court cases. Is the govt machinery gone senile ?

4) Budget is full of lies, as Mr. Venkatesh rightly analyzed with 2-3 examples. If bandwidth is improving,

do not see why the internet speeds are still at 1G level ?

Iyer sir ,

Anyway we all are aware that Modi government is delibrately supporting the Hyperrich corporate/political thieves in recent times. The worst part is not only Modi supporting and safeguarding huge master scamsters but also harassing honest people who are bringing this to notice of PM and Government.

Shakuni FM is only front for Modi. I think expecting anything good from PM Modi now is foolish.

Modi and his team thinks tolerance means tolerance to hi scale corrupts only !!!

There must be some unknown compulsions for Modi ….. May be he will have x TN CM JJ fate very soon !!!

This seems quite possible, You need to tag SEBI, FM, & PMO for this so preventive measures be taken care of.