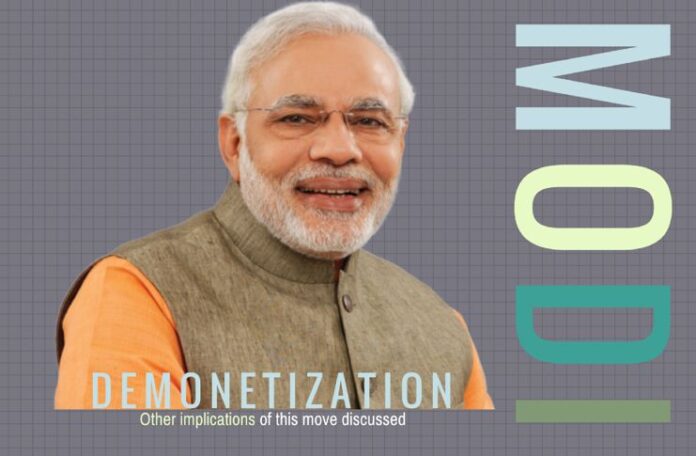

It is intuitive to grasp some of the implications of the recent demonetization of 500 and 1,000 rupee notes by the central government in India. If there is one thing the corrupt government officials are good at, it’s collaboration. Those running a one-man show don’t survive the swamp. When the Indian Revenue Service and the Central Bureau of Investigation are currently not able to effectively prosecute the corrupt government officials they have already identified, owing to an overburdened judiciary, it is unreasonable to expect them to pin down the collaboration that takes place between the good, the bad and the ugly between November 08th and December 30th, the two dates between which one can deposit old notes in a bank. This intuition is likely to kick in when the commotion settles. Right now, it is the thought of a cash hoarder running around and losing sleep over piles of cash under his bed that is keeping people standing in bank queues happy.

A businessman’s wealth is not, unlike the wealth of a corrupt government official, an ill-gotten wealth. He takes risks, employs people, and his wealth is a function of what people were willing to pay for the goods and services he produces.

Other implications, and the underlying reasons behind demonetization, are not so intuitive to understand. I intentionally did not use the term tax-evaders in the paragraph above when I referred to those with illegitimate hoardings of cash. It would be an egregious error for an economist to conflate businessmen who evade taxes and corrupt government officials who take bribes. What you call tax evasion, a free market economist, in the context of the Indian economy, will, and should, call a tax cut. An effective tax cut that incentivizes businessmen to produce goods and services that people need. A businessman’s wealth is not, unlike the wealth of a corrupt government official, an ill-gotten wealth. He takes risks, employs people, and his wealth is a function of what people were willing to pay for the goods and services he produces.

The idea is not to encourage tax default, but to acknowledge the inefficiency of the tax machinery of the government for a low effective tax rate. Lower taxes, to an extent, imply smaller governments. The period between 1776 and 1913 during which the United States became an industrial superpower, the country had a very small government and income tax was unconstitutional. To understand in layman’s terms how the Indian economy will crumble if all businessmen were to be forced to pay a high tax rate, I would encourage you to read the article Republic of Ghaziabad – Part I. The belief that “taxes are high because businessmen don’t pay them” is a fallacy; many businessmen will simply close their operations if they are forced to pay such high taxes.

But this is not the gravest implication of demonetization; I am confident that businessmen in India are smart enough to find a way around it. The most concerning part is that this is not just demonetization as claimed by the government. I predicted the collapse of the banking system in India in my two articles published in 2015: Will India Be The First Domino To Fall? and You Can’t Just Invest On Hope. The hard-earned money that people deposited in nationalized banks was squandered away during the ten years of the UPA government. These banks financed boondoggles, welfare schemes and luxuries of friends of governments, and have now run out of money. The collapse I predicted is here. I believe that the Finance Ministry is grasping for straws and the demonetization step is a last-ditch effort to postpone the financial crisis. This is not demonetization. This is a bank holiday, and it will backfire.

No set of words capture what happens when money is not in the hands of people but their government better than this quote by Milton Friedman.

“There are four ways in which you can spend money. You can spend your own money on yourself. When you do that, you really watch out what you’re doing, and you try to get the most for your money. Then you can spend your own money on somebody else. For example, I buy a birthday present for someone. Well, then I am not so careful about the content of the present, but I am very careful about the cost. Then, I can spend somebody else’s money on myself. And if I spend somebody else’s money on myself, then I am sure going to have a good lunch. Finally, I can spend somebody else’s money on somebody else. And if I spend somebody else’s money on somebody else, I am not concerned about how much it is, and I am not concerned about what I get. And that’s government.”

– Milton Friedman

Let us read the quote above considering the current situation. Under demonetization, a poor woman who has been saving cash to spend on the education of her child will be forced to deposit it in banks operated by the government. The banks (somebody else) will use her money to finance ever-increasing salaries of government officials (somebody else) and to fund “new and innovative” schemes centrally planned for the poor (“somebody else”) by an army of bureaucrats (somebody else). Somebody will use her money to build a toilet for her. Somebody will buy her an LED bulb.

Inflation is a tax, and printing notes out of thin air causes inflation.

When she asks for her money back, and if the cash withdrawal restriction has been lifted by that time, the RBI will print new notes for her. Direct taxation is not the only way the government takes people’s money. Inflation is a tax, and printing notes out of thin air causes inflation. The woman will not be able to educate her child when she receives the devalued cash as the cost of education would have risen. In effect, she won’t be able to educate her child because somebody else has been granted the power to spend her money on somebody else.

The money she would have spent on the education of her child would have employed a pencil and copy manufacturer, a carpenter and a teacher. Now that money will be spent on salaries of bureaucrats who make decisions for her, on salaries of welfare officials who produce nothing for her, and on LED bulb which she doesn’t think is as important as education for her child. Think about millions of people whose choice to spend their own money in a way they want has been taken away by this step, and you will start getting an idea of the magnitude of the impact of this decision. This, I believe, is more damaging than other consequences associated with demonetization, and will continue to worsen the fundamentals of the economy until the cash withdrawal restriction is lifted.

- Solution to Kashmir: A Lesson From The Prairies, the Pampas and the Kashyaps - February 12, 2019

- Kartavya,Adhikaar And Skill. A Worthy recipient of Skill India Scheme? - October 16, 2017

- Demonetization Has Opened A Window Of Opportunity For Modi - December 21, 2016

Very childish article.surprised that editorial team allowed this.

In usa similar demonetisation took place in 1998 and after that cash hoarding stopped.

Corruption stopped.

Today 100 dollar bill is the highest in usa and you can be jailed in usa if you have more than 10,000 dollars in cash!

India can not go cashless i agree but can bring it down to 20 percent .

Today in rural areas they have 4g and every body is busy with whatsapp and face book.so using card to pay for most of every day things are going to be a reality.

Take ola or uber card for example.also rupe card will be on rise.

“In usa similar demonetisation took place in 1998 and after that cash hoarding stopped.”

Which usa madam?

“Corruption stopped.”

LOL –

Dear Nathan, I work in a rural bank. Here at least one member of every family has a bank account. (JDY). In my opinion cash transactions above rs. 20k should be banned

Dear Mr Sondur,

Would you keep your money in another persons account? That itself is an offense under law

I am aware that bankers ( at very senior levels ) knowledge of banking is terrible Here read this comment of mine, as i am sure you did not know for instance

https://www.pgurus.com/modi-abolished-rs-500-rs-1000-notes-effective-immediately/#comment-2796

It may be true to some extent that many tax evaders(businessmen as per the author) may suffer by demonetisation, there will be little or no effect on the bribe takers( the salaried class) who receive grafts with 100% profit and little risk if any; their strong point being collaboration and weak prosecution process.

The Govt if it is serious to tackle corruption it has to undertake a separate exercise to trace all nami/benami property including that of all relatives; impounding them should be the solution, not prosecution; let it be clear that this present demonetisation will not end corruption/bribe taking by the salaried class as they get a chance to hone their skill(of corruption) to perfection along 45 years of their employment.

I’m surprised iit produces such “intelligent” people with such extraordinary insight. I wish the writer would shed some light on the effect of the led bulb distribution on large scale

Very shortsighted article. Restriction is on cash withdrawal not on money transfer. You can alwsys spend by way of money transfer.

On the contrary, a very good article . Perhaps you live in an urban area. More than 50% of Indians do not have a bank account. They cannot do any money transfers.

Very shortsighted article. Restriction is on cash withdrawl and not on money transfer. One can always spend by transferring money.