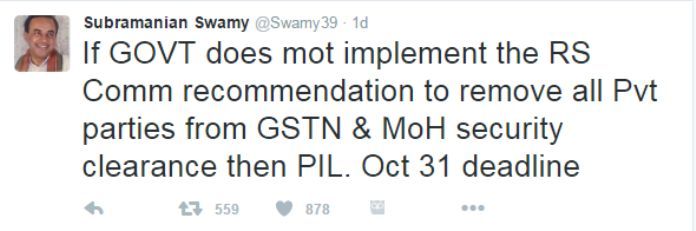

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]A[/dropcap]fter exposing the hidden private shareholding in GSTN for the past three months and alerting Prime Minister Narendra Modi through a series of letters, Senior BJP leader Subramanian Swamy declared that if government is not removing private companies, he would go ahead with a Public Interest Litigation (PIL). Swamy tweeted on Dussehra day evening that, he will wait till October 31 for the government to act, failing which he will go ahead with a PIL to challenge the government in allowing private companies in the Goods Services Tax Network (GSTN).

If Swamy goes ahead with the PIL, this would be his first PIL against Narendra Modi government. The ruling party MPs PILs on several issues on corruption and illegalities had crumbled the previous Congress regime, igniting anti-corruption movements in the country, leading BJP to power.

Like Law and Order, the tax collection is the total responsibility of the government. The question is why the NDA government, sticking to the company – GSTN – dubiously promoted by former Finance Minister P Chidambaram. It is a million dollar question, as to why the current Finance Minister Arun Jaitley is hell bent of supporting the dubious company floated by Chidambaram in March 2013.

In GST, the company floated to administer the GST and collection of taxes in future, the Governments have only 49 percent shareholding and the rest 51 percent of the shares are controlled by private banks and private entities. Actually in 2011, then Finance Minister Pranab Mukherjee envisaged the pattern of fully owned government company with Centre, State Governments and NSDL.

But Chidambaram in a mischievous manner removed NSDL and reduced the shares of Centre and States and inducted five private firms with 51 percent. The GSTN, which operates in sensitive tax collection and administration never obtained the mandatory Home Ministry clearance.

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]T[/dropcap]he Central government holds 24.5 per cent stake in GSTN while State governments together hold another 24.5 per cent. The balance 51 per cent equity is with non-government financial institutions like HDFC Bank, HDFC Ltd, ICICI Bank, NSE Strategic Investment Corporation and LIC Housing Finance. “The ICICI and HDFC shareholding is near about 65-80 per cent owned by foreigners” and “in effect GSTN is foreign controlled and hence, needs to be restructured,” Swamy pointed out in his several letters to Prime Minister for the past three months. LIC Housing Finance is also having several foreign companies as shareholders.

Swamy’s move to go ahead with PIL will a big blow to the Modi government, which has not yet changed the dubious policy adopted under Chidambaram.

Rajya Sabha’s Standing Committee also recommended for the exit of private shareholders in GSTN, citing several issues like possible leakage of sensitive tax data and rigging of stock exchanges.

Department of Expenditure and Department of Revenue officials are also arguing that GSTN should be fully taken over by the government and made as an unit under Central Board of Excise and Customs (CBEC). They point out that Income Tax Department is running a similar organisation very smoothly and tax related matters should be under the full control of Government.

Department of Expenditure has also objected to recruitment and working style of GSTN, dictated by the majority shareholding private bankers like ICICI Bank and HDFC. Bureaucrats have already expressed their anger on recruiting private staffers with exorbitant salaries in GSTN. IRS Officers Association also objected to the involvement of GSTN in tax collection.

Swamy’s move to go ahead with PIL will a big blow to the Modi government, which has not yet changed the dubious policy adopted under Chidambaram. The GSTN’s Articles of Association barring CAG Audit, CVC monitoring will definitely be questioned by Courts. How can such dangerous/ hubris inducing clauses be accommodated when public money is involved?

Will Government rectify the GSTN by removing private companies infiltrated during the UPA regime or will it face Swamy in Court is to be watched in coming days.

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

How come most of the politicians of BJP are silent on this issue is another interesting observation, as if they have no say in it.

it’s a right thinking move. Hope Government will wake up in the nation’s interest. There is a legal weight in his contention.

56″ will be a fool if DrSwamy files this PIL.56″ is on a death do us apart grip with that lutyen gossip monger cum looser and it will end with ash on his face.What explains this obstinacy?

I fully support Dr. Swami

I support Dr Swamy on the PIL.

It is a matter of national security!

BJP needs a shake to come out of its complacency

In a given circumstances if govt is not done inspiite of knowing the facts by Mr.swamy. with this pil we can correct the same.