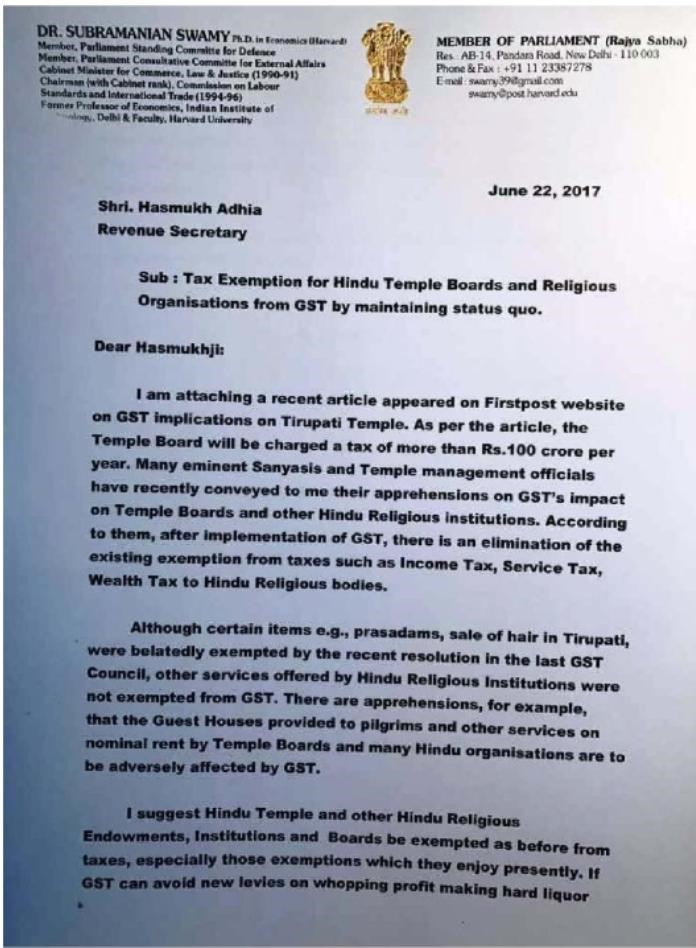

[dropcap color=”#008040″ boxed=”yes” boxed_radius=”8px” class=”” id=””]S[/dropcap]enior BJP leader Subramanian Swamy sought clarifications from Department of Revenue on the implication of GST on Temple Boards and other Hindu Religious institutions. In his letter to Revenue Secretary Hasmukh Adhia and PM’s Principal Secretary Nripendra Mishra, Swamy urged that status quo of complete exemption from all taxes should be maintained for the Temple Boards and other Hindu Religious Institutions and Endowments.

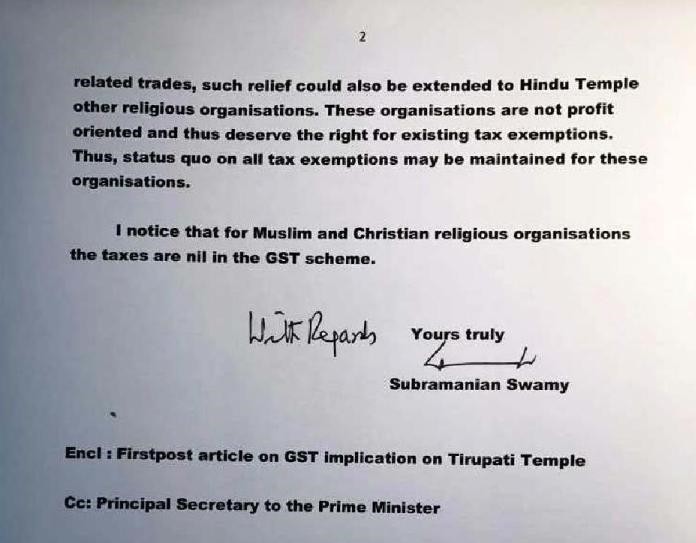

…status quo on all tax exemptions may be maintained for these organizations. I notice that for Muslim and Christian religious organizations the taxes are nil in the GST Scheme,” said Swamy…

Citing an article that appeared in Firstpost website on the burden of more than Rs.100 crore taxes on Tirupati Temple Board after GST implementation, Swamy said that these organizations are not profit oriented and deserve the existing exemptions from all kind of taxes.

“Although certain items such as Prasad, the sale of hair in Tirupati were belatedly exempted by the recent resolution in the GST Council, other services offered by the Hindu Religious Institutions were not exempted from GST. There are apprehensions, for example, that the Guest Houses provided to pilgrims and other services on nominal rent by Temple Boards and many Hindu organizations are to be adversely affected by GST.

“I suggest Hindu Temples and other Hindu Religious Endowments, Institutions and Boards are exempted as before from taxes, especially those exemptions which they enjoy presently. If GST can avoid new levies on whopping profit making hard liquor related trades, such relief could also be extended to Hindu Temple and religious organizations. These organizations are not profit oriented and thus deserve the right for the existing tax exemptions. Thus, status quo on all tax exemptions may be maintained for these organizations. I notice that for Muslim and Christian religious organizations the taxes are nil in the GST Scheme,” said Swamy, arguing for existing complete exemption of taxes to Temple Boards and other Hindu Religious organizations.

Subramanian Swamy’s letter to Revenue Secretary and Principal Secretary to PM is published below:

- Subramanian Swamy approaches Supreme Court on Govt’s modification of 2G Scam Judgment to avoid auction of Satellite Spectrum - April 23, 2024

- Defence Minister Rajnath Singh visits Siachen. Reviews military preparedness - April 22, 2024

- Amit Shah’s shares in the Stock Market almost doubled in the past five years - April 21, 2024

It is quite strange that despite raging controversy about this Jeziya type tax on Hindu emdowments and temples our FM Arun Jetley is silent.Does he want a Hindu backlash against the BJP government of Shri Narendra Modi ji?He will come via RS but what will be the fate of others who have to come via LS.He overjealous attitude towards GST may cost BJP very dearly.

Why do BJP people fail to recognize that Shakuni and his gang is mole of Congress is beyond me. His policies are killing MSME, antagonizing traders,spreading fear among salaried class with his handicapped budgets,re-using useless socialist methods like govt cross insurance, ever increasing govt spending sponsored by inflation and taxing poor, protecting Gandhis and Chidambaram and NDTV by inaction of ED and IT.