This happened on Sunday the 22nd July 2018 at the vessels, furniture and home appliance showroom of Saravana Stores, Ranganathan Street, T.Nagar. This is an account of how some well- known and much-frequented stores evade tax.

The person at the counter was unable to provide an answer and he directed our protagonist to another person who took another fifteen minutes to create a tax invoice!

One of our readers had gone to the above-mentioned store to buy a bag and a gift article. After carrying the articles and the slips they usually give after a purchase, he went to the ground floor counter for billing and payment. He made the payment, collected the purchased items from the delivery section and walked out to continue his shopping. It is the practice in such large establishments that the receipt is put along with the purchased articles into a promotional plastic bag given by the store. Later, when our reader was having his dinner at a hotel nearby, he started collecting the receipts (for accounting purposes) from various shops he had shopped at and found that the one for the articles that he had bought from the showroom of Saravana Stores did not even carry the name of the shop!

Out of curiosity, he visited the showroom once again to find out if they had misplaced the tax invoice. The answer given was, “If you need a proper bill, please go to that counter”! Thus, it became clear that what had happened to him was not a mistake! This was business as usual! What are the implications of this? This means that for all the hundreds of customers who make purchases to the tune of thousands of rupees, every hour in that big store, no tax invoice was being provided unless demanded!

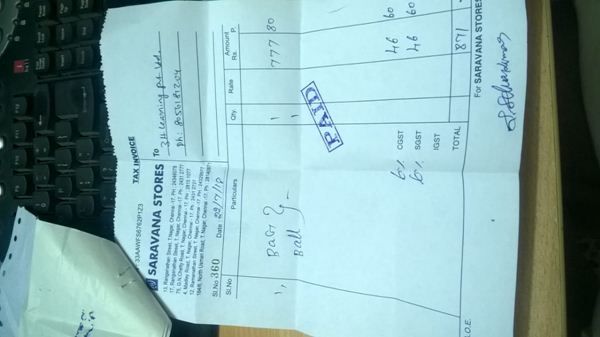

He went to the counter pointed out and showed the slip of paper that he had, to get a proper tax invoice. The person in this “tax invoice” counter took another full five minutes to find out what he had purchased and made him pull out all the items from the cover in which his own colleague had earlier put them, in order to verify the items! After this, he informed our protagonist that if he needed a proper bill, he would need to pay Rs.141 extra for the Rs. 871 that was billed. Our protagonist demanded to know whether the store was making sales without tax as usual practice and if it was the case that he had to pay that extra Rs. 141 because he demanded a tax invoice.

The person at the counter was unable to provide an answer and he directed our protagonist to another person who took another fifteen minutes to create a tax invoice! However, this was not before collecting his phone number and name of the person to whom the bill has to be raised etc. This third person also tried to bulldoze our protagonist saying that it would cost extra if he wanted a tax invoice. However, when he objected, the person yielded, did not collect any further money and handed over the tax invoices to our protagonist.

The whole episode left us wondering regarding the following points

- Every hour, this shop should be having a few hundreds of customers making purchases for a few lakhs of rupees. How is that they are giving articles with no tax invoices?

- Nobody was caring to look into the receipt because, the slip of paper with ‘no name of the shop’ is thrust inside the covers and Saravana stores bags are carried happily by the customers.

- If they are giving tax invoices only to the customers who are asking for it, after demanding additional tax from them, are all these sales being done bang in the middle of T.Nagar, Chennai ‘without tax’?

- Just a back of the envelope calculation tells us that if they are selling for a minimum of a crore a day, what happens to the 5%, 12%, 18% and more taxes to be paid? At an average of 12%, is it that the exchequer is losing a million on a daily basis from a single shop?

- And finally, if when our protagonist took the tax invoice, no additional tax was collected, what did that mean? It just means that the rates on articles were already charged with tax but not remitted to the government!

That is a double profit. Unlike what most of us might think that the shop is giving items ‘without’ tax, each sale is charged with tax and not remitted to the exchequer.

We are not getting answers to any of the above and we are left wondering what is happening in this country!

To illustrate and drive home the issue we are raising, we are enclosing the bills received by our reader at the store.

- Prime Minister Narendra Modi: A Gujju businessman who does not invest his precious time for a losing battle - April 13, 2024

- NIA arrests two accused Shazib and Taahaa in Bengaluru’s Rameshwaram Cafe blast case from Kolkata - April 12, 2024

- National Herald scam: Adjudicating Authority upholds Rs.752 crore assets attached by ED - April 11, 2024

My experience in this store was that they even billed above M R P. When questioned, they returned back the excess charged.

Add to your list- poeple can use sodexo card to purchase at these stores….These are buildings with no proper approval from Corporation!! Only fools will believe govt or authority is unaware of these…

and all govt does is tax salaried class heavily at 20 & 30%!!! only when salaried class understands this reality, biased policies will change…

it is time for enforcement authorities to raid this shop, close it, & then investigate all deals. Closing for few months will send right message.

Your protagonist was lucky. I am a retired beuarocrat and while in Service in another State I visited my hometown Chennai and shopped in one of the dozens of shops this chain had filled that street and its surroundings with. When I was charged 2% extra for using my credit card and asked ‘why’ a burly – stinking – ‘higher up’ with a ten day beard and checked lungi was called by the salesgirl. . He threatened me not to make trouble and was joined by four others. I told him RBI has prohibited the practice. He and his cohorts started being physical with me. Just for my physical safety I had to reveal my official identity which I NEVER liked to do while in Service. Then he asked me to either take the refund, leave the items and go or just take my purchase and go. There was no semblance of respect for my age or my seniority. Knowing who I was was sufficient only to not beat me up. I thereafter heard that this chain retains almost all its employees under duress perpetrating human rights violations on them with impunity.

I used to get wondered about this practice of Big Stores for a long time. Govt should should arrange to collect TAX amount directly from POS machines (at least for Card purchases) instead of having the merchant to collect & submit. In fact, Govt. should encourage Card payment by means of incentives to Customers who uses Card Payment. This will reduce Cash transactions a lot.

The classical Deshi way of creating a level playing field for themselves in the face of competition from the likes of Amazon. Nothing to notice here. Move on.

Prominant politicians, prominent corporates and prominent business class are licensed to cheat the Government. How is this going unnoticed by concerned Tax Authorities so far.

There are many such rougues. Dig deep and u have it