Two things stood out in the Meet the Press event that took place on White House lawns – President Trump with Senate Majority Leader Mitch McConnell –

- Trump is first and foremost a businessman and understands competition. As the US mulls lowering corporate taxes, Trump has been looking over his shoulder to see what the current low tax countries such as Ireland are up to. He said that Ireland is mulling over reducing corporate taxes from 12% to 8%! Can the US match that?

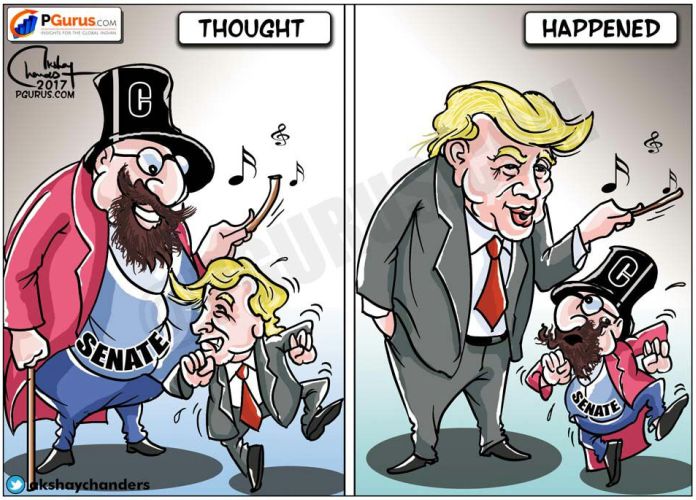

- Is a conciliatory, mutual admiration society being formed? As Trump made glowing praises of Senator McConnell, he got back the same in kind, when it was the Senator’s turn to speak. Is this the new normal for Trump regime, with him trying to get along with fellow Republicans?

As other countries scramble to match the lower rates of America, the question that would be in the minds of businesses is, “What is an equitable corporate tax rate”?

One thing they both were united in… the bashing of “Obstructionist” Democrats, who they said were standing in the way of a better Healthcare deal, a lower tax structure, allowing the sun to rise from the East…. you get the idea.

Is today’s joint speech followed by a Q and A session with the Press a new beginning?

It depends. One has to wait for the next tweet from the dear President to know if this is a passing fancy or a realization that in order to get things done in Washington, he needs to get along with everyone. The sooner he realizes that Democrats are also wanting to serve the nation (and their constituents) the better it would be for America. Amidst all these turf battles, I am hard pressed to explain the irrational exuberance that exists in today’s Stock Markets… Is it pricing in a tax rate cut?

What is a good tax rate for America?

As other countries scramble to match the lower rates of America, the question that would be in the minds of businesses is, “What is an equitable corporate tax rate”? Here is my 2c on this. Several states have state taxes of close to 10%. States like California, which levy a Sales Tax of 7.5%. But that is not the final amount! Based on where you live, there are City and County surcharges that can total up to 1.5%! So the net Sales tax that a consumer pays in California is about 9%. How does this number help determine the Corporate tax for the United States? The answer lies in a psychological question of how much you are willing to part with for any purchase when you know that there are overheads that need to be paid for. So, after looking high and low, taking all factors into consideration, I can say that most businesses will be happy to pay 10% Corporate Tax. By the way, it is not that far off from what is the effective tax rate today – 18%. 35% is nothing but an exaggeration. One must keep in mind that in this race to zero, just how low are countries like Ireland prepared to go?

Mr. Trump, are you listening?

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

True, if not 10% it would be even acceptable if it is 15%. But the Corporate Tax Rate must not be like 30% or 35%.