Bitcoin is largely viewed as an alternative to fiat currency

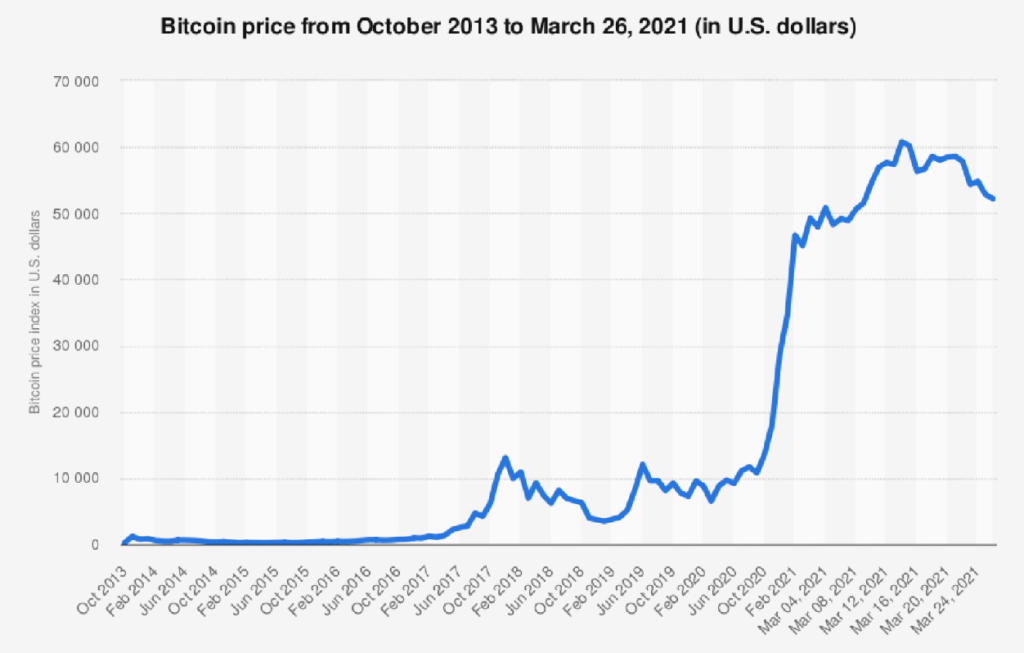

Bitcoin has been one of the best performing assets over the last decade. From near zero, the value of 1 Bitcoin now trades above $50,000. The speculation on the future price of Bitcoin is beset with a range unlike almost any other asset – with values ranging from $1 million per Bitcoin to $0. Perhaps with the exception of gold, there is no other asset whose underlying value (or lack thereof!!!) has been widely debated and yet, misunderstood, like that of Bitcoin

But in what must be very ironic, the biggest proponents as well as detractors of Bitcoin, are both from the limited libertarian community. This is perhaps understandable if one considers the positioning of Bitcoin in the minds of investors as an emerging monetary standard.

Bitcoin is largely viewed as an alternative to fiat currency in general and the US Dollar in particular. One popular phrase used to describe Bitcoin, especially by the proponents, is that it is “Digital Gold”. This is where the fault lines begin to emerge within the libertarian community. While they all for a non-fiat and market money system, whether Bitcoin satisfies the properties desired of money is where these differences emerge.

So is Bitcoin money?

How did all of this “money” business even start…? Quite obviously, commerce started with the system of barter between individuals. This had two particular inconveniences – for barter to work, the system required a coincidence of wants and values between the trading individuals. For example, individual ‘A‘ might be selling chickens and might want a cow, while individual ‘B‘ might have a cow to sell and might want a chicken. So even though the individual goods to be bought and sold might match (which in itself is a very low probability event), the fact that these goods have valuations that are so different ensures that a simple barter cannot happen.

Hence the requirement of “medium of exchange” – an intermediate good that abstracts the value of every other good in terms of the factors of production.

What was the basic requirement of a good that could serve as this “medium of exchange”? Remember that every transaction was going to be made in terms of this good chosen and hence the primary attribute had to be “marketability”. This good had to be widely desired and wanted for its various utilities and this “medium of exchange” just had to be another function to its existing set of utilities. There is a reinforcing mechanism as one or two goods start widely serving this purpose of the medium of exchange as there is a greater demand on account of this additional functionality. Over time, there is a preference for one or two good as they serve the purpose better than other goods. Markets (and not governments) eventually settled on – gold and silver as having the “medium of exchange” properties – and these came to be known as “money”.

But why only Gold and Silver?

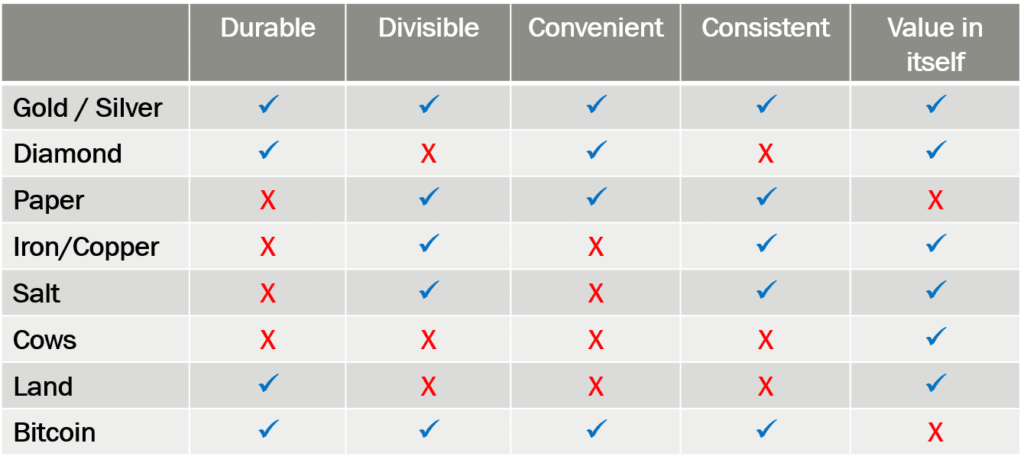

Aristotle had defined the properties of an element or commodity that could serve as money and he outlined five characteristics – durable, divisible convenient, consistent and has value in itself. This is almost Economics-101, but since the world seems to have steered away so far away from the basics, it is worthwhile repeating these lessons.

Historically, and over thousands of years and on several continents, we would have tried almost every possible good as money – tobacco (a slightly more sophisticated version i.e. cigarettes still circulates in most prisons as money even today), sugar, salt (the word “salary” comes from salt), copper, art, sand, real estate, beads, cows, grain, tea, seashells, aluminium, paper, etc. But we eventually settled on gold and silver for the above 5 reasons and we will expand on the same under.

Durable – Almost all commodities are purchased for their consumption value while in the case of money it is done so for its exchange value. This means that the commodity chosen has to be durable over long periods of time, even spanning across generations, if necessary. Even under the most corrosive of conditions (i.e. ocean floor), gold retains its essential property over thousands of years. No other commodity on the planet has these characteristics to the extent gold and silver have.

Divisible – 1 Kg bar of gold or silver can be split into 1000 coins each of 1 gm or even 10,000 coins of 0.1gm weight and yet the cumulative value will be much the same as the original 1kg of gold. In comparison, a diamond, for example, loses its entire value once you divide it into two. This extreme divisibility of gold and silver allows the conduct of even the smallest of monetary transactions using these metals.

Convenient – The conduct of commerce using these commodities must mean it should be easy to carry around and facilitate the conduct of small to large transactions with ease. For example, if one wants to buy a reasonably large house using iron, one will require truckloads of that commodity to be used. The same transaction even today can be accomplished with a few kg’s of gold in most parts of the world. Indeed, it might be worthwhile to point out that, most assets when priced in terms of gold, have pretty much had the same value over centuries. The hedonic improvements to quality are the icing on the cake!!!

Consistent – To enable smooth transactions, every piece utilized as money has to have the same value as another equivalent piece. Every cow is different from another cow; as indeed is the case with diamonds as well as real estate; The fact that a given weight of gold or silver is perfectly fungible with an equivalent weight of the same metal produced in any other part of the world enables transactions on a world-wide basis without any issues.

Given below is a summary of the above discussions. Of course, the “value in itself” needs a lot more elaboration and we will now look into that subsequently.

Bitcoin incidentally started with a long list of utilities – unregulated monetary system, anonymous accumulation of wealth, seamless cross-border transactions, low transaction overheads – and everyone has fallen by the wayside over the years and yet, the price has only gone up.

Just a comment on prices before proceeding – if WeWork could be valued at $100B, Tesla and Gamestop could trade at whatever valuations they are trading at, it is not in the least bit surprising to see the prices of Bitcoin at these levels. During the days of free money, there’s no underlying anchorage to any of these speculative assets – and each is worth whatever it is according to the whims of the individual. One never really knows what one is holding till the tide is down (or more appropriately, interest rates are up).

Why “speculator”…? Because the only reason why somebody buys Bitcoin today is on account of the speculation that prices will go up. There is NO OTHER utility associated with Bitcoin whatsoever. Now one can make the argument that most people who buy gold also do so with the same intent. But what they forget is that these users can always sell the gold to jewellers or industrial users. There is a real-world utility to these monetary metals that underpins their circulation as money to start with.

Think of inmates hoarding cigarettes as money within the prisons today. They do not have to be consumers themselves of these cigarettes…as long as they are convinced that there are end-users for these products, these can circulate within the confines of prison as money. In much the same way, a buyer does not have to be the end consumer of the product. All that has to be guaranteed is that there will be a buyer on account of its underlying utility when they want to sell.

So where goes Bitcoin prices?

Bitcoin proponents can indeed make an argument that it is an alternative to the current fiat currency system which is perhaps on the verge of an unprecedented collapse. On the latter point, there would be near unanimity within the libertarian community. Starting from that point, and given that the number of bitcoins is limited to 21 million by definition, one can come up with a value of $1 million or even several million depending on how they choose to define money supply.

The only problem with the above argument is the assumption that Bitcoin will circulate as an alternate monetary medium. If one strips that away from Bitcoin, its value will drop to “zero” – which in itself should indicate the absurdity of the prices today. Even the infamous tulips had some utility.

Not to mention that Bitcoin is just one of the cryptos circulating and there could virtually be an unlimited supply of this overtime. So even the scarcity part of the argument by Bitcoin proponents is a very flawed one. That said, even if Bitcoin is the only crypto on the planet, the lack of utility ensures that it cannot circulate as money.

Now I have no idea as to when the Bitcoin bubble will pop. All bubbles eventually find a pin and this one is going to no exception. It is indeed the same factor that underpins all the bubbles equity, bonds and real estate i.e. artificially low-interest rates and a virtually unlimited expansion of the US Fed balance sheet. It is the runaway inflation in the years ahead that is going to expose the scam of Central Banking…and these impostors posting as substitutes as well.

There is a legitimate, tried-and-tested alternate system to Central Banking which is the classical gold standard. The world did not move away from the classical gold standard because of any inherent deficiency of the system. On the contrary, governments moved away from the gold standard because it was doing an exceptional job of limiting the power of governments and prohibiting an unabated expansion of the fractional reserves based banking cartel. That of course is exactly the reason why a return to the gold standard will be resisted by these institutions. But that is a topic for another day.

Summing up, Bitcoin will eventually go to zero. But whether it goes to $1 million first and then to zero or otherwise is a question that is best left to an astrologer to answer.

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

[…] Posted: Mon, 29 Mar 2021 14:12:59 GMT [source] […]

[…] Posted: Mon, 29 Mar 2021 14:12:59 GMT [source] […]

How about $5 trillion like the Indian Economy!

In Zimbabwe dollars or the US dollars

Or like the cost of a loaf of bread in Weimar Germany in reichmarks!