The Finance Ministry recently published a case study called the “GST Saga – the story of extraordinary national ambition”. Conveniently, the said booklet details the journey till the launch of GST and stays silent on the matters which the Ministry refers to as “teething problems” pertaining to the GSTN and GST. PGurus will fill that void and provide the readers with all those details and act as a soundboard for the Government to introspect and indulge in corrective measures before the economy tanks. The mainstream media, as usual, has become a silent spectator in this process.

With many sectors of the economy being badly hit by the GSTN tsunami, someone needs to tell the Finance Ministry – It’s the economy, stupid!!!

One of the major grievances of most taxpayers is that the GSTN continues to flout the law and there appears to be no one in the Finance Ministry willing to question them. A senior consultant said “3B returns for the month of August 2017 has to be filed by 20th September 2017. Interestingly less than 4 lakh (out of 60 lakh taxpayers who are to pay tax) returns have been filed as on 16th September 2017. The Government has through multiple ads made it clear that it will grant no extension on this date. But nothing seems to have changed with the GSTN system which continues to be unfriendly to the taxpayer. Part payment is not being permitted for the second continuous month. Strangely if any taxpayer moves a writ petition, let’s say to the Delhi High Court before which maximum matters pertaining to GST are pending, the court will indefinitely / unconditionally extend the last date till the part payment is permitted by the GSTN as per the GST law”.

Interestingly, our source in GSTN, who spoke strictly on condition of anonymity, said that even if GSTN wants to permit the part payment module, it will take around a minimum of 20-30 days to test and allow the module to function and also this may lead to severe disruptions in the entire filing process”.

The only option the Government has, in this case, is to move an ordinance and have the GST law amended to not permit part payment or let the GSTN flout the law consistently. Will the Union cabinet approve of such an amendment?

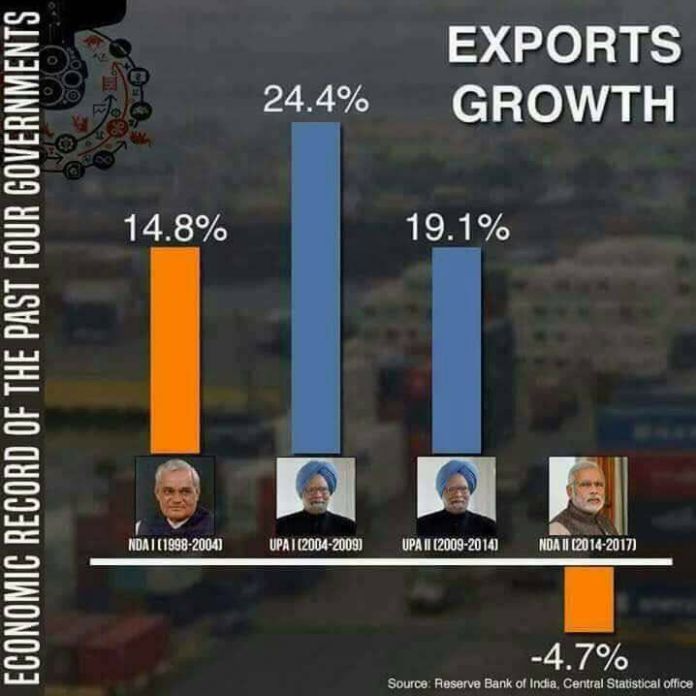

The Reserve Bank of India, Central Statistical Office has recently released the export figures and a -4.7% growth (that is correct, a negative growth) under the present regime (2014-17) is a matter of serious concern. Especially when you compare it with the last 15 years as given below:

The bigger problem for the exporters is blocking of their working capital till the stage of refund. If you thought this in itself is the only problem, the GSTN is complicating it further. The problem GSTN has with the Customs ICEGATE module and the PFMS of the Department of Expenditure is continuing unabated. When will the exporters get the refunds for the month of July when the August returns are fast nearing the deadlines?

In some specific sectors like handicrafts, the exporters generally work mostly on borrowed capital. Payment of GST first and claiming the refund at a later stage is resulting in the blocking of the funds for the small exporters and there is a possibility that the delay in refunds may actually dissuade many of them from indulging in any new orders. This may be a major setback for the entire sector.

Settlement of funds is another major area of concern and the Government, as per the sources in Finance Ministry, is not able to finalize the proposal because of non-cooperation from GSTN. This is a vicious cycle, said a senior officer in CBEC. “Even in the issue of having to reconcile the 65k crore transition credit which is making headlines in the media, the formations of CBEC across India is not able to make the head or tail out of anything as the GSTN is yet to share the data with them”.

The senior GSTN officer said, “Infosys has been asked to streamline the process and expedite the data issues and acknowledged that the requisite data has not been shared with CBEC”.

But this is not the only data sharing issue. Strange as it may sound, the Centre and State Governments do not even have the taxpayer details or database as the GSTN has not shared the same with the tax administrators. This has probably never happened in the history of Indian tax administration. Further, the revenue figures are not being shared by the GSTN with anyone other than the Revenue Secretary as their data management system and dashboards are not yet ready. It is intriguing that the CBEC which administers the indirect tax administration for the Government of India does not even have access to the Revenue data on a daily basis and no one seems to be perturbed in the Finance Ministry.

One of the taxpayers PGurus spoke to had an important point to make regarding the TRAN 1 form issues and the absence of GSTN offline utility tools for the month of July 2017. This complicated the system and most of the companies could not upload the data from their ERP systems leading to numerous entries to be made in the forms filled online, which has led to a lot of errors. What many of these taxpayers ask with concern is whether the Government would waive off the statutory penalties in the case of such errors?

The GST law speaks of a common portal which the Government of India has notified as gst.gov.in which is exclusively managed by the GSTN. Humorous as it may sound, the law and especially the rules, have undergone multiple amendments in the last 75 days post the launch of the GST and the notified site has not been updated with any of these details. Will the GSTN care to address at least this basic issue?

The textile industry has been reeling under stress and is facing multiple issues with the GSTN help desk being not responsive most of the times. The Government must realize that uncertainties and disruptions are two sides of the same coin. GSTN is not only being unfriendly to the taxpayer but has also taken the patience and tolerance of the taxpayer for granted.

The GST council when it met in Hyderabad constituted an empowered committee of Ministers headed by Mr. Sushil Modi, which met in the Infosys office in Karnataka. Not surprisingly and as usual, the Committee and the Revenue Secretary claimed that all was fine with GSTN and the minor issues will be addressed at the earliest. The most important takeaway for the press was the ministers urging the 57 lakh odd taxpayers to not wait until the last date to filing their returns as the server may find it difficult to handle such heavy traffic.

The twitterati reacted very swiftly and two responses stood out. One said, it is our right to file the return even on the last date and it the responsibility of the Government to ensure that the GSTN site functions. Another, which was posted by many tweeters, candidly questioned how many officers working on GST in the Finance Ministry have actually filed a GST return and experienced what this process appears like? Will @askGST_GoI, @askGSTech or @adhia03 answer them?

On a different note, PGurus is curious to know how many of the Finance Ministry officials filed their income tax returns on the last date?

With many sectors of the economy being badly hit by the GSTN tsunami, someone needs to tell the Finance Ministry – It’s the economy, stupid!!!

And we will continue with our “GSTN saga – the extraordinary story and pain of doing business in India”. Watch out for this space.

- Subramanian Swamy approaches Supreme Court on Govt’s modification of 2G Scam Judgment to avoid auction of Satellite Spectrum - April 23, 2024

- Defence Minister Rajnath Singh visits Siachen. Reviews military preparedness - April 22, 2024

- Amit Shah’s shares in the Stock Market almost doubled in the past five years - April 21, 2024

[…] The GSTN Saga – The pain of doing business in India – Sep 17,2017, […]

[…] The GSTN Saga – The pain of doing business in India – Sep 17, 2017, […]

[…] 1 of this series can be accessed here. Part 2 talks about The mystery behind missing numbers. This is Part […]

[…] 1 of this series, The GSTN saga – The pain of doing business in India, talks about the teething pains of GST and wondered if the problem could be the backend. This is […]

It is only in India that you can play and gamble with the economy and get away with it. No country in the world has put its entire economic revenue on to one website.we are asking for trouble.

Brilliant well addressed but for deaf ears.

Love of Modi for Jaitely costing dearer to Indian people.

MAKE IN INDIA.

ACHHE DIN AAYENGE.

Lootlo India are having Achhe Din

These are unpt unexpected teething problems,

They will sort themselves out, in time.

Not in ideal time, will cause harm to taxpayers, and public, but they will sort themselves out.

There is no magic bullet.

The alternative if unbridled corruption is not desirable.

Wow! So, alternative to GSTN is unbridled corruption ? Corruption, anti-national, etc have all become standard bogeyman for incompetence/corruption of this government.