In Parts 1, 2 and 3 we looked at shell companies, and in part 4 we specifically dwelled into Personal Holding Companies (PHC). There is another skew peddled by the offshore tax evasion and money laundering services industry – it is called the Trust!

In this story, we look at two offshore trust-based structures that were used by an HNI and a general partner in a leading fund to manage their investments in India.

Ever since the Narendra Modi government came to power in 2014, it has zeroed in on ‘only-on-paper’ shell companies, closing many of them[1]. Many would remember the fact that the Rs.90 crores that Congress claims that it gave to Associated Journals Ltd. did not come from party funds – rather it came from some Kolkata-based shell companies, which is why they have been objecting to the summoning of documents in the National Herald case[2]. It gets more interesting – the same set of shell companies also donated to the Aam Aadmi Party (AAP)! So now you know the connection between Congress and AAP.

Back to Trusts

The topic of trust is also a vast one (just like permanent establishment in part 3), and we will not be able to cover it here in detail – inquisitive readers may please go through an excellent article on this subject published by the Tax Justice Network[3].

In short, a Trust is used to unbundle different aspects of ownership rights into separate parts so that they can be given away. A trust typically involves three main parties:

- Settlor – who gives away the control of an asset to the trustee of the trust (this also frees the settlor of any liability associated with that asset including tax)

- Trustee – a trusted entity who/ which controls and manages the assets of the trust

- Beneficiary – who is the intended recipient of the asset or the income due to it

The trustee signs and follows a trust deed which has instructions from the settlor on how to manage the trust. There are various types of trusts depending on the trust deeds, but the overall theme is that the asset ceases to belong to the settlor once the trust is settled, and the trustees only manage the trust but don’t have any ownership right to the asset or the resultant income. The spirit behind trust is that all three parties are separate, and it is not used as a devious means to hide ownership (for e.g. settlor’s pretense – where the settlor is indirectly the beneficiary also).

Many of the offshore tax haven jurisdictions have lax laws that allow the settlor to control the trust and also be practically the ultimate beneficiary. In many cases, the secrecy laws don’t permit public disclosure of the identity of the settlor and/or beneficiary, and this is exploited to the fullest. Jersey is a popular destination for setting up trusts because of its favorable trust laws. In any case, one can use the layering (e.g. making PHCs in several jurisdictions as settlor, trustee, beneficiary) to hide ownership. It is also common for the trust deeds to mandate the trustee to appoint an investment manager and practically relinquish the management to it. The investment manager, as you may have guessed, is often a front for the settlor. Therefore, it becomes virtually impossible to detect who owns the asset, and the settlor is able to evade paying tax associated with the asset in the nontax haven where it may be a resident and liable for the tax.

In this story, we look at two offshore trust-based structures that were used by an HNI and a general partner in a leading fund to manage their investments in India.

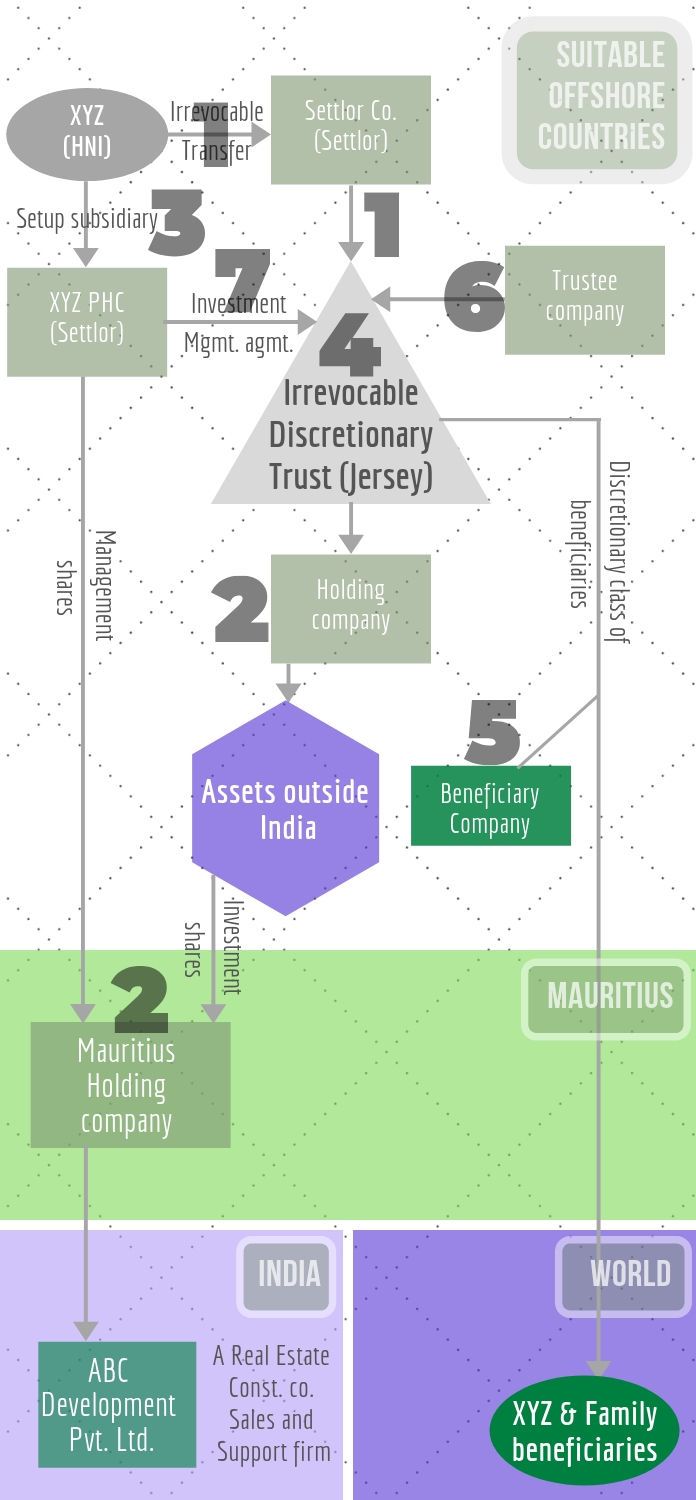

The first case is for an HNI (named XYZ) who created the complex structure shown below in Figure 1 in order to acquire a real estate company (ABC Dev. Pvt Ltd) in India.

- Settlor Co: set up by XYZ as a private limited company in a suitable offshore jurisdiction (Bahamas) that permits a company to settle a majority or all of its assets to a trust. XYZ then irrevocably transferred all the assets outside India he sought to settle to the Settlor Co. in consideration for shares in the Settlor Co. but no board seat. Then the Settlor Co. irrevocably settled assets in the Trust.

- Assets: The assets have been depicted collectively as “Assets outside India” in the figure but actually it consists of a multitude of holding companies and underlying special purpose vehicles in various jurisdictions, cash, and common stock. One such holding company set up a Mauritius Holding Co., which in turn acquired ABC Dev. Pvt. Ltd. in India. Furthermore, all the assets of the trust were consolidated under a single Holding Co. in some offshore jurisdiction (Bahamas).

- XYZ PHC: set up by XYZ in a suitable offshore jurisdiction (Dubai) with himself being a director on its board.

- Trust: set up in Jersey as an irrevocable discretionary trust.

- Beneficiaries: XYZ and family made the beneficiaries along with a Beneficiary Co. setup by XYZ in a suitable offshore jurisdiction (Dubai). XYZ was not named the sole beneficiary.

- Trustee: A well know trustee firm appointed as the trustee and made responsible for the management of the assets of the trust and with the power to distribute the income or assets of the trust to the one or more beneficiaries in any proportion as per their discretion. However, the Trustee immediately delegated its power of management of the income and assets of the trust to XYZ PHC vide an investment management agreement.

- Investment Manager: A company – XYZ PHC set up as the investment manager of the assets and income of the Trust, with complete powers to make investment/divestment decisions and other necessary powers to achieve the Trust’s objectives, and to be remunerated by the Trust at an arms length investment management fee for performing the investment management functions as per the investment management agreement.

So can you see the clever scheme above, where XYZ is in effect the settlor, trustee (the trustee on record delegated the power to investment manager which is controlled by XYZ) and the beneficiary? In all three cases, a layer consisting of a company is created so that XYZ does not appear directly as the settlor, trustee or beneficiary (tax authorities in India will have a tough time finding it out). The Beneficiary Company permits the beneficiaries to receive distributions in a company as opposed to individually. Additionally, to be doubly sure XYZ could create a Protector company, which would be controlled by him and have powers in the trust deed such as the consent power on the addition or the removal of the trustee, the amendment of the trust, etc. The Protector would perform the role of oversight.

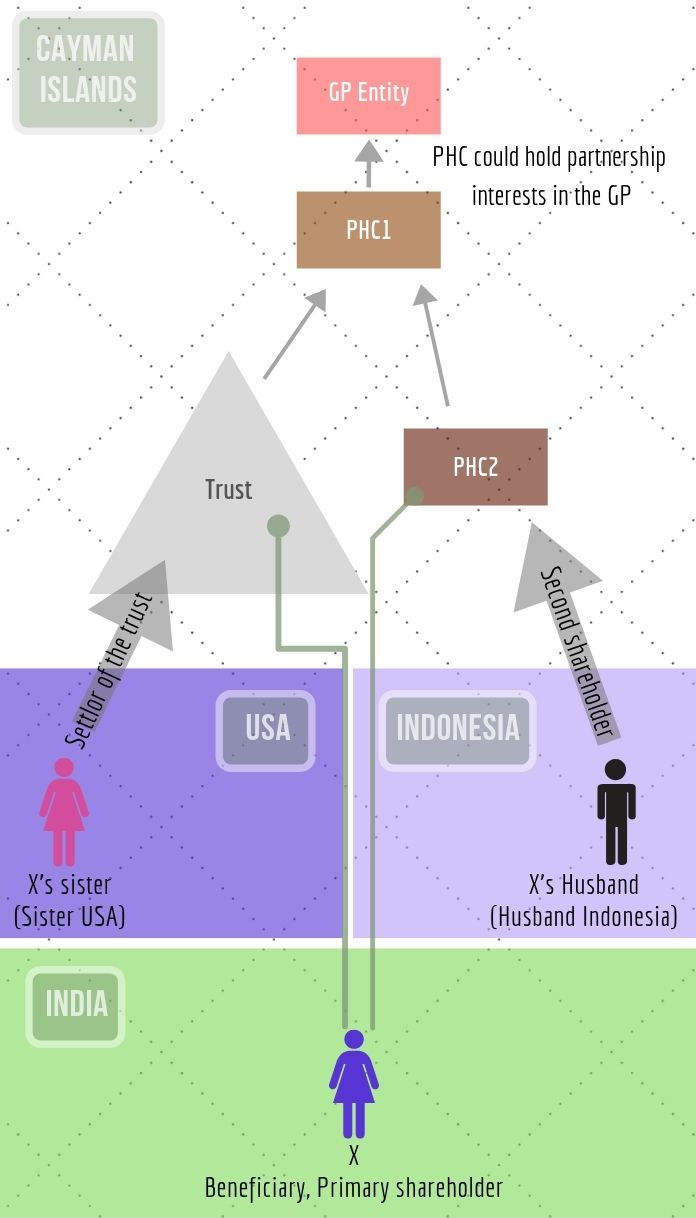

Figure 2 is a simplified structure used by an India based general partner (named X) to manage her interests (make a contribution and receive a distribution) in a leading US venture capital fund based in Cayman Islands and investing in India:

The eventual structure used was a bit more “sophisticated” where the PHC1 was created in British Virgin Islands (BVI), there was a second trust created to be used as the shareholder of PHC2 instead of X directly being its shareholder, and X received the distributions via that trust. Since these are discretionary trusts, the payouts to X could possibly be shown as a distribution of capital (by deferring the payout to a year later than in which the trust receives that income).

While the folks setting up such structures could claim that these are as per the letter of the law, however, these structures are created solely for the purposes of hiding ownership, evading taxes, round tripping, and money laundering. There is no commercial justification, and these are just Forms without any Substance.

Continued…

References:

[1] Crackdown on shell companies: Narendra Modi government, regulators now plan this move – May 13, 2018, Financial Express

[2] Sonia and Rahul object to summoning of documents in National Herald case – Sep 18,2 016, PGurus.com

[3] In trusts we trust – Jul 22, 2009, Tax Justice Network website

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Excellent illustration……time to teach these guerilla techniques in business schools