The rupee is starting to lose ground vis-à-vis the Dollar again; this just does not make sense. Just because the Turkish Lira is slipping against the Dollar does not mean that the rupee needs to follow suit. India is not affected by the Turkish crisis. Further, India is one of the fastest growing countries in terms of Gross Domestic Product (GDP). Then what could explain this sudden slide, which experts predict could make the rupee slip to Rs.75 to a US Dollar in just four weeks?

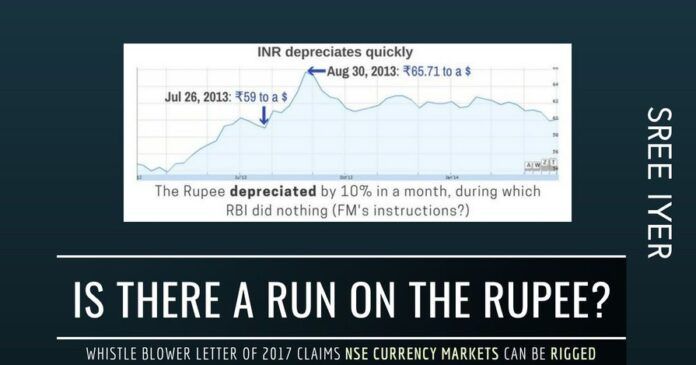

Perhaps the clue lies in someone badly wanting to crash the currency exchange ratio. A similar run on the rupee occurred in 2013, when the rupee depreciated by about 10% in just a month’s time[1]. Prof. M D Nalapat had brought this to the attention of the then Manmohan Singh government after which this abruptly stopped[2]. According to the whistleblower based in Singapore, who goes by the name Ken Fong, the National Stock Exchange (NSE) can be easily rigged to manipulate the currency market, especially the USD-INR conversion rate. To understand how, some basics of how exchange rates of currency pairs (e. g. USD INR) are set must be understood:

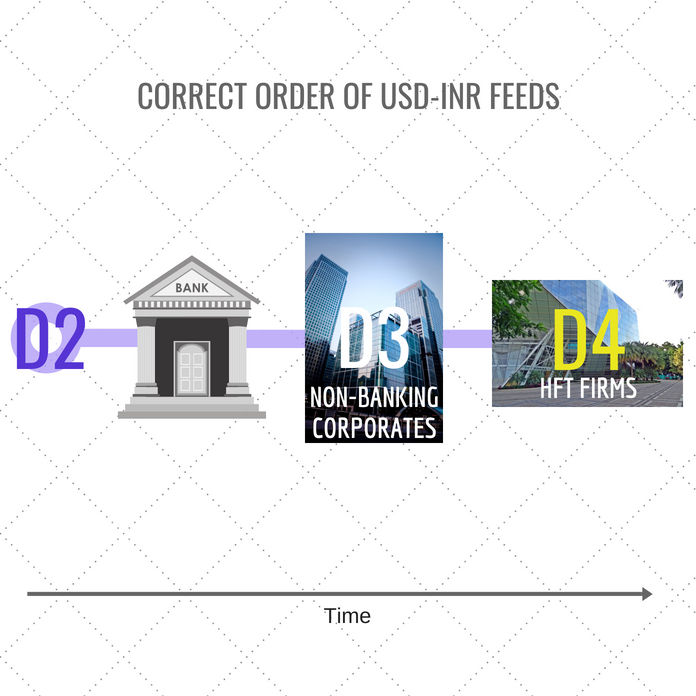

- Any foreign exchange (FX) trader the world over relies on Reuters Dealing 3000 (also called D2) to get the latest exchange rate[3].

- This D2 feed is then delayed a bit and sent to Non-Banking Corporates. Let us time stamp this as D3.

- A further 2 seconds later, the feed is made available to the general public and to all trading firms (D4). Thus D4 = D3 + 2. For more, see Figure 1.

This is where things get interesting… According to the whistleblower, some Global firms such as Tower Capital, owned through a Mauritius firm by a US firm Tower Research, got D2 feeds in the US and then would send this data using electronic means to its Indian company, thereby gaining a handy lead of up to 2 seconds over others (see Figure 2). This is akin to getting the question paper a day ahead of the exam!

There is one more violation of law here, according to the whistleblower – he claims that firms like Tower run their algorithms on Indian markets, sitting outside of India. This is not permitted, according to India’s laws. Indian firms are not permitted to operate their algorithms from outside of India. Further such companies bypass the Direct Market Access (DMA) delays also since they use their own dedicated lines.

There maybe other firms too…

The whistleblower gives a way for the Securities Exchange Board of India (SEBI) to confirm that this indeed is happening. This letter was sent in February 2017, almost 18 months ago. SEBI should have the results of its findings by now. The entire letter addressed to the SEBI Chairman is shown below: (Thanks to MoneyLife.in for the Scribd link)

Whistleblower Letter Dated 14 February 2017 by Moneylife Foundation on Scribd

References:

[1] Anatomy of a Crime P4 – Who benefited from the HFT scam? – Oct 4, 2017, PGurus.com

[2] Inside information behind the collapse of the Rupee – Aug 24, 2013, The Sunday Guardian

[3] International Finance: Theory into Practice – Page 83

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] Whistleblower Ken Fong claims rigging of Currency Markets in NSE by a few – Aug 14, 2018, […]

[…] Whistleblower Ken Fong claims rigging of Currency Markets in NSE by a few – Aug 14, 2018, […]

[…] Whistleblower Ken Fong claims rigging of Currency Markets in NSE by a few – Aug 14, 2018, […]

How come MoF is working without noticing .How can we believe experienced leader in terms of ruling of departments.The key department of ruling is MoF,he should have third eye on this and how he is roaming with closing eyes.

[…] Whistleblower Ken Fong claims rigging of Currency Markets in NSE by a few – Aug 14, 2018, […]

All I could make out from this ‘article’ with complex fiscal nuances :

(1) Another ‘exponentially Mega’ scam had been & is still being perpetrated on the foolish Indians

(2) The DEVILISH DUO – Jaitley & Chidambaram are the brain behind this mega loot

(3) This scam is going to continue for another decade until Modi wakes up to the situation & does something

–

Looking into the frequent JIBES & TAUNTS of the Congress party on the Modi Government over the DOLLAR vs RUPEE rate, I suspect the entire Congress Party is involved in this MEGA RIGGING.

“Old problems remain – only the time size has changed”.

It is all because of Einstein ! 😉

There is NO justification for the INR to “lose” value specially when India’s economic fundamentals have been strong. IMHO some FX operators are indulging in “rupee weakening” to show India/Indian economy/the current government in poor light. This is the gamesmanship of a dangerous kind with 2019 not too far away. In addition whoever the operators are , they know Indian bureaucracy is slow to respond in a fast moving tech driven FX market place. A weaker currency at 70 or 75 will change the narrative of India being a strong economy doing well. It’s all about making Modi look bad.

This is so damning an evidence that Modi Govt is clueless on how its finance ministry is safeguarding the nation’s economic interest all the while when the PMO is working busily to launch schemes to boost the economy.. In 18 months nothing has come out in any of the 24 hour barking news channel.. No opposition member who otherwise want to make jantar mantar their home wants this exposed. So everyone with money and power is in this together.. What next…. Do we have a solution.. I am sure Fin Min will sleep onthis.. SEBI too will do nothing more. NSE is already sleeping on the Ajay Shah – co-location issue..

So will it be as usual Subramanian Swamy to the rescue!! This is getting ridiculous..