The last trip undertaken by Karti Chidambaram (as per the court submissions) was September 20-30th. If you look back over the past few years, this “entrepreneur” has been regularly making visits to England and other countries; sometimes tweeting out pictures of the airstrip he is landing at, challenging Twitterati to identify the place. On top of that the boast that countries have no barriers for High Net-worth Individuals (HNI) like him! So what exactly does he do, when he is abroad? Here is a plausible explanation. But before we jump headlong, we need to understand how the laws of various countries work.

Thanks to globalization, the money stays in countries that give it the maximum leverage – and these happen to be Tax Havens, mostly British colonies such as Cayman Islands, Bermuda, British Virgin Islands and others such as Mauritius, Cyprus[1]. All these British colonies accept British jurisdiction so London provides a one-stop shop for HNIs. In London, an HNI can slice and dice, move titles around, create/ close shell companies, create layers of obfuscation and satisfied that new opaque walls are created, return to their country.

What are the goals of HNIs/MNCs

- Evade taxes

- Read Rule #1!

- To accomplish 1 above gets laws with loopholes enacted in their country

- If #3 is not enough, bend the spirit (but not the letter) of the laws…

How Does This Harm India?

India’s tax base is not widespread, like in the United States or the West. Farmers don’t pay taxes, nor do Corporates, who use every trick in the book to avoid paying taxes – this goes by the euphemism “Tax Planning” (but really is tax evasion). This leaves the salaried middle class, for whom the tax gets deducted at source. Add to this the raging disparity between the rich and the middle class. When the rich (HNI/ Corporates) do not pay their fair share of taxes, it leads to dramatically lower tax collections, results in lack of funds for the government to spend on must-have projects (e. g. water, health, education, infrastructure etc.) and adversely impact India’s development. Remember that Tax is not some charity that citizens do; it is the cost of civilization. Hence tax evasion is not just a ‘civil wrong’ but a heinous crime.

Tax evasion And Money laundering Go Hand in Hand?

The type of tax evasion that we will expose in this series involves amounts which are several orders of magnitude bigger than that was targeted by demonetization (cash-based domestic tax evasion). This is achieved through complex offshore structures, and there is a well-organized industry of highly paid accountants, lawyers, and bankers who enable that. These structures are usually in jurisdictions that provide secrecy in addition to low or zero taxes. These structures not only enable hiding of income and wealth but also their source and owners. Thus these structures not only help in evade taxes but also launder money. After all, a lot of the wealth of the HNIs which is the subject of this series has illegitimate antecedents such as kickbacks, proceeds of crime and falsified sales.

Think of taxation as a game that HNIs/ Corporates (H-C) and the Government play. Government (like Tom Cat in the Tom and Jerry comics) is always just missing to catch Jerry Mouse. Over the years, the government has been plugging loopholes that are exploited to evade taxes, which has now forced H-Cs to resort to methods other than the normal banking channels to salt their money away. Enter the Hawala operator, who can take an HNI’s Rupees and give an equivalent Dollar amount (after commissions) in a country like Dubai where few, if any questions are asked on the source of income. The Hawala route is pretty well known in India – at least most of us have heard the term and believe it to be nefarious. So are the Swiss bank accounts (which are popular is the folklore but have been on the decline in the last few years). In this series, we will cover far more sophisticated mechanisms which are commodities in the offshore tax evasion industry but still are esoteric for the masses (the taxpayers). We hope to demystify this white-collar black-money through some real examples.

Profit Shifting – Over-invoicing and Under-invoicing

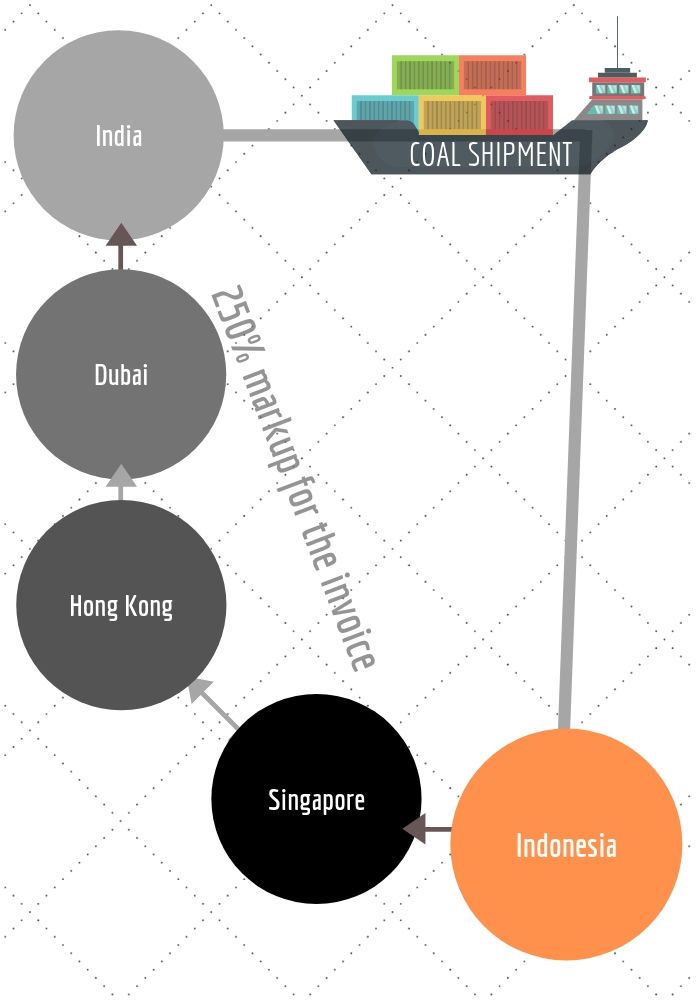

Take the instance when India decided to import Coal from Indonesia. Even though the ships directly land in India from Indonesia, the bills were routed through ’artificial’ and benami firms(shell companies) in Singapore, Hong Kong and Dubai before landing in India. Using the benami shell companies, mostly secretly owned by the importing Indian Corporates, a killing was made by selling coal at inflated prices, which ultimately ends up with common man by paying extra cost to the electricity consumed.

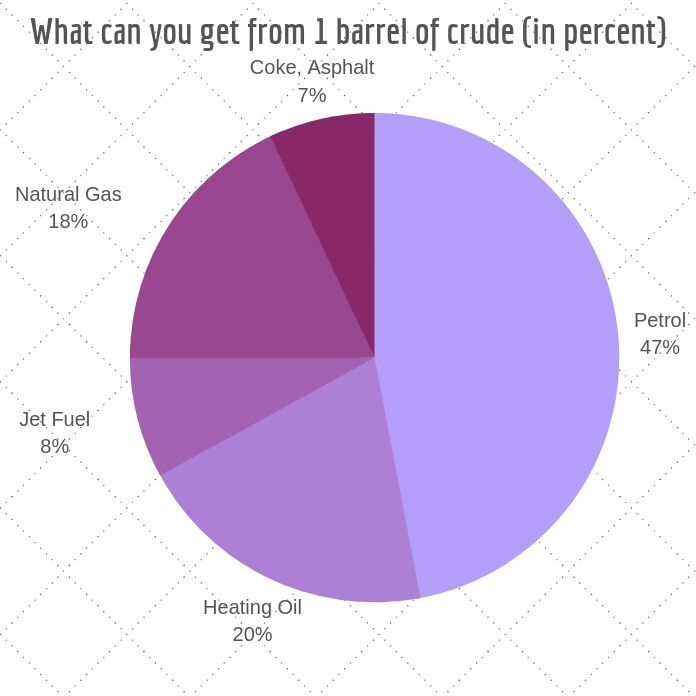

Similarly it is alleged that even today, there is under-invoicing being done for refined oil exports from India. Let us do a back-of-the-envelope calculation of Refined Petrol price per liter. One barrel of crude yields about 21 gallons (80 liters of petrol). The breakdown from crude to finished products is shown below[3] in Figure 2.

Assuming Crude oil costs $70 per barrel (there are 44 gallons in it) one can expect 21 gallons of petrol or 21*3.78 = 80 liters of petrol. At an exchange rate of Rs.73 to a dollar, this works out to 70 * 73 / 80 = Rs.63 per liter. Add refining cost (we are trying to arrive at the bare bones export price for a liter of petroleum here) of say Rs.1 per liter, the cost should be Rs.64. But according to Congress, in their Press Conference[4] on the day BJP announced a cut of Rs.2.5 per liter at the Center (some states matched it), some refiners were exporting petrol at Rs.34 per liter. Exported items do not pay GST so there is a fortune of Rs.30 per liter to be made by under-invoicing the petrol price!

Continued…

References:

[1] Money in Tax Havens – You can run but your cannot hide! Nov 29, 2015, PGurus.com

[2] Why Petrol at the pump should be costing a lot less – Oct 7, 2018, PGurus.com

[3] How much does it cost to refine a barrel of crude oil? Quora.com

[4] AICC Press Briefing By Randeep Singh Surjewala at Congress HQ on Fuel Price Cut – Oct 4, 2018, YouTube

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

[…] we saw his two sons and their wives becoming part of several Mauritius companies. Mauritius is a tax haven where all back money can be dumped and rerouted and this is the main business of this small Island. […]

[…] 1 of this series deals with How Tax Havens are used by HNIs. Part 2 explains why High Net worth individuals open shell companies in tax havens. This is Part […]

[…] Part 1 of the series, we discussed how tax evasion and money laundering go hand in hand. We also discussed some […]

Repeating Prasanna’s point that you have errored in your calculation. Why are you imputing the entire cost of the crude oil to only one of its products, Petrol? If you’re dividing by volume, you get a sum closer to what Prasanna has written. Not necessary that the refiners are doing anything that crude, but even a basic correct allocation removes almost the entire “scam”.

The theoretical remedy for the over-invoicing of imports and possibly under invoicing of exports is competition. If a company with an unnecessarily high landed cost is competing with one whose accounts are clean, theoretically, the latter wipes the floor with the former by being able to sell domestically for a much lower price.

The possibility of corruption comes when there are regulatory barriers to setting up the competitors.

Pg gurus is erring in calculation of petrol price.

If as per his calculation.

petrol 63

Central duties 19.50

K Vat 30% 18.00

Deal margin 3.00

Price of petrol should cross 100 in Karnataka

But it’s less than 90.

You have erred

70×73 is the cost of 1 barrel of crude containing 159 ltrs

1 ltr of crude costs on ur example 32 RS.

Then add refining, dealer margin, central n state taxes.

Check here

https://www.mycarhelpline.com/index.php?option=com_latestnews&view=detail&n_id=417&Itemid=10

That also yeilds other distillates totalling 190 as after refining it increases.

So

This should be the mother of all scams happening on a daily basis!

And going on for so many years!

My God! We (the common people) are really Nuts.

Thanks to Sree Iyer and Pgurus for shedding light so that commons can understand.

U r giving all.wrong information, even Public sector Numaligar refinery is selling today at 48.34 lit petrol.in India, no GST on petrol, by products in refining also gives return, please don’t do armchair writing n mislead

Every imported equipment is over invoiced and every export by the big groups is under invoiced.. Reliance and Essar sold petroleum products this way for ages with the blessing of GOI of course.. The rupee being flushed down the tubes because of rising crude prices is the biggest joke one can be sold.. It can happen only in this country where nobody tries to test any hypothesis with facts and figures.. Consider some ball park numbers here and see where it adds well. . Our reserves are around 480 Bn Dollars, Crude Imports around 90 Billion Dollars, Petroleum exports at 55 Bn.. The differential is 35 Bn dollars which is 8% of our reserves.. Total imports are at 540 Bn.. This imports include all electronics, phones, machinery, gold etc..

If the petroleum products exports were rigged at half price, we are missing around 50 Bn dollars.. This would have covered for trade deficit in complete..

Now while PGurus is right in the underinvoicing part I hope it covers well on how such books can be cooked well enough to be signed by the big 4 🙂 Imagine your importing crude at 80$ a barrel and exporting at Rs 35 a litre.. You must have losses to show of such magnitude that even a blind man cannot miss.. How is that not visible? Some fodder for though for viewers and I hope P Gurus cover this as well as this gap is beautifully covered by the nexus of govt in signing long term purchase contracts etc.. Any wonder how Reliance funds so many ventures from related private vehicles though RIL is a public listed company..What is the source of income for each of these shell companies.. This will let readers understand how this crooked web of corporates, big 4, goi work together.. Our exchange rate sans all this “gol maal” will be no more than 40 Rs to a dollar at its worst case.

Can anyone clean this.. NO is the answer as he will be eliminated before he does it.. Every party is part to this loot evenly and this includes the “party with the difference” too

BJP, is NOT a Party with difference, it is a party with lots of differences

A good revelation about secret service to gangs to bring them up from local to international fraud doings. Real upgradation and innovation in the tax evasion being taught to gangs by kc. Such service is a crime to bring more gangs into such business.

The numbers in Oil will be mind boggling.

Waiting for the next part.

P. gurus failed to cover that our learned Legal Luminary P. C. and his Prodigal Son Karti also render exceptional humanitarian service, offering practical lessons/coaching classes/field trips to other DMK/Kollywood gangs of Tamilnadu who have lesser level of exposure to the outside world. In bringing them up to full speed in the art of doing such international transfers, which they have perfected, they do not fail to collect their service charges or retainer fees. Thus, ALL the trips they make are fully covered and not a cent come out of their ill gotten wealth. For the C-Company/Community every CENT, every second spent, turns out to be lucrative giving high dividends of return in several thousand US/Canadian/Australian/Singapore $$$$, Euros, British Pounds. you have to do another in-depth search to unravel this net working.