Part 1 of this series, The eminent “Yes” man at SEBI – C B Bhave allowed NSE co-location scam, can be found here.

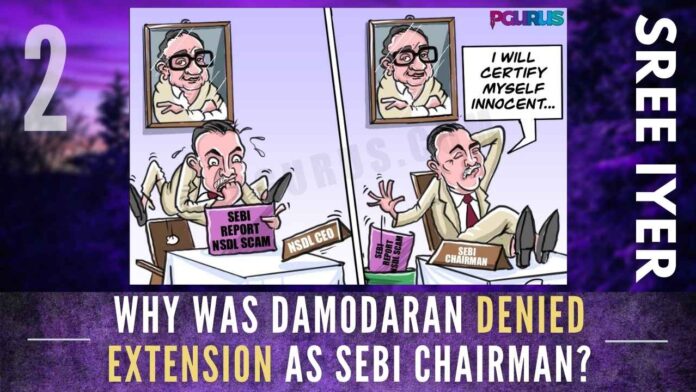

Bhave, SEBI Chairman, exonerated Bhave the CEO of NSDL, of all crimes

The year was 2005. The chief of the Industrial Development Bank of India (IDBI) Melvittil Damodaran became the new chairman of the Securities and Exchange Board of India, succeeding G N Bajpai[1]. A generalist, from the Indian Administrative Service, he set about cleaning house at the SEBI and the markets.

During the tenure (2004 to 2008) of Shri P. Chidambaram as the Finance Minister, Participatory Notes[2] – commonly referred to as P-notes were used by foreign investors who did not want to get registered with SEBI. This led to:

- Huge foreign currency inflows particularly from the beginning of 2007, thereby creating huge volatility both in the securities and currency market.

- Grave misuse of the instrument to launder money, i.e., circumventing provisions of PMLA, 2000.

FDI vs FII – What is the difference?

Unlike the inflow from the Foreign Direct Investment (FDI) which is relatively stable and sticky, the inflow from the FIIs – now called as FPIs – was in the nature of hot money which can leave the country at short notice. Such a huge inflow of foreign currency had an impact on the depreciation of the US Dollar in 2007 by about 12% against INR; the sterilization could not keep pace with the gyrations of voluminous inflows.[3]

This caused consternation among exporters who were used to a gradually depreciating rupee and were not set up for an steeply appreciating rupee. To hedge their export margins in rupee terms, many exporters tried to explore the currency derivatives market. Being new to this market, they did not understand the complexity of the margining system, particularly the daily market-to-market margins which are required to be posted when the exchange rate does not move in the desired direction. Many Small and Medium Enterprises lost money in the process. A lawsuit on this is still pending in the Supreme Court of India.

P-Notes the root cause

Dr. Subramanian Swamy diagnosed Participatory Notes (P-notes) as the root cause of the irrational exuberance in India’s Stock Markets and emphasized the need to identify the ultimate beneficial owner(s) of these P-notes. Since the P-notes were anonymous it was impossible for the SEBI/ RBI/ Government to know the ultimate beneficial owner (UBO)[4]. By not insisting on KYC for the foreign investors not only the level playing field between domestic investors and foreign investors was tilted in favour of foreign investors, but a flood gate was opened for money laundering. Thus, the Prevention of Money Laundering Act, 2002 which was enacted to fight against the criminal offence of legalizing the income/ profits from an illegal source was violated in letter and spirit.

As Chairman SEBI, Damodaran decided to end the reign of anonymous P-notes, the decision which cost him another term as Chairman[5]. SEBI released a draft paper on P-notes, insisting that the identity of the individual/ entity be revealed[6]. This caused a 1700-point fall in the SENSEX and an 870-point recovery the following week. As a principled regulator, Mr. Damodaran was focused on the robustness of the regulatory framework rather than the day-to-day gyrations in the SENSEX. In gross interference in the regulatory domain, the then finance minister P Chidambaram announced that the government was not in favour of insisting on the identity of the UBO of P-notes. Ask yourself why Mr. Chidambaram did not want the identities revealed. The answer is simple – The P-notes route was blatantly being used to round-trip the bribe money of politicians and other HNIs, going out via Hawala and coming back as White money.

Damodaran had to go

But the damage was done. A carefully constructed paradigm by the evil genius was almost ruined because of one individual. This, among other things, was why P. Chidambaram opposed giving Damodaran another term.

In 2008, Prime Minister, Shri Manmohan Singh had been advised by his senior colleagues Montek Singh Ahluwalia, Deputy Chairman of the Planning Commission, and C Rangarajan, Chairman of PM’s Economic Advisory Council to extend Damodaran’s term as the SEBI chairman.

The two advisors told the PM that Damodaran had, “a High reputation among the investor community.” They further informed Singh that, “SEBI’s overall performance under Damodaran was good and there was nothing amiss with the regulator under his tenure.”

Dr. Manmohan Singh looked inclined to take the good counsel, however, Chidambaram differed with that advice and confronted the PM.

“There are serious concerns about the ability of Damodaran to pull along as a team player, which would impose great stress on the system,” the FM told PM Singh.

Chidambaram also provided Singh with a series of instances where he felt SEBI could have performed better[7]. While many points were strutted out, the real reason was that Damodaran dared to upset the gravy train that Chidambaram had devised for the select few. In fact, this was Step one in Chidambaram’s plans to enrich the select few, creating an illusion of a vibrant stock market and sucking up retail money too to enable some to pocket huge profits via the NSE co-location scam, that would unveil in a few months.

Bring in a tainted guy (Bhave) who will be pliant

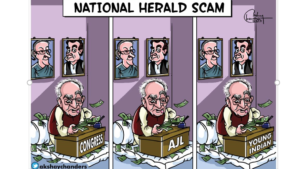

This Chandrashekhar Bhasker Bhave, who had not even applied for the post of SEBI Chairman, who was under investigation by SEBI for his misdeeds as the CEO of NSDL, became the judge and jury to preside over the case of Bhave of NSDL. Like in the National Herald scam, where the Treasurer of Young Indian, Motilal Vora, spoke with the Treasurer of AJL, Motilal Vora, and the Treasurer of the Congress Party, Motilal Vora, a farce of an investigation ensued[8]. Needless to say, Bhave was let off the NSDL scam by (who else?) Bhave.

Continued…

Reference:

[1] Damodaran is the new SEBI chief – Feb 18, 2005, The Economic Times

[2] C-Company Part 2 – NSE – The early years & PC’s first scam – Nov 07, 2017, PGurus.com

[3] FDI and FPI: Making Sense of It All – Aug 04, 2021, Investopedia

[4] The rise & fall of Participatory Notes – Jul 12, 2020, Deccan Herald

[5] Purging the P-Note – Oct 25, 2007, India Today

[6] Sebi tightens rules on P-notes, to need separate registrations – Nov 06, 2019, The Economic Times

[7] PM chose Bhave over Damodaran as SEBI Chairman – Nov 13, 2011, The Times of India – Nov 06, 2019, The Economic Times

[8] National Herald Frauds – Sree Iyer, Amazon.in

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Commend PGuru’s investigational journalism. What or who is prohibiting the current government from prosecuting the culprits is a big question?

Till date no information on cancellation of promissory notes system. Hail the transparency system of India & Indian judiciary