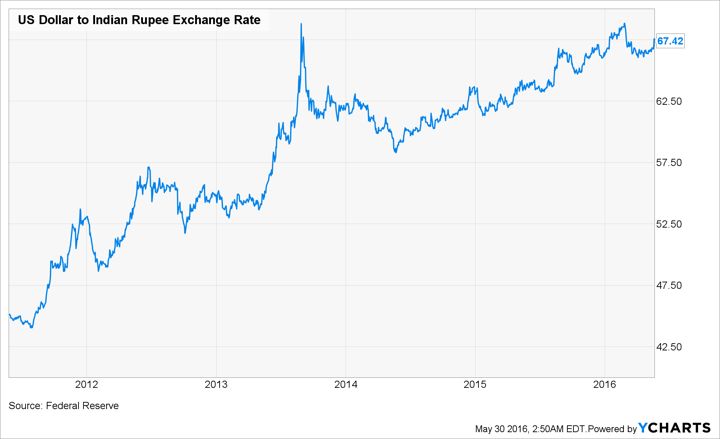

In the past two and half years, that is since last quarter of 2013, Indian rupee had depreciated by over 35% vis-à-vis the global benchmark of US dollar. While much is said about the benefits of a weaker home currency for cheaper exports and dearer imports, a lot is missed. A substantial part of India’s imports is for the purpose of value addition for exports than for home consumption. Take the case of Crude oil for export-oriented refineries in Gujarat or rough diamond and gold which is processed into finished diamonds and jewelry. This should explain the consistent trend of a simultaneous expansion and contraction in India’s imports and exports.

Further, for the past two years, even after a much-hyped political campaign, economic growth and consumption growth remained lackluster. India imports advanced machinery for core manufacturing sector such as Power, Metals, Cement, etc and also for labor-intensive manufacturing sectors such as Textiles, Diamond polishing, etc.

Given, the external scenario of a steep depreciation in rupee and a muted growth in demand, I postulate economic non-viability of capacity addition by import of machinery in the manufacturing sector on account of the enhanced cost of depreciation and capital vis-à-vis the existing capacity.

That is to say, the cost of manufacturing a unit of product by a relatively older unit will be lower than the cost of manufacturing the same by a newly set-up unit on account of additional cost of capital and depreciation due to rupee depreciation on imported machinery. The existing slack capacity and muted growth in demand will ensure that there is no price inflation. This has become the biggest hurdle in adding manufacturing capacity in India which is a trigger event for economic growth.

The present dispensation led by Narendra Modi has maintained status quo in vital policy sectors concerning all factors of production – land acquisition and rigid labor regulations coupled with a lot of liberalization in external capital (FDI) and some fireworks for entrepreneurs such as Ease of Doing Business Campaign and Startup India. To conclude with a lot of sarcasm, the previous government had put all brakes at its command on the national economy. The new government has changed the gears and pressed the accelerator but for some reason best known to them seem to have forgotten to release the brakes. What we have as a result is a stationary car making a lot of noise. Some observers do blame the winds! (global economy for the analysts!)

Note:

1. Text in Blue points to additional data on the topic.

2. This post appeared first in February 2016.

- Social Security Payments : Tax or Savings - September 28, 2017

- India Uninc set for a giant leap post Demonetization & GST : A Contrarian opinion - September 3, 2017

- India Myanmar Strategic Economic Cooperation - September 1, 2017