Sree Iyer: Hello and welcome to episode number 57 of global daily insights with Sri and Sree. Today is the 21st of December, SridharJi, namaskar and welcome to PGurus channel

Sridhar Chityala: Namaskar and very good morning to everybody and early good evening in India on this Christmas week.

Sree Iyer: Sir, we are going to take a look at the stimulus, the economy and the markets today and also a little bit about covid. So let’s start with what is happening on the stimulus package, there was an agreement in principle, but we don’t know the details yet, but there is some convergence going on in Washington DC isn’t it.

Sridhar Chityala: It is, there clearly is an agreement that will be put to a vote today. They were able to get the one-day extension from the President. So, the government will not run out of money. So, one-day extension expires Monday midnight, which is today’s midnight here and today we expect to pass the budget. Now, the principal point of contention appears to be, this 439 billion dollars or 429 billion dollars unused money that was given by the treasury to Fed was called back. That’s the backend collateral to cover a lot of potential loans to corporates and small. So, that was called back because it was unused. So, raising much of contention that when the new government comes in, they won’t be money available and they have to come back to the house. They wanted the money to be left behind and Mnuchin followed the principles of the government, which is effectively to say there is nothing called approval and carry over. So, the things expired, but we are going to keep the money in the treasury, once the new government takes over that includes the House, the Senate, the President then you can get an expeditious approval and take the money once the programs are determined that was the sticking point. So, it went on and on and on and delaying the budget, so they seem to have resolved. Now, this is my inference that they also seem to have a spot of this agreed to some components of the budget for 2021 going up to September 30th. This is the first Snippets of information going up to not a full year but, going up to September 20 21.

So, stimulus plus some spending budget, so the government has the money to fund till September 30th. So, that seems to have broken the ices and so because then there is a broad consensus on where the use of capital be deployed. And the program’s no one doubts, the programs that we have been discussing at a high level every kind of almost every other day. The programs will be obviously not a $1,200 direct check but it’s a $600 check to families. I think it’s per dependent, so, they have expanded per dependent, not only those who are young, they have extended that to I think another $300 per dependent. They’ve extended the unemployment insurance, which is the same, again, $300 over and above what the states offer.

There have also agreed on the testing program given the corona situation and also all the hospitals and the frontline workers etc, which require money, with the rising kind of cases in the United States and obviously for money to be spent for the vaccines. The one new addition which I think is excellent is the 15 billion dollars, I know, it’s a small number but, 15 billion dollars to the airline programs. The airline program is basically, you know, they want to get all this stuff back, it’s the payroll protection to bring people back and get the confidence when the economy really does take off Airline is the Hub and spoke of travel in the United States, as you all as we all know, so, they don’t want to have hiccups and inconvenience. So, I think that’s the program is, so, that’s the scope, unfortunately, will be able to share more details tomorrow. But, this is the high-level headlines on the stimulus.

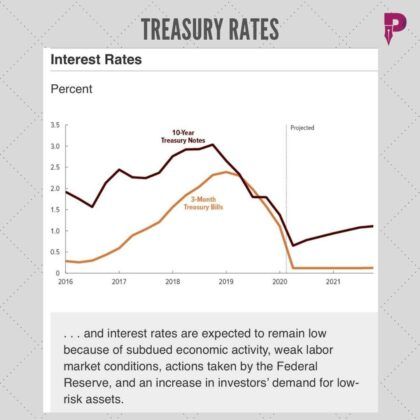

Sree Iyer: Sir, with your permission, I’m putting up the first slide which is to talk about treasury rates and a look at the treasury rates, as they have varied from 2016 onwards and what is your projection on how the interest rates are going to be? Because yesterday I think I saw that 30 year fixed is now 2.5%. I have never ever in my life seen a 30-year fixed come down to 2,5%. So, what do you make of these treasury rate trend sir?

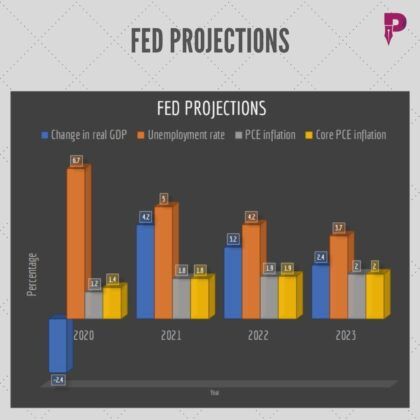

Sridhar Chityala: You must buy two more houses as an investment-grade property at 2.5% sir. So, you know just on the spread you can make a little bit of money on that. Well, the long-term interest rates if I think people are looking at the chart, you can see that Jerome Powell has effectively stated in 2021 is going to be kept maintained at 0%. Zero per cent here means that the base rate is around 0.25 per cent and that extends into 2022. So, 2022 also we could see the 0.25% extension going. The reasons are that there are no macro indicators that show inflation about their notional target of 2%. If you look at the inflation number, when we come up to the next shot, you will see that 2020 inflation is around 1.2% and the 2021 inflation is around 1.8% or 1.9%. This is the core inflation; I said is core inflation is around those two numbers, so, which effectively implies even on the interest rates, they are managing the interest rates at a manageable level. The whole goal is to get the employment up, so, we had a temporary hiccup and the unemployment today is around 6.7% or 7%. We were at 6.7% but, when we had these numbers go from 710,000 to about 853,000 the numbers, that’s when it kind of slightly ticked up. So, the other number that they look at the headline unemployment rate, they expect the unemployment rate to come down to 5%, that is the whole nature of the stimulus programs. How do you contend stimulus bill? So, the government inject cash into the small business, which is roughly 50% of the GDP and employment. So, by infusing capital into the small businesses, also the airline industry, this employs a decent number of people and the health care industry, which also employs a decent number of people. So, you are beginning to see that there is an infusion of capital to fund augmenting the industry. So, naturally, that allows the interest rate benefits to flow through into the system.

Yes, indeed 3.67 % was the average mortgage rate last year. Okay, when you bring it to 2.5 to 2.6%, which is the variance. We are talking about 1.1 % or 1.17% give back to the consumers. So, the consumer stuff is namely that they’re able to rebalance their books besides the stimulus program and also, the other variable that we also always project is the crude. The Crude is around still less in the 40 to 45 dollars so, which is a big item of expenditure for an average consumer. So, you have the fuel, you have the food, you have a cash infusion, you have a reduction in the rate. You will also see that the rents have been stabilizing and the rental market has also seen a decline in the demand.

Sree Iyer: San Jose just reported that there is a decline of 7.7% in the rentals; just yesterday it gave the number. So, they have steadily going downwards. We are having nuclear families now becoming more and more the norm, children are coming back to stay with their parents and this is a trend that is expected to continue on. Sir, would you like me to go to the next slide?

Sridhar Chityala: Oh, yes, please.

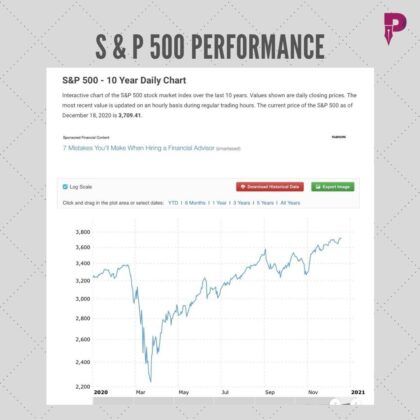

Sree Iyer: S&P 500 performance, sir.

Sridhar Chityala: I think if I go to S&P 500 performance when I’m looking at the same slide. Well, it’s quite amazing that we started the year at 3200 before we started this morning, we were at 3709 roughly around 15.9% or 16% growth in just in 2020. That’s quite astounding in terms of this being a pandemic year. While we drop 62 points in the Futures have dropped 62 points. So, we are around I think now 3640 or 3650 the Futures market, the S&P. The Dow is down 400. We always use S&P as a kind of a base barometer in terms. So it’s quite a kind of a stellar performance. I know there is concentration here, the concentration in the tech, the concentration in retail, the concentration in semiconductor, concentration in the content consumption industries, you saw Disney and you know Netflix etc kind of go up, but, it is at least people are able to participate. They haven’t seen a decline in their relative savings or in the 401K. I know people here, sometimes you see comments, but, you have to look at numbers as numbers, whether there is President Trump sitting or whether Obama is sitting or Biden is sitting or whether Bill Clinton is setting or Ronald Regan is sitting. The fact is that when President Trump took over, we were around 2200. If you take the number, let us say 3600 that’s about 1400 point rise in four years or less than four years and one month, one month less than four years. That’s roughly 1400 over 22, you’re talking about like 70% of growth, 60% type of growth so when you look at that specific number, the average growth per year has been around 15 to 16%. We did have a dip when the interest rates went up to2.25% in 2018-19 when the markets went from 278 – 2607. And that’s the 2018 – 19 number but barring the discount in that year you find that the markets have kind of, at that point of time people were expecting a recession and the general disposition in the past four years despite one full year going down in pandemic, if you have been in S&P, you have done very well in the last four years. So that’s the headline message and it’s expected to do well again next year because when we look at the next year projection, in the previous chart you would have seen, you know, we are talking about your 4.2% GDP growth, that’s a terrific number relative to a contraction of -2.4% in the current year, right? So, therefore, that also augurs well. The market pundits are predicting a 9% growth. They expect gyrations in the market in the first two quarters as we are seeing right now as to what’s happening in the UK because everything is around covid. There’s no predictability in the curve, and the good news is we have vaccines now around the world and people have the ability to respond to it. So you may see gyrations just as today, Dow 400 points down, S&P 62 points down, NASDAQ 127 points down. So just as you see the gyrations, the first two quarters, they do expect some amount of gyrations, but the general disposition is the markets to be very good if you’re in markets, public markets to be very good in 2021.

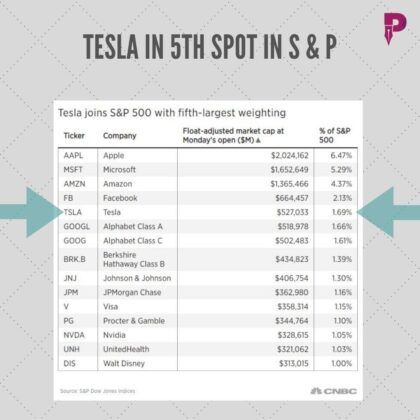

Sree Iyer: So let’s take a look at the latest entrant into the standard and poor index because it’s a nice point to segue into that. The rise and rise and rise of Tesla has been meteoric. I think now the company cap is the combined cap of all the other automobile manufacturers, if I do my math right in the United States like GM 4 and so on. This rise has been meteoric, it is essentially a computer on wheels if that’s how I see it. What are your thoughts are and now that Tesla is moving to Texas that’s going to be another blow to the Californian economy that’s especially in the Bay Area. What are your thoughts on this? Is that a good move? Would they be able to get the same kind of talent in Texas? What are your thoughts, sir?

Sridhar Chityala: The first and foremost I think congratulations to Tesla. Congratulations to Elon Musk, a remarkable job, you wanted to turn the company profitable and show the profitability over six quarters and you have achieved the goal. He has demonstrated Positive Growth. He has expanded markets, sales growth, Top Line Sales growth, has accomplished, I think as you rightly said Tesla is the next Generation automobile on a computer. It is also about EV. In five years from today, we may have more EVs is coming out of our ears and eyes rather than what we see today. The best way if people are looking at the S&P, the top 12 companies or top 14 companies by weightage. The cutoff is around 300 billion market cap. It is a very fascinating chart, the one you are studying, if you look at the bottom of the chart, it’s Walt Disney at 313 billion market cap, if you look at the top of the chart take a look at the Apple then it’s around $2.02 trillion in terms of the market cap. It is very striking, it is almost 7x multiple between, I’m not talking about 500, we are talking about 15 companies here. It’s a 7x multiple in market cap. That’s obviously reflected. So what it means is that and again if some of you had asked someone in 2010, would you have seen this specific chart? You don’t see Walmart. You don’t see JC Parry’s, you don’t see Target. You don’t see General Motors, you don’t see ford, you don’t see any of these companies in this specific chart. Apple, Microsoft, Amazon, Facebook, well Tesla, Tesla sits there. What it simply implies is that these guys have understood the market they have moved ahead with the deeds of the market and people should go back to the 2008-2009 financial crisis. One of the biggest things that were impacted was the automobile industry the Detroit crisis. They call it the Detroit crisis. So the story is that sadly they’re moving up but they have not reinvented themselves to the extent what Tesla has done. That is a classic example in eight years the industry can change and change quite dramatically. That’s what Tesla is telling us which is to say the future, we knew the future and that is why we have made an effort and also now contemplating a merger potentially. They would be interested, not contemplating. They would be, maybe perhaps with Daimler. So that’s the message that I get on Tesla’s side. And Tesla is also in space. Their SpaceX program is successful. So is the market also weighing in what you call as the unquantified benefit that can flow on given that they have demonstrated on this whole EV side from Battery to distribution to production of vehicles that they can deliver.

Sree Iyer: One question, Sir. SpaceX is a separate company. Does Tesla have an investment in it? Is that how it is?

Sridhar Chityala: I have a feeling they have some amount of either investment or stake in it. I need to be corrected. But that’s one of the things that has been pointed out is that their SpaceX program is successful that to some extent gave a boost whether they have a stake or whether they are a supplier of some components to this SpaceX programs obviously Elon Musk is the connection point whether company to company whether there is anything that needs to be, I need to go back and take a look at that again.

Sree Iyer: Sir, Let’s move on to covid. The latest news that is coming out of the United Kingdom how much of a concern is that for the people of the world? I know that countries are now stopping to fly to the UK. Is there a temporary halt do you see, because a lot of other statements also have come, saying that the vaccine will not change that it will be able to still treat the new variant also. How do you see this play out sir?

Sridhar Chityala: Well, I think it’s almost like when you have a little cold you sneeze. Obviously, it’s caused concern if one has to use the principle of isolation as the best method by which you deal with this. So the world has responded by dealing with it the same way, when they observed it on over the weekend they saw it rapidly infecting people. They saw the cases going up so immediately the world responded by basically disconnecting the UK, in or out there is no transport including people are concerned whether I am sure they will figure out a way by which these vaccines supplies which need to be airlifted to Britain because the BioNTech – Pfizer factories are in Europe whether that supplies can reach the UK to meet the needs of the people, from a vaccination point of view. So what how do I see it? Well, they say it’s a new strain, a new state which is causing they said the same thing about India. They said it is a stain which is slightly less in intensity, which is why there’s a very high recovery rate in India and it can deal with this what you call as the herd immunity, a lot of people acquire it and then they develop the self immunity as a part of the process. So I don’t think any of us can answer, at least we have a clue or we have a framework or the solution so I don’t think so, sir.

I think that is the concern but there are vaccines, that is the good news relative to six or seven months ago. We have enough vaccines. Now we have vaccines from Russia, we have vaccines from India, we have vaccines from Europe, we have vaccines from the United States, Moderna just got approved. So, therefore, there is a vaccine, India is manufacturing enough vaccines, they are going to do 300 million for the Sputnik vaccine for Russia so, I think that there is sufficient amount of capacity now available and reach that is available which allows the world to deal with this issue. So I don’t think that there is any panic, it’s a response to a weekend event.

Sree Iyer: And I think I must mention that these are passenger flights that have been stopped, the freight flights have been going on from anywhere to anywhere. It has been happening for several months now. So I’m sure that the vaccine will be available everywhere in the world including the United Kingdom. It’s just my first thoughts if there’s a change, we will let you know tomorrow or the day after, whenever we get an update but this brings us to a close on today’s edition. We will be back tomorrow with more news on the election front, the US Politics and everything else that is happening around the world. Namaskar. Thanks for joining us and please do subscribe to PGurus Channel.

Sridhar Chityala: Namaskar and thank you so much. Have a wonderful week.

- Rahul Hood read the Right story (Robin Hood) but applied it to the wrong oppressed - April 24, 2024

- Xi Jinping treats Chinese people like Ganna (Sugarcane) – Squeeze them & throw them away! - April 9, 2024

- Tharoor Aadat se Majboor - April 7, 2024