The ultimate solution seems to be to boost govt. spending, make the country more tax-friendly, address the ills in the non-banking financial sector with speed, and create an environment that is entrepreneur and investor-friendly.

Feige (1994) defines Black Money activities as all activities that contribute to the official or observed calculation of the GDP but that are not properly registered.

Schneider and Enste (2000) define it as activities in themselves are legal, which create added value, but that are not taxed or registered and in which most can be classified as “black” or clandestine work.

Schneider (2007) says the shadow economy includes all the legal production of goods and services on a market basis that is deliberately concealed from public authorities.

The government’s anti-corruption drive through demonetization and GST has led to many contractions in the shadow economy and consequently impacted India’s economic growth adversely.

All such definitions hold in no uncertain terms that shadow economic activity produces GDP. The underground economy can, therefore, be said to be beneficial in the sense that it adds to the economic growth numbers, as it caters largely and mostly to the demand for small urban service as well as small‐scale manufacturing. Further, a large informal sector/ shadow economy provides the economy with a dynamic and entrepreneurial spirit and could lead to more competition and higher efficiency to a large majority. We also find that the shadow economy harbours a huge employment force and these activities help in pumping and circulation of the black money further aiding consumption and investment. Now, the informal sector constitutes 75 per cent of all Indian businesses, making this one of the largest informal economies in the world.

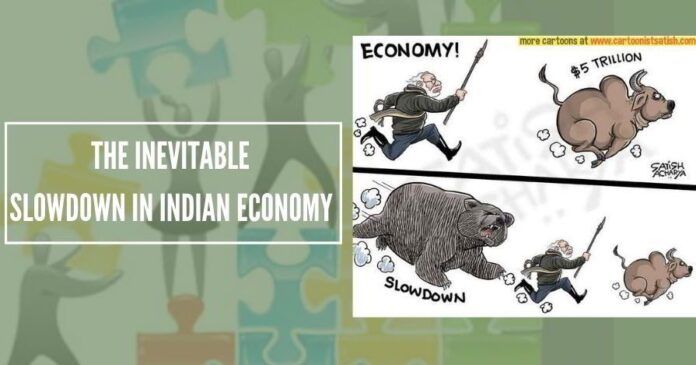

The shock of demonetization and the disruptive launch of a new tax regime, Goods and Services Tax (GST), soon after are still echoing in the Indian industry. The job losses that followed have, in turn, curbed consumption further and the economy is now caught in a vicious cycle. India’s economic growth dropped to a low of 5% in the April-June quarter of 2019-20. The growth rate is the slowest in 25 quarters and has been continuously decreasing over the last 4 yrs. “A plunge in domestic private consumption demand, a slump in manufacturing, halving of merchandise exports growth, and a high base effect from last year have gnawed away at first-quarter growth,” CRISIL said in a report released recently.

A Bloomberg gauge of high-frequency indicators suggests that economic activity continued to weaken in July, with investment and consumption both falling. Economists at Nirmal Bang expect GDP growth to bottom out in the quarter ending September but believe that “a counter-cyclical government spending boost is required.”

The govt. started its anti-corruption drive with the demonetization and has been continuing it sincerely with GST and other measures. All this has led to many contractions in the shadow economy and consequently impacted India’s economic growth adversely. Further, the informal economy has reduced much and formal economic activity has not expanded enough to compensate for the contraction. The slowdown was therefore inevitable.

Unfortunately, in the formal sector too, domestic consumption demand is stagnant and investment, especially in the private sector, is not forthcoming. The export market is also not buoyant particularly for India’s product country matrix, although lower interest cost and depreciating Rupee should help somewhat. Hence, the real solution is encouraging investment in infrastructure and low cost/high-tech products particularly by foreign investors so that consumption gets stimulated and investment too goes up thereby expanding the economic activity in the formal economy. But FDI inflows will not be forthcoming as long as investors fear that the rupee is going to weaken. Therefore, the govt. must urgently make all efforts to stabilize the Rupee in the exchange market.

The ultimate solution seems to be to boost govt. spending, make the country more tax-friendly (a rate cut in GST is an example), address the ills in the non-banking financial sector with speed, and create an environment that is entrepreneur and investor-friendly. The govt. has initiated measures like the withdrawal of the bad taxes on capital gains and start-up funding. These and its attempts to encourage more retail credit flows and energize aggregate demand by front-loading bank recapitalization as well as the promised quick disbursal of tax refunds and vendor payments to the private sector should help improve the economic sentiments.

Note:

1. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

- The real Parivartan is to be ushered in now. - March 23, 2021

- When will the truth dawn on Bengalis? - March 13, 2021

- The many arguments of anti-Modi intellectuals - November 5, 2020

Demonetisation was a brainless idea. Bureaucracy made GST too complicated. Luckily for Modi, during elections the slowdown effects were not so visible. Some suggestions for ending raid on entrepreneurship:

1. Increase GST threshold for Goods and Services to Rs. 10 Cr.

2. Simplify Companies Act for Private Companies (now even a shareholder can’t give loans to a company without any restrictions)

3. Remove section 56(2) and 50C and 50CA of Income-tax Act. These sections are causing havoc with regard to investment and restructuring of businesses. Most of tax litigation is with regard to these sections. So called Angel Tax is a creature of section 56.

4. Remove limit of Rs. 2 lakhs cash on sale of goods and services. People are willing to spend but businesses can’t accept cash above Rs. 2 lakhs! Receiver is penalised by the IT Department.

I hope someone close to Modi reads it or Sree Iyer please pass on this to PMO.

[…] post The inevitable slowdown in Indian economy and the remedies appeared first on […]