Sunil Karanth

Aditya Birla Nuvo Ltd

Aditya Birla Nuvo is a ₹28,931.36 Crore (US$ 4.39 Billion) premium conglomerate, part of ₹2,69,587.71 crores (US$ 41 billion) Aditya Birla Group. It commands leadership position in India across its Financial services, Fashion & Lifestyle, Telecom, Linen and Manufacturing businesses. Mergers & Acquisitions have also played a key role in the company’s transformational journey from a manufacturing company in the late nineties to a premium conglomerate today. The consolidated revenue of the company has risen 25 times to ₹26,516 Crore (US$ 4.03 billion) in the last 15 years. Its market capitalisation has surged 72 times to over ₹24,300 Crore (US$ 3.69 billion) for the same period.

Today, the company touches the lives of more than 16 Crore (160 million) Indians and offers varied products and services, through more than 20 popular brands to meet their needs for life assurance, investment, financing, fashion, digital communication and agri products. Birla Sun Life Insurance, Birla Sun Life Mutual Fund. Aditya Birla Finance, Idea Cellular, Louis Phillipe, Van Heusen, Allen Solly, Peter England, Pantaloons, Linen Club, Birla Shaktiman Urea, Aditya Birla Insulators and Ray One are among the most admired brands in India.

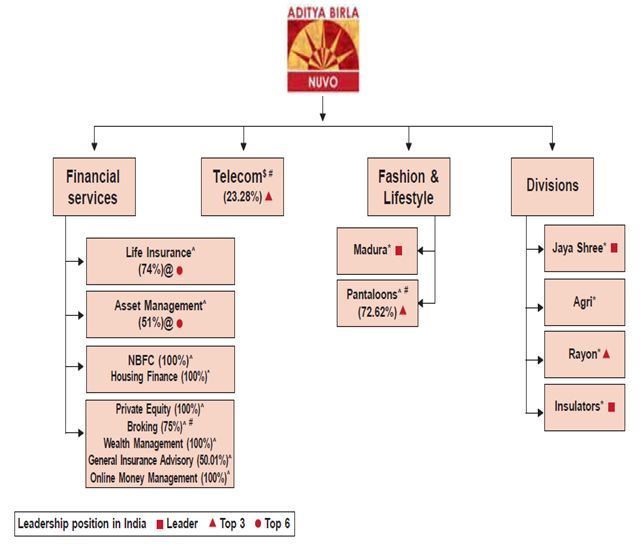

Financial Services – Aditya Birla Financial Services

- Among the top 5 Fund managers in India.

- Diversified portfolio with 10 lines of business.

- Managing assets worth ₹1,80,821.02 Crore (US$ 27.5 Billion).

- Lending book of ₹19,725.93 Crore (US$ 3 Billion).

- Trusted by over 60 Lakh (6 Million) customers.

Telecom – Aditya Birla Idea Cellular

- 6th largest cellular operator in the world in terms of subscriber base in a single country.

- 3rd largest telecom service provider in India in terms of revenue market share.

- Customer base of 15.78 Crore (157.8 Million) subscribers.

Fashion and Lifestyle – Aditya Birla Madura F&L and Aditya Birla Pantaloons

- Madura Fashion & Lifestyle is the # 1 branded menswear player in India.

- Pantaloons is the # 1 branded womenswear retailer in India.

- A large 1.8 Crore (10.8 Million) loyalty customers base.

- Widest retail network in the fashion space.

Divisions – Linen Club, Birla Shaktiman Urea, Aditya Birla Insulators and Ray One

- India’s largest linen yarn & fabric player.

- 8th largest Urea manufacturer in India.

- Among the top 2 Viscose Filament Yarn (VFY) manufacturers in India.

- India’s largest & world’s 4th largest manufacturer of insulators.

In May 2015, the company had announced merger of its apparel business.

Under this scheme, the apparel business and another group firm Madura Garments Lifestyle Retail Company Ltd (MGLRCL) will be merged into listed firm Pantaloons Fashion & Retail Ltd (PFRL), which will be renamed as Aditya Birla Fashion and Retail (ABFRL). As per the scheme, shareholders of ABNL will get 26 new equity shares of PFRL for every 5 equity shares held in ABNL. Similarly, shareholders of MGLRCL will get 7 new shares of PFRL for every 500 shares held in MGLRCL pursuant to the demerger of Madura Lifestyle. This consolidation will create India’s largest pure play branded apparels company by bringing Madura – India’s #1 branded menswear player and Pantaloons – India’s #1 branded womenswear retailer, together.

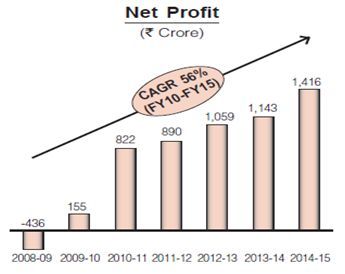

Financial Performance

FY 2015-16 (Q1) Revenue =₹6,820.47 crores (US$ 1.037 billion), (+9.88%, YoY)

FY 2015-16 (Q1) Net Profit =₹419.21 crore (US$ 63.75 million), (+50.76%, YoY)

Recommendation

Revenue generation of ABNL has been continously in the upward mode during the difficult years after the global meltdown in 2008. The company has been able to achieve this due to strong management. The management has been focussing on promising sectors and building a strong talent pool. The company is poised for higher growth, given the upturn in the economy. Indian markets may rally higher as the Fed has deferred a rate hike and there is a possibility of lowering of rates in India by RBI (Reserve Bank of India) Governor Raguram Rajan. Finance Minister of India Arun Jaitley has said recently that conditions are favourable for the RBI to cut rates. Net Profits of the company will increase when the banks reduce lending rates. Over all the factors are conducive for the company to do well. Long term investors can invest in this stock and forget about it for atleast 3 years to get a handsome return. Short term investors with 1 month holding capacity can buy this stock to make gains. If the Fed doesn’t cut rate even in october, medium term investors can invest till december Fed meet.

Note:

- The conversion rate used is 1 US$ = ₹65.31

- CAGR – Compounded Annual Growth Rate is the mean annual growth rate of an investment over a specified period of time longer than one year.

- Aditya Birla Nuvo, a #Perform15 stock - September 21, 2015

- Blow to Modi – Are we judging him too soon? - July 23, 2015