Unlike in movies, all business relationships are arranged. A rigorous inspection of the other side, in the name of due diligence, is undertaken and elaborate agreements are drawn up to foresee every eventuality and how it should be handled. Flipkart has grown but needs a steady infusion of cash and it is not clear as to when it will be in the black. But along the way, it generated a huge presence in the e-Commerce market of India and it is for this reason that Walmart has acquired it. Many have expressed concerns about the entry of a behemoth and the possible damage it will inflict upon India. I, however, have a different view.

Walmart needs to stand up to Amazon

Walmart’s tag line, till recently used to be Always low prices! Always! By becoming big quickly it acquired huge purchasing power and could command payment terms of up to 9 months from its suppliers (most of whom ended up being in one country). This kind of a large window of payment gave it the power to use the float to finance much of its growth. And the economies of scale allowed it to keep prices low, eventually driving the smaller shops out of business.

Amazon eats Walmart’s lunch

Until Amazon came along. What Walmart did to the small mom and pop stores across America, Amazon started doing the same to Walmart. People realized that they could order whatever they wanted from the comfort of their home, using Amazon’s website. And for the most part, if they lived outside the state of Washington, they did not need to pay sales tax!

Amazon started, just like Flipkart, as an online bookseller. This made sense – there are hundreds of thousands of books and they can all not occupy shelf space in a book store and plus there was no need to feel a book before buying it.

But as Amazon grew, it realized that there were many unchartered areas, especially after the Dot com bust that happened sometime in 2000. Amazon was quick to realize the potential of its Amazon Web Services (AWS), which it developed for its own use and then started becoming a hosting provider of choice for the world (till Microsoft and Google caught up).

Walmart was so consumed by its bricks and mortar model until it realized (too late, in my opinion) that the future of shopping was going to be online. And now it is scrambling to catch up with Amazon.

Walmart’s stock fell about 4.5% ($10 billion in valuation) on news of the Flipkart acquisition. This indicates that Wall Street is not happy with the marriage.

The Bright side

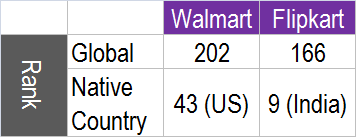

First, let us look at the ranking of the two websites Walmart.com and Flipkart.com. Globally, Flipkart ranks higher than Walmart.com as shown in Figure 1 below:

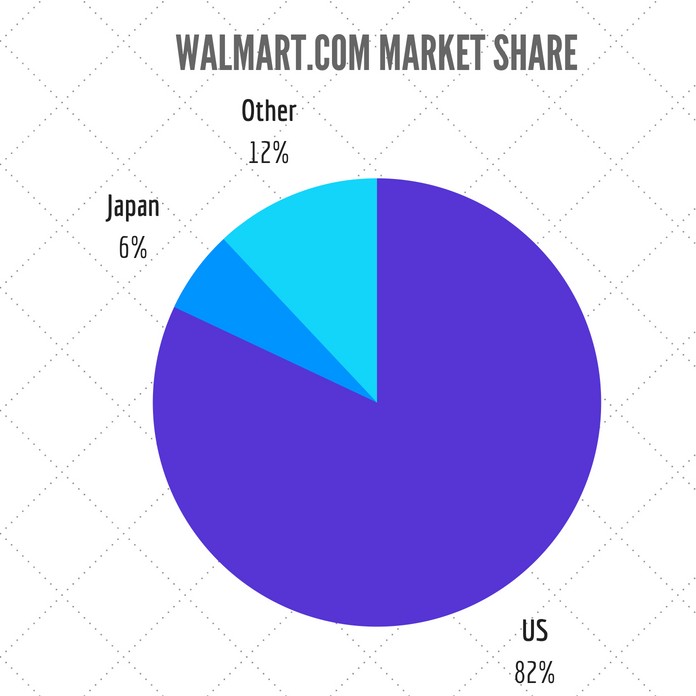

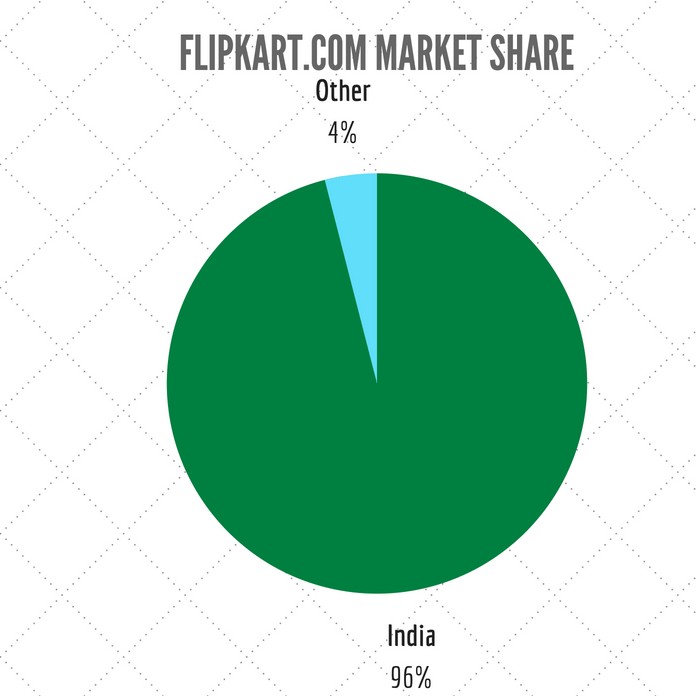

See Figure 2 and Figure 3 below. A quick look at the two pie charts shows that there is hardly any overlap between the two companies in terms of online presence. However, Flipkart boasts of a robust back end because of the demanding networking infrastructure of India and therefore is well placed to replicate such systems in other countries.

In terms of building online presence, Walmart has a long way to go and it can use the resources and engineering team of Flipkart to design, develop and maintain all the new countries into which it may want to expand into. This would mean hiring boat loads of Cloud Computing and Regional Specialists and most of these jobs will be in India. So I see this merger as a net positive for India as these high paying jobs will create many other ancillary jobs.

As to Walmart lowering the prices of products to take out other competitors, I think this has already happened when Flipkart, SnapDeal and Amazon were slogging it out. Now that it is a two-horse race, prices will stabilize – After all, Walmart has to recover the cost it paid Flipkart for the acquisition right?

Watch the above video

I expressed the same views in the video above. Pl. do watch it and if you like it, share with others.

- Indian Parliament’s Special Session is convened to mark the shifting to new Parliament building - September 3, 2023

- Why did Rajat Sharma of India TV not declare that Adani owns more than 16% shares in his channel? - January 29, 2023

- Prannoy Roy to get Rs.605 crore from Adani as per Stock Exchange filing. Why is Income Tax not acting on Roys’ dues of over Rs.800 crore? - January 4, 2023

Naturally as an agent of Suit Boot ki Sarkar you will be extremely happy to the core on 100% free FDIs,Global Elites looting our nation when ease of doing business and setting up a business in India by Indians is extremely difficult even after decades of run by many indian multi nationals are still regarded startups! so the govt.has no means to boost the domestic growth but its very good if foreigners invade and enslave us again with our own policies crafted in their favour! Well an agent like you wont mind but true nationalists do!