2022 will be viewed as a pivotal year

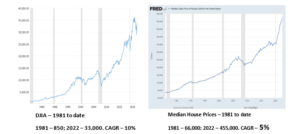

In the annals of finance, 2022 will be viewed as a pivotal year – perhaps without even a historical comparison. The period between 1981 and 2021 was pretty much a one-way street for stocks, bonds, and real estate investors. The Federal Reserve Put was available at hand to prevent the smallest of downturns and all that an investor had to do was buy-and-hold. “Stocks for the long run” was the overarching theme – Riches were guaranteed and Risks were nearly non-existent.

At this point, the only class of investors without the above muscle memory would have to be 70+ years old if they had been investors during the 1970s. Or subscribers to Austrian Economics.

All this fantasy where the fundamentals did not matter and wealth could be generated magically through a printing press had to end someday. And it has in no uncertain terms in 2022. The last 40 years are an aberration and unlikely to restart anytime soon – not during this decade or even the next. & for the sake of humanity, I hope perhaps never again. It is not the artificial boom that we have had for the last 40 years that is the problem – it is the market correction of these hyper-valuations that lies ahead which will be extremely tumultuous.

Even more importantly, if the governments just stood aside and allow for the liquidation of malinvestments i.e. adopt a Lassiez Faire approach to problems created by central banking, then it will be a short and swift process ala 1920-21. But intervene for sure they will – and this will convert what ought to be a short but severe deflationary bust into a prolonged hyperinflationary depression. Perhaps even on a worldwide basis; unless countries choose to untether themselves from the US Dollar standard that has been unwittingly adopted.

So what has changed so dramatically in 2022 for the above dire prognosis?

Asset valuations and what caused it:

There are plenty of 40-year periods in history where asset prices have not moved at all. What was so unique in the last 40 years to have resulted in this unprecedented one-way boom?

At the risk of reducing a once-in-a-multigeneration complex phenomenon into a single-factor explanation, I would have to state that the “magic of ever-falling interest rates” would almost completely explain the above i.e. is a necessary and sufficient condition to explain the asset price movements. If I have to necessarily add a second factor, it would be the US money supply. However, it could be rightfully argued that the growth in money supply in itself was caused by the falling interest rates and hence it is really not an independent variable that would indeed take us back to square one.

An interesting point to remember at this stage is that interest rates falling were not caused by excess savings as a student of economics would conclude. This was a phenomenon engineered by the US Fed to support asset prices and an economy that has all the characteristics of a banana republic.

So how do falling interest rates support asset prices and the economy? It’s a pretty basic question and most investors know the answer, at least in part. Who wouldn’t have heard Warren Buffet’s famous quip “Interest rates are to asset prices what gravity is to the apple. When there are low-interest rates, there is a very low gravitational pull on asset prices. The most important item over time in valuation is obviously interest rates.”

Though I suspect very few would truly appreciate the extent to which interest rates, and most particularly ZIRP (Zero Interest Rate Policy) have held up zombie companies and indeed the US economy itself afloat.

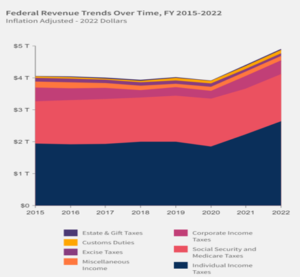

For the 40-year period, the growth in tax revenues has been about 7 times, while the debt has soared more than 30 times. The interest outgo has however grown only 4 fold due to falling interest rates and a shift in the loan portfolio of the US government towards shorter maturities.

At a mere 5% net interest rate, and this rate is substantially below even the official consumer price inflation numbers let alone what consumers experience on a daily basis, the US government would have to spend nearly 32% of its gross income on just interest payments. Zombie corporations have better financials.

That’s however only a part of the story. An equally interesting but much less understood part would be the growth in Federal revenues and how the asset bubbles have propped this up as well.

After remaining steady at around $4T between 2015 and 2020, the revenues have shown an astounding 20% to 4.9T growth in the 2-year period between 2020 and 2022. Individual income taxes and payroll taxes combined have contributed between 80 to 85% of the total throughout this 7-year period. These two components account for this entire 20% increase witnessed over the last 2 years. Individual income taxes have been propped up by asset bubbles on stocks, cryptos, and real estate while the payroll (or employment) has been an indirect beneficiary of the same asset bubbles phenomenon.

What this means is that in a mild recession without the taxation revenues from asset bubbles (and that’s already history for all practical purposes), Federal revenues would dip to less than $4T, and at a 5% interest rate, the interest outgo could easily touch 40%. Factor in the guaranteed bipartisan additional stimulus to save the US economy from the recession and we would be within shouting distance of the 50% mark. In the not-too-distant future, the world will wake up to realize that the US Emperor has no clothes. In fact, hasn’t had any for a looong time now!!!

What has changed in 2022 to declare that this 40-year party has definitively come to an end?: Out-of-control consumer price inflation and hence the dire necessity to increase the Fed funds rate in a futile attempt to control the same. After lying asleep at the wheel for nearly a decade and a half, the Fed has taken a few baby steps in the direction of increasing rates.

The high consumer price inflation we have witnessed in 2022 is the consequence of decades of monetary inflation and we have a long road ahead to correct the malinvestments in terms of increasing rates, gut-wrenching recessions, and high unemployment for at least another decade. As said earlier, it doesn’t have to come to this, but given the interventionist governments we have these days, these outcomes are a given.

How would the current crop of politicians stack up on the scale of interventionism as compared to Hoover and Roosevelt during the Great Depression? Both Hoover and Roosevelt, interventionists as they were by the then prevailing standards, would appear to be near Lassiez Faire when juxtaposed. Nothing much to write home about at all.

2022 – The start of the world re-learning economics

One of the first lessons that the world has re-learnt in this new era is that inflation and recessions are not mutually exclusive. Till now, the world at large has believed in this elixir of central banking. Running the world economy was so simple i.e. recessions – cut rates, inflation – raise rates. Few even contemplated the possibility of what will central banks do when you have both inflation and recession at the same time. While investors indeed recognize that we are living through one such phase, most are yet to connect the dots to come to the correct conclusion that the institution of central banking is the problem and not the solution.

But at least the problem statements are being formulated and so there’s hope.

There are many other lessons that we will re-learn and I am listing a few below:

Quite a complex set of issues and these indeed appear insurmountable. Again, at the cost of simplifying what is indeed an extremely complex problem, if we can affect just one change that would indeed go a long way in correcting most of the issues.

That would be to get rid of the current government-controlled monopolistic monetary system through central banking and revert to a market-based monetary system i.e. the classical gold standard in which the amount of money and interest rates are markets determined.

The realization that the above is the solution to prevent malinvestments and that capitalism is the best economic model not only to get rid of poverty but also to reduce inequalities is furthest away from the minds of investors, influencers and decision-makers today. Slowly but surely, as the problems unfold over the next few years, I hope the ideas of free markets and capitalism take centre stage. If the goal of society is life, liberty, and the pursuit of happiness, this indeed would be the way to achieve that.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023