The Great Depression was deflationary and the one we are living in the early stages of is going to be inflationary

It is an acknowledged fact within the circle of Austrian Economists that the Central Banks have to continuously rely on and actively indulge in the propaganda of Voodoo Economics to hide the extreme imbalances that they have created in the world economy.

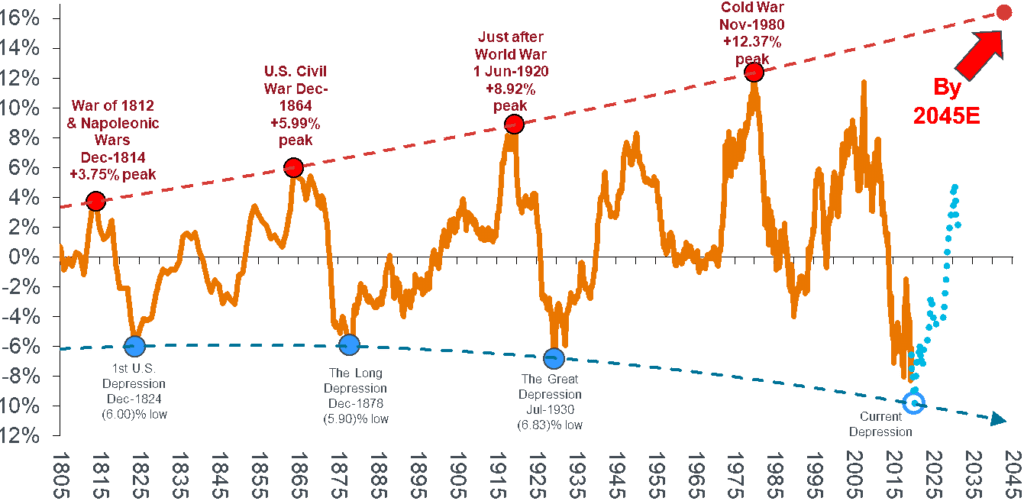

What lies in the decade ahead for much of the Western economies and indeed most parts of the world is a prolonged period of high inflation combined with an economic depression. I should add that if one were to account for inflation correctly even today, we are probably in stagflation (inflation+recession) already in most parts of the world. But the sleight of hand of Central Banks in the way they underreport consumer price inflation (CPI), will allow them to hide the reality for a few more months. If we draw a comparison between the stagflationary seventies (1970’s in which gold went from $35 to $850/oz, Oil from $3 to $40/barrel etc.) and what lies ahead, it’s almost a given at this point that the inflation is going to be substantially higher than what we had in the 1970s and the economic recessions much deeper.

If deflation resulted in a depression, the US ought to have been a basket-case with a century of deflation leading up to 1914.

Before I proceed further, it would be useful to clarify the term “Depression” used above. Most Economists confound Depression with Deflation. These are two different economic phenomena – the former refers to the condition of GDP growth and the latter refers to a monetary phenomenon. Depression denotes a prolonged period of rapid economic declines and a steep fall in the living standards of most people. It primarily refers to GDP growth that is negative by a substantial degree over a period of at least a few years. Deflation, on the other hand, is a monetary phenomenon that refers to a condition of falling prices of consumer goods.

Depressions can be either deflationary or inflationary – in fact, more often than not, most depressions are inflationary. The 1930’s “The Great Depression” was deflationary and the one we are living in the early stages of is going to be inflationary.

Does deflation lead to depression?

Most Economists think that the 1930’s Great Depression was caused by deflation and this is a myth that has entirely been propagated by the US Fed[1]. As Murray Rothbard explains in his book “America’s Great Depression”, deflation (or falling prices) made the depression a lot more tolerable than would otherwise have been the case[2]. The entire century before the formation of the US Fed (from 1815 to 1914) when the US was on the classical gold standard was deflationary. This was the period in which the US economy transitioned from a primitive agrarian society to the world’s leading economic powerhouse with an estimated CAGR of more than 4% (with real growth being even higher due to falling prices) for a century.

If deflation resulted in a depression, the US ought to have been a basket-case with a century of deflation leading up to 1914. Ironically, with more than a century of inflation since then, courtesy, the US Fed, the US economy is indeed a basket-case today and the unravelling of the currency and the economy when it happens in the years ahead will be swift and decisive.

The above US Fed propaganda of the witchcraft Keynesian economics has indeed been extraordinarily successful – so much so that after a century, even they seem to believe in it themselves.

Now that a very basic but important distinction has been made, we can expand on the theme of the Inflationary Depression ahead.

So how did we reach this precipice?

Well for the world to have reached such a precarious situation as I have painted above, the problems have to be deep-rooted, fundamental and long-standing. That is indeed the case and as Mises said during 1951, the origins can predictably be traced to the Central Banks…

“There is nowadays a very reprehensible, even dangerous, semantic confusion that makes it extremely difficult for the non-expert to grasp the true state of affairs. Inflation, as this term was always used everywhere and especially in this country [the United States], means increasing the quantity of money and banknotes in circulation and the number of bank deposits subject to check. But people today use the term “inflation” to refer to the phenomenon that is an inevitable consequence of inflation, that is the tendency of all prices and wage rates to rise. The result of this deplorable confusion is that there is no term left to signify the cause of this rise in prices and wages. There is no longer any word available to signify the phenomenon that has been, up to now, called inflation. It follows that nobody cares about inflation in the traditional sense of the term. As you cannot talk about something that has no name, you cannot fight it. Those who pretend to fight inflation are in fact only fighting what is the inevitable consequence of inflation, rising prices. Their ventures are doomed to failure because they do not attack the root of evil.”

What Mises indeed ruled above is what is commonly referred to as “Inflation is too much money chasing too few goods”. Or as Milton Friedman said, “Inflation is and everywhere a Monetary Phenomenon”. What Mises spoke of in 1951, today is ubiquitous. It would be almost impossible to spot a single economic commentator (other than the handful of Austrian Economists) who would distinguish the cause from the effects when talking about inflation. To add insult to injury, most mainstream economic commentators believe that consumer price inflation is caused by growth and that “some” inflation is indeed good/ desirable/ required for economic progress.

The above US Fed propaganda of the witchcraft Keynesian economics has indeed been extraordinarily successful – so much so that after a century, even they seem to believe in it themselves. The last US Fed Chairman who understood the distinction between propaganda and the truth was Alan Greenspan[3]. His essay “Gold and Economic Freedom” still remains one of the best expositions written to date on this topic. The subsequent ones have been thoroughbred Keynesians, who pretty much subscribe to the above ridiculous notion as gospel truth.

So under the garb of promoting economic growth, we have just allowed the Central Banks around the world to print money with impunity. This has long been the case since 1971 when the last vestiges to Gold and Currency were removed. After Richard Nixon closed the Gold Window “temporarily” in 1971, the Central Banks have had little reason to restrain themselves. But they have indeed gone berserk after 2008 … and even more so in the last year or two. Each transgression makes the erstwhile felony look like a misdemeanour.

But where has all the Inflation – esp since 2008 – Gone?

Going forward we will use the phrase “monetary inflation” to denote the cause and “consumer price inflation” to denote the effects.

During the 1970s, the link between rising monetary inflation and increasing consumer prices was extremely well understood. The money supply growth figures that the US Fed used to publish on a weekly basis was one of the most keenly watched numbers and any abnormal increase in the Fed Balance Sheet would invite a strong rebuke from the Bond Vigilantes who used to send the stocks and the bonds lower.

It is astonishing to see how basic finance and economics has been reshaped in a diabolical way in just a few decades. Very few commentators and even economists understand the correlation these days. Even more ironic is the belief that a negative GDP growth/ unemployment report is seen as good for stocks and bonds as the Fed would then expand its balance sheet via QE to suppress yields. This thinking is almost as perverse as the “Tulipmania” and though it has survived a long longer than the average asset bubble, the days of such Voodoo Economics are numbered and we are now in the early stages of the unravelling of the epic “Fed Bubble”[4].

If the US Fed could not raise rates when the National debt was less than $20 Trillion, what chances are there for a similar action when the debt is expected to cross $30T in the next few months?

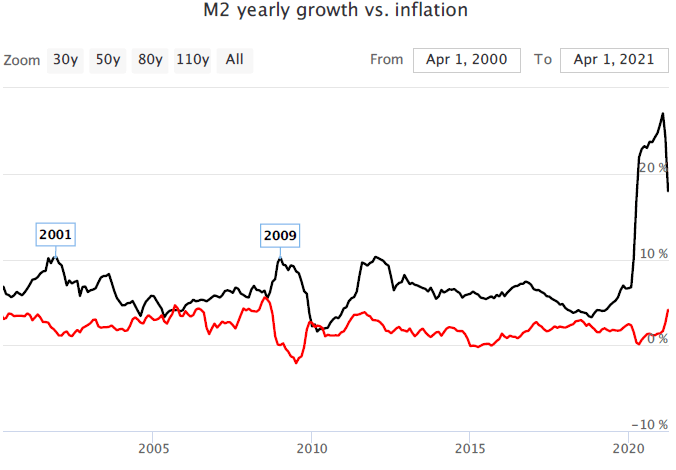

Returning to the question posed above – Where has all this “monetary inflation” gone, especially since the trend of massive monetary inflation since 2008?

As readers can see, there has been a significant divergence between monetary inflation and consumer price inflation since the Great Recession of 2008. How do we explain this?

- The CPI number reported is a process of self-appraisal by Central Banks and so they have a strong motive to underreport the actual numbers. There is no conspiracy theory in this but the way CPI calculations have evolved since the 1970’s using substitution, hedonic adjustments, owner’s equivalent rent etc. ensures that there is an in-built bias towards under-reporting of numbers.

There are a number of economists who calculate CPI using the same methodology as was done during the 1970s (John William of Shadow Statistics, for example) and those numbers show inflation in high single-digits / low double-digits which would be consistent with the monetary inflation that we have observed. - But there is a far more important reason – one that Austrian Economists refer to as the Cantillon Effect. What this essentially means is that while the Money Supply growth will cause the price of different assets to go up in different proportions. Indeed it is even possible during times of even relatively high money supply growth for one category of assets to go up while the others go down, not only in relative terms but in nominal terms as well.

What this Cantillon Effect implies is that all of the monetary inflation has gone into financial assets – Stocks, Bonds, Real Estate, Bitcoin, Nasdaq 2.0 etc – that do not show up in the CPI numbers. In fact, any rational investor who understands the basics can observe a sea of hyper bubbles in these asset classes that have been propped by artificially low-interest rates.

The 10-year treasury that underlines the valuations of all of the above classes has been suppressed by the US Fed that there really is no basis for rationally valuing these assets any longer. Courtesy, the US Fed, nominal interest rates are at a 5000 year low and it is the inevitable increase in rates that will cause these bubbles to unwind.

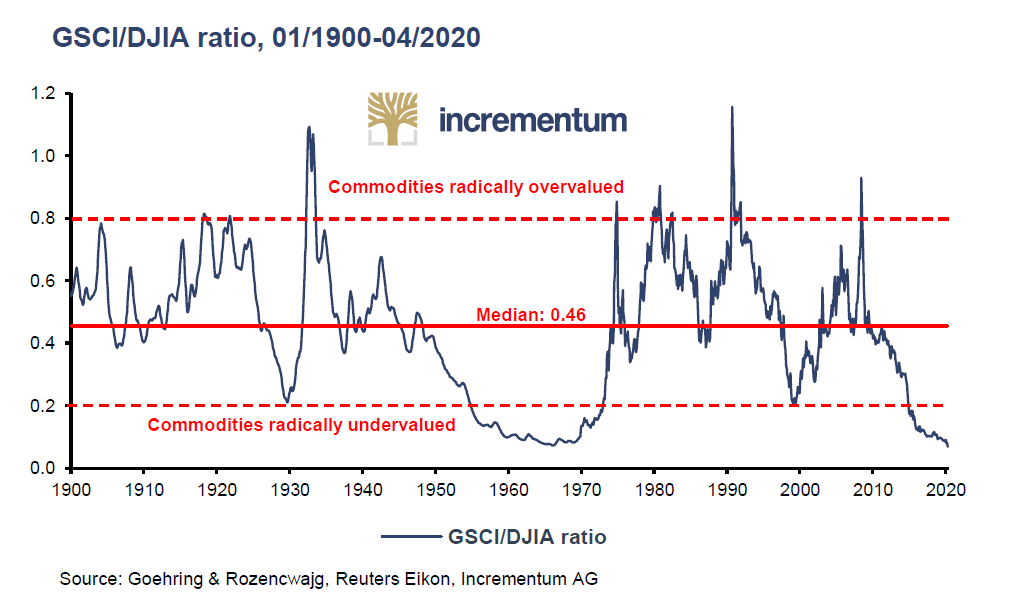

The only asset class that remains undervalued, almost by definition, is commodities. In fact, commodities in a relative sense, have never been cheaper in 100 years than what it is today. So virtually all the money printed has ended up driving the prices of all other asset classes to valuation hitherto unheard of.

So what gives?

So what has accompanied the high M2 growth since 2008 is the price of stocks, bonds and real estate? And what has gone down in relative terms are the commodities. This largely explains why the CPI has stayed muted over the last decade. So why can’t this situation continue for a few more years or another decade?

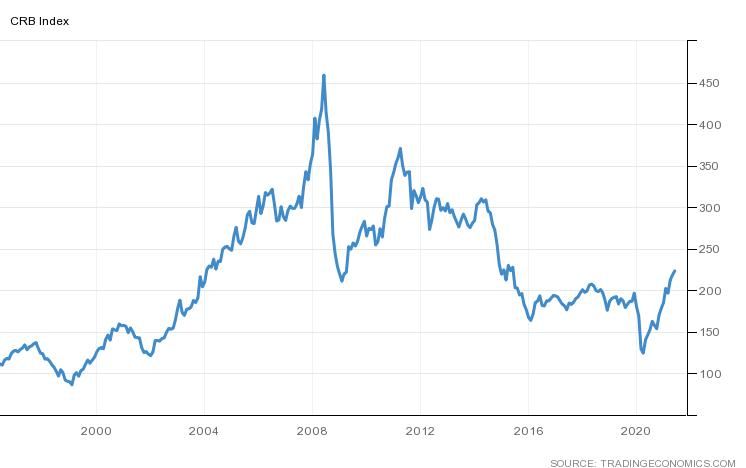

In this epic battle between US Fed and Sound Money (gold and silver), we crossed the rubicon when the CRB index bottomed out in Apr 2020. Gold has always been a leading indicator and has been on an uptrend since early 2016. Since the Index bottomed more than a year ago, it is up more than 50%, albeit from historically very low levels.

To make the commodities chart simple for readers to understand see below figure.

All commodities – lumber steel, zinc, soybeans, corn etc. most are up significantly over the last year. While this is attributed to the Covid induced supply reductions, the cause for all inflation is the same every time – an excess supply of money. It is this increase in commodity prices that is causing the CPI in the US to levels of 5%+. An interesting observation would be that Richard Nixon, who closed the gold window, introduced wage and price controls when CPI crossed 4%, never bothering to consider inflation’s possible “transitory nature”.

Forget the future monetary inflation, which I am sure will make the monetary expansions since 2019 look like another misdemeanour, but we have already created sufficient monetary inflation that guarantees a commodity uptrend for the next several years. This will ensure that the dream of the US Fed that these CPI increases are transitory remains just that – a dream. In fact, I would not in the least be surprised if CPI doubles from the current 5%+ to reach a double-digit number within a 12-18 month timeline.

Does the Fed really believe that CPI is Transitory?

I don’t in the least believe that to be the case.

What should the appropriate actions of the US Fed be if CPI is 5%+ and showing an increasing trend on an m-o-m basis? In the normal scenario, the interest rate ought to be such that real interest rates are positive and that would imply an interest rate of at least 5%. Where is the interest rate today?

ZERO. Or very close to that. After more than 8 years at near zero, when the US Fed under Jerome Powell tried to reverse course and increased it to 2.5% over a 3 year period (between 2016 and 2019), the junk bond pretty much froze and threatened to unravel the entire US financial system. Predictably, in very short order, Powell took it back to its original levels.

If the US Fed could not raise rates when the National debt was less than $20 Trillion, what chances are there for a similar action when the debt is expected to cross $30T in the next few months? The threat of a market collapse that happened at a 2.5% rate in 2019 will probably happen even at a 1 to 1.25% rate today. The leverage in the system is so much higher than the probability of having positive real interest rates in the US for the foreseeable future is ZERO. There can be no two ways about it.

So given that the US Fed cannot have interest rates at a level that will curtail the monetary inflation, what can they do? The only option for them is to pretend that the current Consumer Price Inflation (which is the end result of decades of monetary inflation) is transitory so that they need not embark on a course of action that is guaranteed to collapse the US stocks, bond and real estate market.

THE END GAME

As said, we are at the early stages of an Inflationary Depression in the US and something that will run for a decade if not longer. Given this, the dual mandate of the US FED i.e. maximum employment and price stability cannot be pursued any longer. They will have to choose between controlling consumer price inflation with markedly higher interest rates and persisting with the illusion of a stable economy for a few more months with this artificially low-interest rate regime.

Decades of artificially low-interest rates have led to tremendous malinvestments in the US with excessive debt-fueled consumption and very little savings led production. The only solution is to put interest rates at high enough levels that will dramatically shrink the growth in money supply as well as reduce the national debt. That of course will immediately plunge the US economy into a massive recession.

Readers should remember that Paul Volcker did not put the US interest rates at 20%+ in the early 1980s for amusement or because he wanted the US to suffer a recession[5]. That was the only choice in front of him at the stage i.e. to save the US Dollar or prolong the malinvestments. The choice is, even more, stark today. If the US Fed tries to prolong the bubble economy by maintaining these deeply negative real interest rates, it is going to end up destroying the US Dollar.

That unfortunately is the most likely course of action for the US Fed as well. Predicting the exact timing of the US Dollar crisis is fraught with danger. But given the imbalances, the size of the bubbles in the US Economy and the rather early stages of the commodities bull market, I think we will witness the collapse before Biden completes his term.

What about the Indian Economy?

Less said the better I guess. When Ms Nirmala Sitharaman and Mr Shaktikanta Das occupied the positions of the Finance Minister and the RBI Governor – the two most critical positions from an economic perspective – I had some hope. Both these people knew nothing about Economics and were starting at ground zero – and I am saying this in all seriousness, I felt there was a chance that they looked at the problems with an open mind which would have led them to the altar of the Mises Institute.

But instead, they have allowed the neo-Keynesians within these Institutions to run on steroids and they have done the exact opposite of what they ought to be doing i.e. raising rates, encouraging savings, curtailing government expenditure, deregulating etc. If you think the Indian government bungled bigtime on Covid, just wait till we face the full consequences of the actions of our economic planners. The Covid missteps will appear like a misdemeanour.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

References:

[1] Great Depression – Causes of the decline – Britannica.com

[2] America’s Great Depression – Mises Institute

[3] Capitalism in America: A History – Good Reads

[4] Dutch Tulip Bulb Market Bubble Definition – Jan 29, 2021, Investopedia

[5] President’s Message: Volcker’s Handling of the Great Inflation Taught Us Much – Jan 01, 2005, St. Louis Fed

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

Shanmuganathan, even though, I have had earth sciences educational background with interest I read your article having maze of details and I appreciate published graphs with references. Last month, in one of the episodes of Shree Iyer and Sridhar Chityala hangouts they did refer to US$29Tn total US Debt and Biden Admin’s proposed 6Tn Dollar Budget, inflation going to rise, huge debt hurting future generations and too much money in public hands won’t go to work –welfare without work as put it by FoxNews and 75% American want lower taxes.

USA Economy: – I am a novice in Economic curriculum. But all I know is that the US is the Numero Uno debtor country in the world! There is no doubt that USA has been a World’s Economic Growths Engine. Actually Japan came close to overtake the America in the 80s and now China is going to pound USA badly before Biden bows out of Office in 2024 and or even much one year earlier also and further the US economy may go into a rabbit hole if not sink or collapse with US 30Tn debt and Chinese’s currency Yuan may replace US$ as world’s trading currency! Covid economic management in BJP and Non BJP states are similar to Red and Blue States in USA!

Indian Economy:-You have touched upon Indian Economics with great expectations from a degree holder from JNU and another having a degree in History subject add on with a Chicago degree holder as Economic Advisor to PM Modi ji/his Govt does give straight answer just like Biden’s press secretary Psaki ! I have been a keen reader of terminologies used with their respective definitions such as GDP, GNP,GNI, Inflation, Stagflation, deflation, depression, recession and so on and so forth. Dr.S.Swamy has been holding weekly Gyan on Economics in the VHS web-portal.

In the Indian contexts and situations all the above said terminologies have been going into oblivions under the present dispensation for over seven years now working very opaquely but only three PM ji ; FM ji and Economic advisor see some green shoots with V Shape growth un the “tughlakianomics” “Modi-fied” growths taking various avtaars from A to Z growth shapes a la A to Z vitamin tablet also prescribed for Covid19 to strengthen our immunity along with Zincovit always talking about 5Tn economy at the backdrop of FY1516 +8.2%, FY1617 +7.5%, FY1718 +7%, FY1819 +6.1%, FY1920 +4% and FY2021 -7.3% growths without having a data on formal, informal sectors and badly hit Self-employed and MSME authentic data is not captured! Look at the confusion created by the non –Economists /Finance experts cum academicians becoming Cabinet rank FMs of our unfortunate nation! The economics has become a cruel joke in our Country!

The slogan used during 1975 late Indira Gandhi’s State Emergency was that “the nation is in your motion”!! In college we extended the slogan further in a lighter vein as “the nation is in your motion and that will be known to you at the time of your dehydration”!! This is the state of our dehydrated GDP with changed formula economy having add on two per cent GDP driving black money shadow economy!! Stock answer from the government of the day is an “ACT OF GOD”!