Update from Infosys on June 9th…

Bugs being fixed, expect the system to stabilize this week.

Govt faith in Infosys continues, despite a failed GST, MCA portals implementation

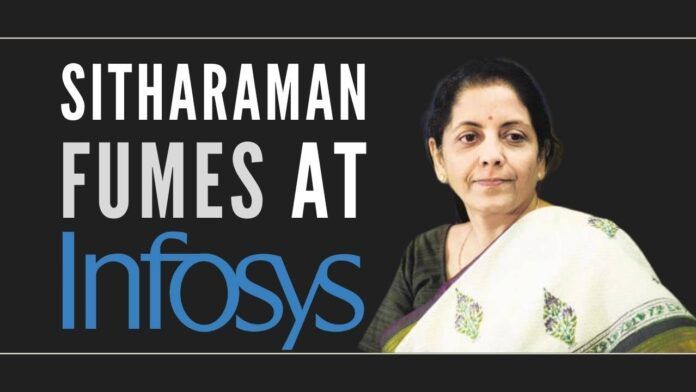

The software developer company Infosys came under fire from Finance Minister Nirmala Sitharaman as users faced technical glitches in the new Income Tax e-filing portal, which was launched Monday evening. Getting a lot of complaints from the users on her Twitter account, the Finance Minister on June 8th asked Infosys and its co-founder and chairman Nandan Nilekani to address the grievances in a tweet.

“The much-awaited e-filing portal 2.0 was launched last night (June 7th) at 20:45hrs. I see in my TL (Timeline) grievances and glitches. I Hope @Infosys & @NandanNilekani will not let down our taxpayers in the quality of service being provided. Ease in compliance for the taxpayer should be our priority,” she Tweeted.

The much-awaited e-filing portal 2.0 was launched last night 20:45hrs.

I see in my TL grievances and glitches.

Hope @Infosys & @NandanNilekani will not let down our taxpayers in the quality of service being provided.

Ease in compliance for the taxpayer should be our priority. https://t.co/iRtyKaURLc

— Nirmala Sitharaman (@nsitharaman) June 8, 2021

This is not the first time Infosys is getting criticism for its development of Government portals. Niti Ayog CEO Amitabh Kant in 2015 blamed Infosys for several glitches in Ministry of Company Affairs portal in 2015, which was earlier maintained well by TCS (Tata Consultancy Services) for decades.

The GSTN portal developed by Infosys is still facing widespread criticism from traders and chartered accountants for its failures and glitches for the past four years. Infosys got this contract of maintaining portal of GST for Rs.1570 crore.

Here the question is why the government awards contracts after contracts to Infosys which failed in the delivery of portals of MCA (Ministry of Corporate Affairs) and GST (Goods and Services Tax), where thousands of users raise complaints per day. PGurus in 2019 published a detailed article when Infosys was granted development of an Income Tax portal for more than Rs.4200 crores[1].

Infosys was awarded the contract for the Income Tax portal in 2019 after the bidding process with an outlay of Rs.4,242 crore. The project aimed to develop the next-generation Income Tax filing system to reduce processing time for returns from 63 days to one day and also expedite refunds. The system went live on June 7 evening and ran into glitches since then, with many users posting tweets tagging the Finance Minister.

While Infosys and Nilakeni have not yet responded, former Infosys Director Mohandas Pai defended the company. In a Tweet, he said, “Every large system like this will have issues! Most are at the user’s side too, takes time to settle down! User education, data input, data population, comments on the design, etc., takes time to settle down!”

Every large system like this will have issues! Most are at the users side too, takes time to settle down! User education, data input, data population,comments on design, etc takes time to settle down! https://t.co/fMvZHLpQUE

— Mohandas Pai (@TVMohandasPai) June 8, 2021

References:

[1] Even after creating chaos in Company Registry & GSTN, Infosys bags Govt. contract worth Rs.4242 crores for Income Tax processing project – Jan 17, 2019, PGurus.com

[…] Finance Minister Nirmala Sitharaman fumes at Infosys for glitches in Income Tax portal – Jun 14, 2021, […]

[…] days of continuing glitches in the new Income Tax portal, Tuesday’s meeting with Finance Minister Nirmala Sitharaman and Infosys officials ended with no solutions – except Infosys promising that all issues will be […]

[…] To Read More, Visit Source […]

Careful Ms NS. Has your PM taken permission from the real powers that be to make such a statement?

His pal Gurumurthy should put you straight.