US Fed reiterates its focus only on price stability

In his recent speech at Jackson Hole (given below), Jerome Powell reiterated the overarching commitment of the US Fed to achieving price stability. In his entire 8-minute speech Powell addressed only one issue i.e. achieving price stability. The markets, as has been the case over the last few decades, seem to have taken the words of the US Fed Chair’s commentary as gospel truth. As I will explain this perceived duel of “Inflation Vs the US Fed” is going to be as one-sided as the fight between David and Goliath. Quite often wrongly quoted as the victory of the underdog, here is the link as to why Goliath did not stand even a 1-in-100 chance before David.

Almost as misunderstood as the example of David and Goliath is the one between inflation and the US Fed. As I see it, the probability of the US Fed winning the perceived duel on inflation is the same as Goliath had against David i.e. almost Zero.

Why have I used the terms “misunderstood” and Perceived Duel? While the above outcome is almost a certainty at this point, it is also a gross misrepresentation of the underlying Economics. The US Fed is the engine for the inflation firestorm that manifested in consumer prices a year back and one that will intensify in the years ahead. We are closer to the trough of inflation than the peak as far as the current cycle is concerned. By the time Powell’s objectives of price stability (and that certainly will not happen in his tenure), the fed funds rate will be in double-digits and the first digit is quite unlikely to be “1”.

To paraphrase the inimitable Jim Grant, while the US Fed pretends to be the Fireman in public view trying to douse the fire of inflation, it is indeed the Arsonist behind the scene. In fact, the single most important lesson that the world will learn from the ongoing inflationary depression is this – Central Bankers, around the world and without exception, are Arsonists masquerading as Firemen. The differences between individual countries are one of degree and not kind.

For those who find the above idea outlandish, this is how it is going to play out. Despite a faltering economy (more on this shortly), Powell could possibly continue to hike rates, i.e. the equivalent of the Fireman. Behind the scenes, the Fed will also be feverishly cranking the presses to inflate the money supply i.e. the job of the Arsonist. In the entire 8-minute monologue of Powell, there was not a single mention of Quantitative Tightening or a reduction of the Fed balance sheet. For a master laying out his grand vision on quelling inflation, isn’t that odd?

I have explained this several times, but given the extensive propaganda on this illusion that almost everybody (except, of course, readers who understand Austrian Economics) has about Central Banking, it’s worth repeating. Inflation is the expansion in the supply of money and credit and one of the consequences of inflation is rising prices. So if one is interested in knowing the direction of Consumer Price Inflation in the years ahead, the correct metrics to observe are not the direction of the US Fed Funds rate, but the changes in money supply i.e. the monetary inflation caused by the US Fed.

Monetary Inflation is the cause. Consumer Price Inflation is the result.

What lies ahead for the US Economy?

In my earlier articles, I have explained why the artificially low-interest rates have created a hyper-bubble in stocks, bonds, cryptos, and real estate. While the first 3 asset classes have meaningfully corrected to be classified as in a bear market, real estate continued to hold the fort. Till now.

Before explaining why the currently ongoing real estate downturn will be much worse than the 2008 crash, I should point out that stocks, bonds, and cryptos continue to be extremely overvalued despite the recent correction. “Expensive” is not the correct word for cryptos as anything above zero would mean an overvaluation. Bonds, incidentally, may not be far beyond cryptos when investors realize that high inflation is here to stay for years, perhaps for even longer than a decade. For those who insist bonds are not comparable to cryptos, I should point out that bonds, at the end of the day, represent a future claim on pieces of paper.

US Housing Bubble (HB) 2.0

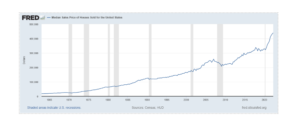

The current housing bubble is much bigger than the 2008 bubble and one can easily see that by observing the price of Median houses sold in the US. While the increase from about USD 257,000 during the 2007 peak to about 440,000 today is well above trend growth, the CAGR for this works out to just under 3.7% which cannot be termed as unusually large. Or at the very least, can be possibly explained using other economic indicators such as GDP growth.

Where the analysis shows up even more graphically is when we take the median income into account. The ratio of median home prices to median income is at an all-time high. While there is nothing abnormal in a linear uptrend in asset prices (i.e. median housing prices in the chart above) due to the perpetual monetary inflation of the Central Banks, when ratios that take into account this inflation (such as factoring in median income) shows record valuations, then it is definitely indicative of a bubble.

Unfortunately for people invested in the US housing market on the long side, the story of excess valuations doesn’t end there. The critical factor between the 2008 housing bubble and now is the direction of interest rates.

If the median housing prices declined by 20% after the 2008 crash, it seems very likely that we will have at least a 40% decline in the current slowdown that will accelerate in the weeks ahead to a full-fledged housing bust. The pin that pricked HB 2.0 is of course the rise in interest rates. The interest rate on a 30-year housing loan between July 2021 and July 2022 has increased from about 2.8% to 5.4% translating into a nearly 40% increase in the EMI for homeowners. Prices have to decline by at least that much just to maintain affordability.

The pain of raising rates will also ensure that the decline in asset prices would be much greater than 40% in the years ahead. Both the fed funds rate as well as the spread between the fed funds rate and the mortgage rate – indicative of turbulent market conditions – are set to widen further. What put a floor to the 2008 crash was the then unheard-of ZIRP (Zero Interest Rate Policy). With the Fed likely to raise rates going into the crash as Powell has promised, what is going to provide the floor?

QE – The Socialist Elixir

In essence, QE is the mechanism for Central Banks to fund the government deficits that they are not able to finance through external borrowings. The distinguishing factor between the Central Banks of banana republics and the developed economies is the near absence of QE in the latter.

Though the US government has run deficits for a long time now, this task of QE on behalf of the US Fed was pretty much done by the other Central Banks (Saudi, Chinese, Japanese, etc.) of their own volition. The US Dollar trade surplus of these countries was reinvested back in US treasuries as the treasuries then had a substantial real yield i.e. risk-free returns. Today, treasuries guarantee what Grant referred to as near-returns-free-risk – even in nominal terms let alone real yields. So not only will these countries not increase their US treasury holdings, it is almost certain that they will liquidate their current holdings as they are losing substantial purchasing power.

The task of financing the ballooning deficits of the US Govt will now be solely left to the US Fed. Add to this the QE to support the US housing markets (a very likely outcome to provide a floor to the housing market) and we have a massive increase in money supply on the cards i.e. the monetary inflation task of the Arsonist.

In public view, Powell will maintain the illusion of fighting inflation by raising the nominal interest rates. Volcker’s interest rate increases worked because it was set to 20% when the consumer price inflation was running at 14%. Incidentally, using the same metrics as was done during the Volcker days, the current consumer price inflation would be 18% and not the reported 9%. With the excess leverage in the system (public, private, and individuals), Fed funds rates will continue to remain negative for a long time and so the fireman stands no chance against the arsonist.

Digging the Hole Deeper

How well does Powell understand the evolving economic scenario? I will just quote three observations to show how misinformed the US Fed members have been.

- Growth this year – to be – well above potential – January 2022

- Recession risk “not particularly elevated” – March 2022

- Recession “a possibility”, but not likely – June 2022

Then of course, we did get the two-quarters of negative GDP growth numbers of Q1 and Q2 at -1.6% and -0.6% respectively. While this has been the generally accepted definition of a recession, the White House economists insist that a recession constituted a broad-based economic decline which they have not seen as yet.

Given below is the chart of the FAANG real growth and perhaps for the first time ever, the real revenue growth was negative. Additionally, every possible housing stat (housing starts, mortgage applications, permits applied, median prices, etc.) has been down over the last 3 months. If these are not indicative of a broad-based decline, I really don’t know what else would constitute one.

For sure, the right thing to do is to raise rates substantially and run a massive QT to shrink the Fed balance sheet. This would of course collapse asset prices, but this is the only way to force the hand of the US government to return to its intended mission – respecting free markets, balanced budgets, sound money, and a non-interventionist foreign policy.

That is also the only way to save the US Dollar. On the current course, the US Dollar is set to follow the fate of the Reichsmark.

Note:

1. Text in Blue points to additional data on the topic.

2. The views expressed here are those of the author and do not necessarily represent or reflect the views of PGurus.

PGurus is now on Telegram. Click here to join our channel and stay updated with all the latest news and views

For all the latest updates, download PGurus App.

- 2008 Redux? YES and NO - October 23, 2023

- Is there a conundrum in the US Housing Market? - September 21, 2023

- Why the Fitch downgrade doesn’t make sense - August 14, 2023

The more he tries to climb out of the hole, the deeper he will sink.

One of the key factors for the growth and stabilization of US economy is its ability to print more paper money. this creates an insatiable thirst for consumer goods. The present cycle including demand for tangible assets from people who squirrel away money the ‘soon to be’ retirees aka empty nesters. Add on top of this institutional investors who are investing in residential real estate as they move away from commercial real estate due to WFH (work from home) created during the pandemic. Visit any strip mall aka small business shopping centers which shuttered during pandemic and have not reopened. Why the rental rates are strong for residential properties.. Again Demand and Supply.

While the author’s note need to be taken with a pinch of salt, what is QT – quantitative tightening do? Catalyze the recession during mid term election year! Democrats are very good in winning elections on the economy whereas the Republics win on National Security! One wealth is created then it needs to be protected. These two diamterically opposite philosophies like the Yin-Yan which live rolling along US political and economic landscape.

What is the message or conclusion of this long article ?